FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

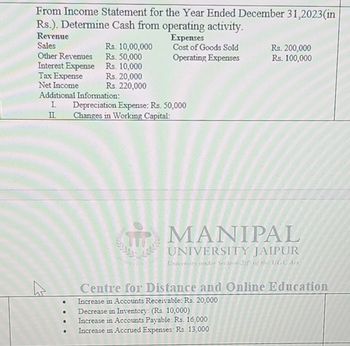

Transcribed Image Text:From Income Statement for the Year Ended December 31,2023(in

Rs.). Determine Cash from operating activity.

Revenue

Sales

Rs. 10,00,000

Expenses

Cost of Goods Sold

Rs. 200,000

Other Revenues

Rs. 50,000

Operating Expenses

Rs. 100,000

Interest Expense Rs. 10,000

Tax Expense

Net Income

Rs. 20,000

Rs. 220,000

Additional Information:

I Depreciation Expense: Rs. 50,000

II

Changes in Working Capital:

MANIPAL

UNIVERSITY JAIPUR

University under Section 2 of the UGC Art

•

Centre for Distance and Online Education

Increase in Accounts Receivable: Rs. 20,000

• Decrease in Inventory: (Rs. 10,000)

• Increase in Accounts Payable: Rs. 16,000

•

Increase in Accrued Expenses: Rs. 13,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider a cash flow and interest profile as shown: The worth at the end of Year 3 of these cash flows is: a. $5,000.00 b. $5,504.72 c. $5,994.56 d. $5,440.00arrow_forwardCurrent Attempt in Progress Lee Enterprises reports the following information: Net income Depreciation expense Increase in accounts payable Increase in accounts receivable $5180000 $3979520. $5180000. $6380480. $5706480. 704480 159000 337000 Lee should report cash provided by operating activities ofarrow_forwardssarrow_forward

- Calculate the free Cash Flow ratioarrow_forwardBauer Industries is an automobile manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 12.3% to evaluate this project. Based on extensive research, it has prepared the following incremental free cash flow projections (in millions of dollars): 1. a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV if revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would…arrow_forwardFrom Income Statement for the Year Ended December 31, 2023 (in Rs.). Determine Cash from operating activity. Revenue Expenses Sales Rs. 500,000 Cost of Goods Sold Rs. 200,000 Other Revenues Rs. 50,000 Operating Expenses Rs. 100,000 Interest Expense Rs. 10,000 Tax Expense Rs. 20,000 Net Income Rs. 220,000 Additional Information: I. Depreciation Expense: Rs. 30,000 II. Changes in Working Capital: Increase in Accounts Receivable: Rs. 10,000. Decrease in Inventory: (Rs. 5,000). Increase in Accounts Payable: Rs. 8,000. Increase in Accrued Expenses: Rs. 3000arrow_forward

- Revenues - Cost of Goods Sold - Depreciation =EBIT - Taxes (20%) =Unlevered net income +Depreciation - Additions to Net Working Capital - Capital Expenditures =Free Cash Flow Year 0 OA. by 35% OB. by 41% OC. by 69% O D. by 55% Year 1 500,000 - 300,000 Year 2 500,000 - - 100,000 -100,000 165,000-165,000 235,000 -47,000 235,000 -47,000 Year 3 500,000 -165,000 -100,000 188,000 188,000 100,000 100,000 - 20,000 - 20,000 268,000 268,000 Visby Rides, a livery car company, is considering buying some new luxury cars. After extensive research, they come up with the above estimates of free cash flow from this project. Visby learns that a competitor is thinking of offering similar services, thus reducing Visby's sales. By how much could sales fall before the net present value (NPV) was zero, given that the cost of capital is 8%, and that cost of goods sold is 45% of revenues? 235,000 - 47,000 188,000 100,000 - 20,000 268,000arrow_forwardThe following details are provided by a manufacturing company: Investment Useful life Estimated annual net cash inflows for first year Estimated annual net cash inflows for second year Estimated annual net cash inflows for next ten years Residual value Product line OA. 2.74 years OB. 6.36 years O c. 6.71 years OD. 2.24 years $1,030,000 12 years $460,000 $430,000 $190,000 $50,000 Depreciation method Straight-line 12% Required rate of return Calculate the payback period for the investment. (Round your answer to two decimal places.) ...arrow_forwardNeed Correct answer of the questionarrow_forward

- Free Cash Flow The following information is from the financial statements of Evans & Sons. Cash flow from operating activities $1,600,000 Capital expenditures 850,000 Current liabilities, beginning of year 300,000 Current liabilities, end of year 380,000 Calculate the free cash flow for Evans & Sons. $ 0arrow_forwardNeed Help.arrow_forwardStatement of Cash Flows The following is a list of the items for L Company's 2019 statement of cash flows: a. depreciation expense, $4,100 g. proceeds from issuance of note, $6,100 b. proceeds from sale of land, $5,500 h. gain on sale of land, $1,900 c. payment of dividends, $5,000 i. payment for purchase of building, $14,000 d. net income, $8,000 j. increase in accounts receivable, $2,800 e. conversion of bonds to common stock, $7,000 k. ending cash balance, $14,000 f. increase in accounts payable, $3,000 Required: Prepare the statement of cash flows. Use a minus sign to indicate cash outflows, a decrease in cash or cash payments. L COMPANY Statement of Cash Flows For Year Ended December 31, 2019 Operating Activities: $fill in the blank 2 Adjustment for noncash income items: fill in the blank 4 fill in the blank 6 Adjustments for cash flow effectsfrom working capital items: fill in the blank 8…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education