FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Using Table 11-1, compute the amount of compound interest (in $) earned in 1 year and the annual percentage yield (APY) for the investment. (Round your answers to two decimal places.)

Principal

Nominal

Compound Interest Annual Percentage

Interest

Rate (%) Compounded

Earned in 1 Year

$34,000

12

monthly

$

Yield (APY)

%

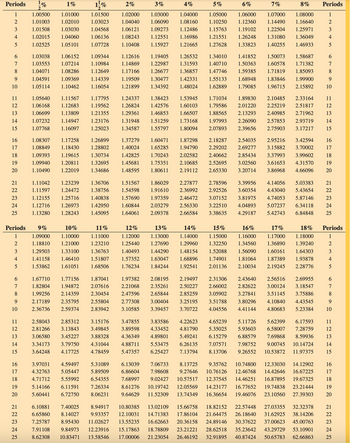

Transcribed Image Text:Periods

%

1%

1%

2%

3%

4%

5%

6%

7%

8%

Periods

1

1.00500

1.01000

1.01500

1.02000

1.03000

1.04000

1.05000

1.06000

1.07000

1.08000

1

2

1.01003

1.02010

1.03023

1.04040

1.06090

1.08160

1.10250

1.12360

1.14490

1.16640

2

3

1.01508 1.03030

1.04568

1.06121

1.09273

1.12486

1.15763

1.19102

1.22504

1.25971

3

4

1.02015

1.04060

1.06136

1.08243

1.12551

1.16986

1.21551

1.26248

1.31080

1.36049

4

5

1.02525

1.05101

1.07728

1.10408

1.15927

1.21665

1.27628

1.33823

1.40255 1.46933

5

10

67890

1.03038

1.06152

1.09344

1.12616

1.19405

1.26532

1.34010

1.41852

1.50073 1.58687

1.03553

1.07214

1.10984

1.14869

1.22987

1.31593 1.40710

1.50363

1.60578

1.71382

1.04071

1.08286

1.12649

1.17166

1.26677

1.36857 1.47746

1.59385

1.71819 1.85093

1.04591

1.09369

1.14339

1.19509

1.30477

1.42331

1.55133

1.68948

1.83846 1.99900

1.05114

1.10462

1.16054

1.21899

1.34392

1.48024

1.62889

1.79085

1.96715 2.15892

10

67890

11

1.05640

1.11567

1.17795

1.24337

1.38423

1.53945

1.71034

2216 62822 22222

1.06168

1.12683

1.19562

1.26824

1.42576

1.60103

1.79586

13

1.06699

1.13809

1.21355

1.29361

1.46853

1.66507

1.88565

1.89830 2.10485 2.33164

2.01220 2.25219 2.51817

2.13293

2.40985 2.71962

14

1.07232

1.14947

1.23176

1.31948

1.51259

1.73168

1.97993

2.26090

15

1.07768

1.16097

1.25023

1.34587

1.55797

1.80094

2.07893

2.39656

2.57853 2.93719

2.75903 3.17217

16

1.08307

1.17258

1.26899

1.37279

1.60471

1.87298

2.18287

17

1.08849

1.18430

1.28802

1.40024

1.65285

1.94790

2.29202

2.54035 2.95216 3.42594

2.69277

3.15882 3.70002

18

1.09393 1.19615

1.30734

1.42825

1.70243

2.02582

2.40662

2.85434

3.37993 3.99602

19

1.09940

1.20811

1.32695

1.45681

1.75351

2.10685 2.52695

3.02560

20

1.10490

1.22019

1.34686

1.48595

1.80611

2.19112 2.65330

3.20714

3.61653 4.31570

3.86968 4.66096

21

1.11042

1.23239

1.36706

1.51567

1.86029

2.27877

2.78596

3.39956

4.14056 5.03383

1.11597

1.24472

1.38756

1.54598

1.91610

2.36992

2.92526

3.60354

4.43040 5.43654

23

1.12155

1.25716

1.40838

1.57690

1.97359

2.46472

3.07152

3.81975

4.74053 5.87146

24

1.12716

1.26973

1.42950

1.60844

2.03279

2.56330

3.22510

4.04893

25

1.13280

1.28243

1.45095

1.64061

2.09378

2.66584

3.38635

4.29187

5.07237 6.34118

5.42743 6.84848

=2315 62222 22222

11

14

16

17

18

19

20

21

23

24

25

Periods

9%

10%

11%

12%

13%

14%

15%

16%

17%

18% Periods

1

1.09000 1.10000

1.11000

1.12000

1.13000

1.14000

1.15000

1.16000

1.17000

1.18000

1

2

1.18810

1.21000

1.23210

1.25440

1.27690

1.29960

1.32250

1.34560

1.36890

1.39240

2

3

1.29503

1.33100

1.36763

1.40493

1.44290

1.48154

1.52088

1.56090 1.60161

1.64303

3

4

1.41158

1.46410

1.51807

1.57352

1.63047

1.68896

1.74901

1.81064

1.87389

1.93878

4

5

1.53862

1.61051

1.68506

1.76234

1.84244

1.92541

2.01136

2.10034

2.19245

2.28776

5

10

67820

1.67710

1.77156

1.87041

1.97382

2.08195 2.19497

2.31306

2.43640

2.56516 2.69955

1.82804

1.94872

2.07616

2.21068

2.35261

2.50227

2.66002

1.99256 2.14359

2.30454

2.47596

2.65844

2.85259

3.05902

9

2.17189

2.35795

2.55804

2.77308

3.00404

3.25195

2.36736 2.59374

2.83942

3.10585 3.39457

3.70722

2.82622 3.00124 3.18547

3.27841 3.51145 3.75886

3.51788 3.80296 4.10840 4.43545

4.04556 4.41144 4.80683 5.23384

67

8

9

10

11

2.58043

2.85312

3.15176

3.47855

12

2.81266 3.13843

3.49845

3.89598

13

3.06580

3.45227

3.88328

4.36349

14

3.34173 3.79750 4.31044

4.88711

15

3.64248

4.17725

4.78459

5.47357

5.53475

6.25427

3.83586 4.22623

4.33452 4.81790

4.89801 5.49241

6.26135 7.07571

7.13794 8.13706

4.65239

5.35025

5.11726

5.93603

6.15279

5.62399 6.17593

6.58007 7.28759

6.88579 7.69868 8.59936

7.98752 9.00745 10.14724

9.26552 10.53872 11.97375

11

12

13

14

15

16

3.97031

4.59497

5.31089

6.13039

17

4.32763

5.05447

5.89509

18

4.71712

5.55992

6.54355

19

5.14166

