Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Required:

Compute the following for Iguana, Incorporated, for the second quarter (April, May, and June).

Note: Do not round your intermediate calculations.

| April | May | June | 2nd Quarter Total | |

| 1. Budgeted Sales Revenue | $6,250selected answer correct | $7,500selected answer correct | $10,000selected answer correct | $23,750 |

| 2. Budgeted Production in Units | 270selected answer correct | 340selected answer correct | 390selected answer correct | 1,000not attempted |

| 3. Budgeted Cost of Direct Material Purchases | $4,656selected answer incorrect | not attempted | not attempted | $4,656 |

| 4. Budgeted Direct Labor Cost | not attempted | not attempted | not attempted | $0 |

| 5. Budgeted Manufacturing |

not attempted | not attempted | not attempted | $0 |

| 6. Budgeted Cost of Goods Sold | not attempted | not attempted | not attempted | $0 |

| 7. Total Budgeted Selling and Administrative Expense |

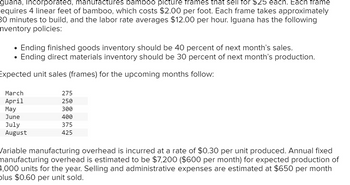

Transcribed Image Text:guana, Incorporated, manufactures bamboo picture frames that sell for $25 each. Each frame

equires 4 linear feet of bamboo, which costs $2.00 per foot. Each frame takes approximately

30 minutes to build, and the labor rate averages $12.00 per hour. Iguana has the following

Inventory policies:

•

Ending finished goods inventory should be 40 percent of next month's sales.

•

Ending direct materials inventory should be 30 percent of next month's production.

Expected unit sales (frames) for the upcoming months follow:

March

275

April

250

May

300

June

400

July

August

375

425

Variable manufacturing overhead is incurred at a rate of $0.30 per unit produced. Annual fixed

manufacturing overhead is estimated to be $7,200 ($600 per month) for expected production of

4,000 units for the year. Selling and administrative expenses are estimated at $650 per month

plus $0.60 per unit sold.

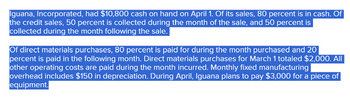

Transcribed Image Text:Iguana, Incorporated, had $10,800 cash on hand on April 1. Of its sales, 80 percent is in cash. Of

the credit sales, 50 percent is collected during the month of the sale, and 50 percent is

collected during the month following the sale.

Of direct materials purchases, 80 percent is paid for during the month purchased and 20

percent is paid in the following month. Direct materials purchases for March 1 totaled $2,000. All

other operating costs are paid during the month incurred. Monthly fixed manufacturing

overhead includes $150 in depreciation. During April, Iguana plans to pay $3,000 for a piece of

equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ottis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the annual ordering cost. 2. Compute the annual carrying cost. 3. Compute the cost of Ottiss current inventory policy. Is this the minimum cost? Why or why not?arrow_forwardIngles Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other institutions. The table tops are manufactured by Ingles, but the table legs are purchased from an outside supplier. The Assembly Department takes a manufactured table top and attaches the four purchased table legs. It takes 16 minutes of labor to assemble a table. The company follows a policy of producing enough tables to ensure that 40 percent of next months sales are in the finished goods inventory. Ingles also purchases sufficient materials to ensure that materials inventory is 60 percent of the following months scheduled production. Ingless sales budget in units for the next quarter is as follows: Ingless ending inventories in units for July 31 are as follows: Required: 1. Calculate the number of tables to be produced during August. 2. Disregarding your response to Requirement 1, assume the required production units for August and September are 2,100 and 1,900, respectively, and the July 31 materials inventory is 4,000 units. Compute the number of table legs to be purchased in August. 3. Assume that Ingles Corporation will produce 2,340 units in September. How many employees will be required for the Assembly Department in September? (Fractional employees are acceptable since employees can be hired on a part-time basis. Assume a 40-hour week and a 4-week month.) (CMA adapted)arrow_forwardKaune Food Products Company manufactures canned mixed nuts with an average manufacturing cost of 52 per case (a case contains 24 cans of nuts). Kaune sold 150,000 cases last year to the following three classes of customer: The supermarkets require special labeling on each can costing 0.04 per can. They order through electronic data interchange (EDI), which costs Kaune about 61,000 annually in operating expenses and depreciation. Kaune delivers the nuts to the stores and stocks them on the shelves. This distribution costs 45,000 per year. The small grocers order in smaller lots that require special picking and packing in the factory; the special handling adds 25 to the cost of each case sold. Sales commissions to the independent jobbers who sell Kaune products to the grocers average 8 percent of sales. Bad debts expense amounts to 9 percent of sales. Convenience stores also require special handling that costs 30 per case. In addition, Kaune is required to co-pay advertising costs with the convenience stores at a cost of 15,000 per year. Frequent stops are made to each convenience store by Kaune delivery trucks at a cost of 30,000 per year. Required: 1. Calculate the total cost per case for each of the three customer classes. (Round unit costs to four significant digits.) 2. Using the costs from Requirement 1, calculate the profit per case per customer class. Does the cost analysis support the charging of different prices? Why or why not? 3. What if Kaune charged the average price per case to all customer classes? How would that affect the profit percentages?arrow_forward

