Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

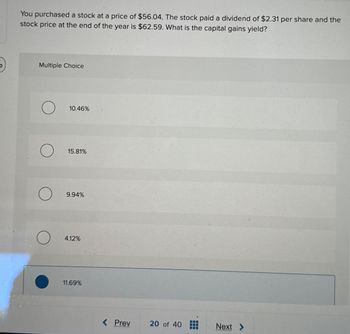

Transcribed Image Text:You purchased a stock at a price of $56.04. The stock paid a dividend of $2.31 per share and the

stock price at the end of the year is $62.59. What is the capital gains yield?

Multiple Choice

10.46%

15.81%

9.94%

4.12%

11.69%

< Prev

20 of 40

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You bought a stock on 1 January 2018 for $135.5 and below are the year-end price data and annual dividends for the stock: Date Closing Price Annual Dividend 31 December 2017 135.5 3.6 31 December 2018 138.2 3.65 31 December 2019 136.8 3.5 31 December 2020 140.7 3.7 What is the standard deviation of returns on this stock over the 2018-2020 period? 0.0173 0.0005 0.0009 0.0212 O 0.0303arrow_forwardIf a $100 par value preferred stock pays an annual dividend of $5 and comparable yields are 10 percent, the price of this preferred stock will be a. $100 b. $50 c. $75 d. $25arrow_forwardPlease answer the following multiple choicearrow_forward

- naranarrow_forwardThe Co. pays an annual dividend that is expected to increase by 4.1%/year. The stock’s return = 12.6% and sells for $24.9/share. Calculate the next dividend (D1) A. $2.03B. $2.12C. $3.17D. $2.20arrow_forwardYou buy a share on 1 January for $35.18 and sell it on 31 December for $41.38. During the year you receive $2.30 in dividends from the share. What is your capital gain yield? a. -14.98% b. 14.98% c. 17.62% d. -17.62%arrow_forward

- son.2arrow_forwardA stock is selling today for $50 per share. At the end of the year, it pays a dividend of $3 per share and sells for $59. Required: a. What is the total rate of return on the stock? b. What are the dividend yield and percentage capital gain? c. Now suppose the year-end stock price after the dividend is paid is $44. What are the dividend yield and percentage capital gain in this case?arrow_forwardListen You purchased stock in Magneto Vision for $13 per share on January 1, 2022. Over the next year you received $2.22 per share in dividends. On December 31,2022 Magneto Vision is selling for $12.50 per share. What has been your total gross return (in percent) over the one-year period? 13.23% 113.23% 1.13% 13.00%arrow_forward

- You invested in a stock with a price of $46.92. You sold the stock a year later for $52.86. During the year, you received a dividend of $0.85. What is your return? 14.47% 10.85% 11.24% 12.85% 12.66%arrow_forwardOne year ago, KJ Industries stock sold for $52 a share. Over the past year, the stock has returned 16.0 percent with half of that return coming from dividend income. What is the current price of this stock? Multiple Choice O о O $56.16 $47.84 $60.32 $43.68arrow_forwardSuppose you invested $56 in the Ishares Dividend Stock Fund (DVY) a month ago. It paid a dividend of $0.80 today and then you sold it for $67. What was your return on the investment? OA. 23.18% OB. 16.86% O C. 14.75% O D. 21.07%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education