6.11591

7.26334

20

5.60441

6.72750

8.06231

7.06733

6.86604 7.98608

7.68997 9.02427

8.61276 10.19742

9.64629 11.52309

8.13725 9.35762 10.74800 12.33030 14.12902

9.27646 10.76126 12.46768 14.42646 16.67225

10.57517 12.37545 14.46251 16.87895 19.67325

12.05569 14.23177 16.77652 19.74838 23.21444

13.74349 16.36654 19.46076 23.10560 27.39303

16

17

18

19

20

22222

21

6.65860

23

7.25787

6.10881 7.40025 8.94917

8.14027 9.93357

8.95430 11.02627

24

7.91108

25

10.80385 13.02109 15.66758 18.82152 22.57448 27.03355 32.32378

12.10031 14.71383 17.86104 21.64475 26.18640 31.62925 38.14206

13.55235 16.62663 20.36158 24.89146 30.37622 37.00623 45.00763

9.84973 12.23916 15.17863 18.78809 23.21221 28.62518

8.62308 10.83471 13.58546 17.00006 21.23054 26.46192 32.91895

21

22

23

35.23642 43.29729 53.10901

24

40.87424 50.65783 62.66863

25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Using Table 11-1, compute the amount of compound interest (in $) earned in 1 year and the annual percentage yield (APY) for the investment. (Round your answers to two decimal places.) Principal NominalRate (%) InterestCompounded Compound InterestEarned in 1 Year Annual PercentageYield (APY) $6,000 12 semiannually $ %arrow_forwardUsing Table 11-1, compute the amount of compound interest (in $) earned in 1 year and the annual percentage yield (APY) for the investment. (Round your answers to two decimal places.) Principal NominalRate (%) InterestCompounded Compound InterestEarned in 1 Year Annual PercentageYield (APY) $3,000 14 semiannually $ %arrow_forwardUsing Table 11-1, calculate the compound amount and compound interest (in $) for the investment. (Round your answers to the nearest cent.) Principal TimePeriod (years) NominalRate (%) InterestCompounded CompoundAmount CompoundInterest $6,000 4 14 annually $ $arrow_forward

- Using Table 11-1, compute the amount of compound interest (in $) earned in 1 year and the annual percentage yield (APY) for the investment. (Round your answers to two decimal places.) Compound Interest Earned in 1 Year Annual Percentage Yield (APY) Nominal Interest Principal Rate (%) Compounded $33,000 12 monthly $ % Need Help? Read It 3 Type here to searcharrow_forwardUsing Table 11-1, calculate the compound amount and compound interest (in $) for the investment. (Round your answers to the nearest cent.) Time Nominal Interest Compound Compound Principal Period (years) Rate (%) Compounded Amount Interest $6,000 4 12 annually $ $arrow_forwardUsing Table 11-1, calculate the compound amount and compound interest (in $) for the investment. (Round your answers to the nearest cent.) Time Principal Period (years) Nominal Rate (%) Interest Compounded $26,000 11 5 annually $ Compound Amount $ Compound Interestarrow_forward

- Using Table 11-1, calculate the compound amount and compound interest (in $) for the investment. (Round your answers to the nearest cent.) Time Nominal Interest Compound Compound Principal Period (years) Rate (%) Compounded Amount Interest $8,000 4 12 annually Ex Enter a number.arrow_forwardUsing Table 11-1, calculate the compound amount and compound interest (in $) for the investment. (Round your answers to the nearest cent.) Principal TimePeriod (years) NominalRate (%) InterestCompounded CompoundAmount CompoundInterest $8,000 4 12 annually $ ?? $ ??arrow_forwardFor the following investments, compute the amount of compound interest earned in 1 year and the annual percentage yield (APY). Compound Interest Earned in 1 Year Nominal Interest Principal Rate Compounded $5,000.00 10% semiannually A $36,000.00 12% monthly C A: Annual Percentage Yield (APY) B D B: A Z C: A D:arrow_forward

- Manually calculate the compound amount and compound interest (in $) for the investment. Principal TimePeriod (years) NominalRate (%) InterestCompounded CompoundAmount CompoundInterest $1,000 2 10 annually $ $arrow_forwardCalculate the present value (principal) and the compound interest (in $). Use Table 11-2. Round your answers to the nearest cent. CompoundAmount Term ofInvestment NominalRate (%) InterestCompounded PresentValue CompoundInterest $18,500 18 months 4 semiannually $ $arrow_forward22.Calculate the present value (principal) and the compound interest (in $). Use Table 11-2. Round your answers to the nearest cent. CompoundAmount Term ofInvestment NominalRate (%) InterestCompounded PresentValue CompoundInterest $26,500 18 months 4 semiannually $ $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education