Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:2

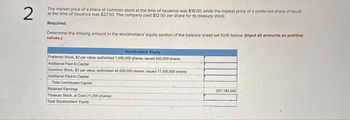

The market price of a share of common stock at the time of issuance was $18.00, while the market price of a preferred share of stock

at the time of issuance was $27.50. The company paid $12.50 per share for its treasury stock.

Required:

Determine the missing amount in the stockholders' equity section of the balance sheet set forth below. (Input all amounts as positive

values.)

Stockholders' Equity

Preferred Stock, $2 par value, authorized 1,000,000 shares; issued 600,000 shares

Additional Paid-In Capital

Common Stock, $3 par value, authorized 40,000,000 shares; issued 17,500,000 shares

Additional Paid-In Capital

Total Contributed Capital

Retained Earnings

Treasury Stock, at Cost (11,000 shares)

Total Stockholders' Equity

207,183,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The market price of a share of common stock at the time of issuance was $19.50, while the market price of a preferred share of stock at the time of issuance was $29.00. The company paid $14.00 per share for its treasury stock. Required: Determine the missing amount in the stockholders' equity section of the balance sheet set forth below. (Input all amounts as positive values.) Stockholders' Equity Contributed Capital: Preferred Stock, $2 par value, authorized 1,000,000 shares; issued 675,000 shares Additional Paid-in Capital - Preferred Stock Common Stock, $3 par value, authorized 40,000,000 shares; issued 19,000,000 shares Additional Paid-in Capital - Common Stock Total Contributed Capital Retained Earnings Treasury Stock, at Cost (10,000 shares) Total Stockholders' Equity 207,483,000arrow_forward17. Analyze the equity section of Gingerbread Corp's balance sheet and determine the following. Be careful to discriminate between a non monetary value and a monetary value. Use a $ sign to indicate a dollar value. 1.Number of shares of common stock that have been issued 2.Number of shares of preferred stock that have been issued 3.BlankDollar value the company paid to repurchase their own stock 4.How many shares of stock are in treasury stock?arrow_forwardPlease solve the question ASAP.arrow_forward

- Help Be cleararrow_forwardStock Issuance and Treasury Stock Diva, Inc. recorded the following capital stock transactions: Balance Sheet Assets = Liabilities + Stockholders' Equity PIC in Excess of + Common Stock + Common Treasury PIC from Stock Stock + Treasury Stock (1) 1,048,800 110,400 938,400 (2) (107,800) (107,800) (3) 87,360 73,920 13,440 Use the following additional information about the above transactions when answering questions a through e. (1) issued common stock for $38 cash per share (2) purchased treasury shares at $44 per share. (3) sold some of the treasury shares: a. How many shares were originally issued? 0 b. What was the par value of the shares issued? $ 0 C. How many shares of treasury stock were acquired? 0 d. How many shares of treasury stock were sold? o e. At what price per share was the treasury stock sold? $ 0arrow_forwardThoughtful Comfort Specialists, Inc. reported the following stockholders' equity on its balance sheet at June 30, 2024: (Click the icon to view the partial balance sheet.) Read the requirements. Requirement 1. Identify the different classes of stock that Thoughtful Comfort Specialists has outstanding. Thoughtful has outstanding. common stock preferred stock preferred stock and common stock preferred stock and treasury stock Requirements 2. 1. Identify the different classes of stock that Thoughtful Comfort Specialists has outstanding. What is the par value per share of Thoughtful Comfort Specialists' preferred stock? 3. () Make two summary journal entries to record issuance of all the Thoughtful Comfort Specialists' stock for cash. Explanations are not required. 4. No preferred dividends are in arrears. Journalize the declaration of a $800,000 dividend at June 30, 2024, and the payment of the dividend on July 20, 2024. Use separate Dividends Payable accounts for preferred and common…arrow_forward

- [The following information applies to the questions displayed below.] The stockholders' equity section of Velcro World is presented here. VELCRO WORLD Balance Sheet (partial) (S and shares in thousands) Stockholders' equity: Preferred stock, $1 par value Common stock, $1 par value Additional paid-in capital Total paid-in capital Retained earnings 5,800 28,000 1,028,600 1,062,400 286,000 (360,000) $ 988,400 Treasury stock, 12,000 common shares Total stockholders equity Based on the stockholders' equity section of Velcro World, answer the following questions. Remember that all amounts are presented in thousands Problem 10-4A Part 4 4. If retained earnings at the beginning of the period was $248 million and $28 million was paid in dividends during the year, what was the net income for the year? (Enter your answer in million (i.., 5,000,000 should be entered as 5).) Net income millionarrow_forwardPlease answer competelyarrow_forwardNeed help with correctarrow_forward

- Required: 5. The average per-share sales price of the common stock when issue $? per share 6. The cost of the treasury stock per share $? per share 7. The total stockholders' equity $? 8. The per-share book value of the common stock assuming that there are no dividends in arrears and that the preferred stock can be redeemed at its par value $? per sharearrow_forwardDiva, Inc. recorded the following capital stock transactions: Balance Sheet Assets = Liabilities + Stockholders' Equity Common PIC in Excess of Treasury PIC from Stock + Common Stock + Stock + Treasury Stock |(1) 1,092,500 115,000 977,500 |(2) (61,600) (61,600) (3) 49,920 42,240 7,680 Use the following additional information about the above transactions when answering questions a through e. (1) issued common stock for $19 cash per share (2) purchased treasury shares at $22 per share. (3) sold some of the treasury shares: a. How many shares were originally issued? b. What was the par value of the shares issued? $ c. How many shares of treasury stock were acquired? d. How many shares of treasury stock were sold? e. At what price per share was the treasury stock sold? $arrow_forwardneed correct and complete help please with workingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,