- Crescent Company produces stuffed toy animals; one of these is Arabeau the Cow. Each Arabeau takes 0.20 yard of fabric (white with irregular black splotches) and eight ounces of polyfiberfill. Fabric costs 3.50 per yard and polyfiberfill is 0.05 per ounce. Crescent has budgeted production of Arabeaus for the next four months as follows: Inventory policy requires that sufficient fabric be in ending monthly inventory to satisfy 20 percent of the following months production needs and sufficient polyfiberfill be in inventory to satisfy 40 percent of the following months production needs. Inventory of fabric and polyfiberfill at the beginning of October equals exactly the amount needed to satisfy the inventory policy. Each Arabeau produced requires (on average) 0.10 direct labor hour. The average cost of direct labor is 15 per hour. Required: 1. Prepare a direct materials purchases budget of fabric for the last quarter of the year showing purchases in units and in dollars for each month and for the quarter in total. 2. Prepare a direct materials purchases budget of polyfiberfill for the last quarter of the year showing purchases in units and in dollars for each month and for the quarter in total. 3. Prepare a direct labor budget for the last quarter of the year showing the hours needed and the direct labor cost for each month and for the quarter in total.arrow_forwardCloud Shoes manufactures recovery sandals and is planning on producing 12.000 units in March and 11,500 in April. Each sandal requires 1.2 yards if material, which costs $3.00 per yard. The companys policy is to have enough material on hand to equal 15% of next months production needs and to maintain a finished goods inventory equal to 20% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forwardThis year, Hassell Company will ship 4,000,000 pounds of chocolates to customers with total order-filling costs of 900,000. There are two types of customers: those who order 50,000 pound lots (small customers) and those who order 250,000 pound lots (large customers). Each customer category is responsible for buying 1,500,000 pounds. The selling price per pound is 2 per lb for the 50,000 pound lot and 3 per lb for the larger lots, due to differences in the type of chocolate. ABC would likely assign order-filling costs to the customer type as follows: a. 450,000, small; 450,000, large (using pounds as the driver) b. 360,000, small; 540,000, large (using revenue as the driver) c. 750,000, small; 150,000, large (using number of orders as the driver) d. 450,000, small; 450,000, large (using customer type as the driver)arrow_forward

- Elliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of 25,750 and is capable of processing as many as 6,500 purchase orders per year. Each clerk uses a PC and laser printer in processing orders. Time available on each PC system is sufficient to process 6,500 orders per year. The cost of each PC system is 1,100 per year. In addition to the salaries, Elliott spends 27,560 for forms, postage, and other supplies (assuming 26,000 purchase orders are processed). During the year, 25,350 orders were processed. Required: 1. Classify the resources associated with purchasing as (1) flexible or (2) committed. 2. Compute the total activity availability, and break this into activity usage and unused activity. 3. Calculate the total cost of resources supplied (activity cost), and break this into the cost of activity used and the cost of unused activity. 4. (a) Suppose that a large special order will cause an additional 500 purchase orders. What purchasing costs are relevant? By how much will purchasing costs increase if the order is accepted? (b) Suppose that the special order causes 700 additional purchase orders. How will your answer to (a) change?arrow_forwardIguana, Inc., manufactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo, which costs $2.00 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $12.00 per hour. Iguana has the following inventory policies: • Ending finished goods inventory should be 40 percent of next month's sales. • Ending raw materials inventory should be 30 percent of next month's production. Expected unit sales (frames) for the upcoming months follow: March April 275 250 May 300 June 400 July August 375 425 Variable manufacturing overhead is incurred at a rate of $0.30 per unit produced. Annual fixed manufacturing overhead is estimated to be $7,200 ($600 per month) for expected production of 4,000 units for the year. Selling and administrative expenses are estimated at $650 per month plus $0.60 per unit sold. Iguana, Inc., had $10,800 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit sales, 50 percent is…arrow_forwardIguana, Incorporated, manufactures bamboo picture frames that sell for $20 each. Each frame requires 4 linear feet of bamboo, which costs $1.50 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $13 per hour. Iguana has the following inventory policies: Ending finished goods inventory should be 40 percent of next month's sales. • Ending direct materials inventory should be 30 percent of next month's production. Expected unit sales (frames) for the upcoming months follow: March April May June July August 325 350 400 500 475 525 Variable manufacturing overhead is incurred at a rate of $0.30 per unit produced. Annual fixed manufacturing overhead is estimated to be $6,000 ($500 per month) for expected production of 5,000 units for the year. Selling and administrative expenses are estimated at $550 per month plus $0.60 per unit sold. Iguana, Incorporated, had $12,000 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit sales, 50…arrow_forward

- Iguana, Incorporated, manufactures bamboo picture frames that sell for $30 each. Each frame requires 4 linear feet of bamboo, which costs $2.50 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $14 per hour. Iguana has the following inventory policies: • Ending finished goods inventory should be 40 percent of next month's sales. • Ending direct materials inventory should be 30 percent of next month's production. Expected unit sales (frames) for the upcoming months follow: March April May 295 290 340 440 June July August 415 465 Variable manufacturing overhead is incurred at a rate of $0.20 per unit produced. Annual fixed manufacturing overhead is estimated to be $9,000 ($750 per month) for expected production of 5,000 units for the year. Selling and administrative expenses are estimated at $800 per month plus $0.50 per unit sold. Iguana, Incorporated, had $11,800 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit sales,…arrow_forwardsasarrow_forwardIguana, Inc., manufactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo, which costs $2.50 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $14 per hour. Iguana has the following inventory policies: • Ending finished goods inventory should be 40 percent of next month's sales. • Ending direct materials inventory should be 30 percent of next month's production. Expected unit sales (frames) for the upcoming months follow: March April May June July August 315 330 380 480 455 505 Variable manufacturing overhead is incurred at a rate of $0.60 per unit produced. Annual fixed manufacturing overhead is estimated to be $7,200 ($600 per month) for expected production of 3,000 units for the year. Selling and administrative expenses are estimated at $650 per month plus $0.50 per unit sold. Iguana, Inc., had $11,000 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit sales, 50 percent is…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College