Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

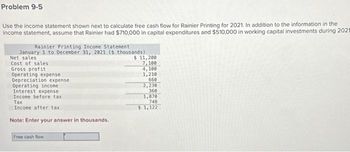

Transcribed Image Text:Problem 9-5

Use the income statement shown next to calculate free cash flow for Rainier Printing for 2021. In addition to the information in the

income statement, assume that Rainier had $710,000 in capital expenditures and $510,000 in working capital investments during 2021

Rainier Printing Income Statement

January 1 to December 31, 2021 (s thousands)

$ 11,200

Net sales

Cost of sales

Gross profit

Operating expense

Depreciation expense

Operating income

Interest expense

Income before tax

Tax

Income after tax

Note: Enter your answer in thousands.

Free cash flow

7,100

4,100

1,210

660

2,230

360

1,870

748

$ 1,122

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Free Cash Flow The following information is from the financial statements of Evans & Sons. Cash flow from operating activities $1,600,000 Capital expenditures 850,000 Current liabilities, beginning of year 300,000 Current liabilities, end of year 380,000 Calculate the free cash flow for Evans & Sons. $ 0arrow_forward↓ The following table shows the projected free cash flows of an acquisition target. The potential acquirer wants to estimate its maximum acquisition price at an 8 percent discount rate and a terminal value in year 5 based on the perpetual growth equation with a 4 percent perpetual growth rate. Year Free cash flow 1 -950 2 3 -475 0 4 290 a. Estimate the target's maximum acquisition price. Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. > Answer is complete but not entirely correct. Maximum acquisition price $ 8,640 x 5 880 b. Estimate the target's maximum acquisition price when the discount rate is 7 percent and the perpetual growth rate is 5 percent. Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. X Answer is complete but not entirely correct. Maximum acquisition price $ 46,921 Xarrow_forwardFree Cash Flows Rhodes Corporation’s financial statements are shown below. Rhodes Corporation: Income Statements for Year Ending December 31(Millions of Dollars) 2020 2019 Sales $ 13,000 $ 11,000 Operating costs excluding depreciation 11,604 9,684 Depreciation and amortization 340 320 Earnings before interest and taxes $ 1,056 $ 996 Less interest 180 100 Pre-tax income $ 876 $ 896 Taxes (25%) 219 224 Net income available to common stockholders $ 657 $ 672 Common dividends $ 201 $ 200 Rhodes Corporation: Balance Sheets as of December 31 (Millions of Dollars) 2020 2019 Assets Cash $ 550 $ 500 Short-term investments 110 100 Accounts receivable 2,750 2,500 Inventories 1,450 1,300 Total current assets $ 4,860 $ 4,400 Net plant and equipment 3,850 3,500 Total assets $ 8,710 $ 7,900 Liabilities and Equity Accounts payable $ 1,100 $ 1,000 Accruals 550…arrow_forward

- Given the following data for Year 1: Earnings before Interest and Tax = $11 million; Interests = $3 million, Taxes = $2 million; Depreciation = $4 million; Investment in fixed assets = 5 million; Investment net working capital = $1 million. Calculate the free cash flow (FCF) for Year 1: Group of answer choices $8 million $9 million $6 million $7 millionarrow_forwardFrom the following information on the income statement and the balance sheet, what is free cash flow to the firm (FCFF) in 2019? Assume that the tax rate is 0.3. Income Statement Items 2018 2019 Revenue 2,542 3,004 Cost of goods sold 1,017 1,235 SG&A expense 308 353 Depreciation 409 505 Interest expense 108 155 Balance Sheet Items 2018 2019 Cash 151 308 Accounts receivable 456 903 Inventory 905 1,207 PP&E 9,087 12,843 Accumulated Dep 4,241 5,739 Accounts payable 605 656 Short-term debt 304 505 Long-term debt 3,044 3,448 Common stock 1,800 1,800 Retained earnings x xarrow_forwardFordson has the following financial information for FY 2023 (in thousands): Operating revenue Salary expense Depreciation expense All other operating expenses Tax expense (20% tax rate) Net Income Expected working capital increase of Capital expenditure What is free cash flow? O 420 720 820 O 1120 O Cannot be calculated 4000 1000 400 1200 280 1120 300 400arrow_forward

- Calculate the Cash Flows in the Statement of Cash Flows below from the provided Balance sheet and Income Statement BALANCE SHEET (in millions of dollars) INCOME STATEMENT (in millions of dollars) 2015 2014 2015 2014 Assets Net sales $3,000.0 $2,850.0 Cash and equivalents 10 $ 80 Operating costs except depreciation and amortizatio 2,616.2 2,497.0 90.0 100.0 Accounts receiva ble 375 315 Depreciation and amortization $ 283.8 $ 263.0 Inventories 615 415 Earnings before interest and taxes (EBIT) Total current asse ts $ 1,000 $ 810 Less interest 88.0 60.0 $ 195.8 $ 203.0 Net plant and equipment 1,000 870 Earnings before taxes (EBT) $ 2,000 1,680 Total assets Taxes 78.3 81.2 117.5 $ 121.8 Net income Liabilities and Equity Common dividends 57.5 53.0 Addition to re tained earnings Accounts payable $ $ 60 $ 30 60.0 $ 68.8 Accruals 140 130 Notes payable 110 60 Tax rate 40% 40% 310 $ Total current liabilities 220 Long-term bonds 750 580 $ 1,060 $ Total liabilities 800 Common stock (50,000,000…arrow_forwardGiven the following information calculate the relevant annual Net Cash Flow After Tax [NCFAT], needed to calculate NPV. Forecast Annual Income $ Cash Revenue 360,000 Less Cash Operating Expenses 160,000 Admin Cash Flow Expenditure 60,000 Depreciation 36,000 Interest 24,000 Net Profit Before Tax Tax @30% 24,000 Net Profit After Tax 56,000arrow_forwardWhat is National Co.’s free cash flow for 2022?arrow_forward

- Determine the cash fixed costs which are used when calculating EBDAT:Administrative expenses = $100, 000; Rent expenses = $70,000;Depreciation expenses = $50,000; and Interest expenses = $20,000arrow_forwardMake sure you provide complete answers, and show your work with calculation problems Given the following information, calculate the Net Free Cash Flow. Net income = $25,000; Capital expenditures = $4,000; Cash dividends paid to shareholders = $2,500; Repayment of Long-term debt = $1,500; Depreciation, Depletion & Amortization = $5,000; Increase in current assets = $250; Increase in current liabilities = $750;arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education