FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

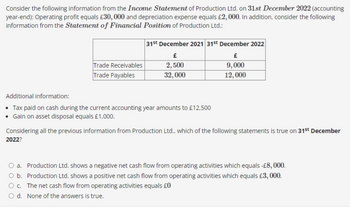

Transcribed Image Text:Consider the following information from the Income Statement of Production Ltd. on 31st December 2022 (accounting

year-end): Operating profit equals £30,000 and depreciation expense equals £2,000. In addition, consider the following

information from the Statement of Financial Position of Production Ltd.:

Trade Receivables

Trade Payables

31st December 2021 31st December 2022

£

£

2,500

9,000

32,000

12,000

Additional information:

• Tax paid on cash during the current accounting year amounts to £12,500

• Gain on asset disposal equals £1,000.

Considering all the previous information from Production Ltd., which of the following statements is true on 31st December

2022?

O a. Production Ltd. shows a negative net cash flow from operating activities which equals -£8,000.

O b. Production Ltd. shows a positive net cash flow from operating activities which equals £3,000.

O c. The net cash flow from operating activities equals £0

O d. None of the answers is true.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The XYZ Company had the following income statement on 31.12.2020 Deprecation 12000 Net income 85000 OMR The following accounts decreased during 2020: Accounts receivable 18000 inventory 22000 OMR, Rent payable 6000, Machinery 15000 OMR The following accounts increased during 2020:Notes receivable 12000 Accounts Payable 11000 long term Bonds payable 30000 OMR Calculate cash flows from operating activities a. 149000 OMR b. 145000 OMR c. 130000 OMR d. NONE OF THESEarrow_forwardReview the Statement of Cash Flows and UIG 1031 - Accounting for the Goods and Services Tax, particularly point 11. What is one change that needs to be made to the Statement of Cash Flows to ensure it is in compliance with the accounting standards?arrow_forwardHow to prepare a statement of cash flow for this question?arrow_forward

- Suppose you collected the following information of ABC corp. from the financial statements published in 2019. Entry Total Current Assets 14050001206000 Current Liabilities Notes Payable Earning before Interest and Taxes Depreciation Capital expenditures Tax rate Select one: @a. 1279990X b. 187578 0c Estimate the Free Cash Flow available for ABC corp. at the end of 2019. 60030 2019 d. 1092412 e 30 2018 602000 571500 476990 457912 97680 159000 -30000 40%arrow_forwardThis Information will be used for all questions: Selected Balance Sheet Information Year 2020 Year 2021 Cash 40,000 ? Accounts Receivable 10,000 14,000 Prepaid Rent 5,000 6,000 Inventory 35,000 30,000 Accounts Payable 3,000 2,000 Unearned Revenue 5,000 7,000 Income Taxes Payable 14,000 12,000 Other Relevant Information for 2021 Beginning Cash Balance 40,000 Net Income 65,000 Depreciation Expense 40,000 Cash Paid for Dividends 10,000 Cash Received for Loan 40,000 Cash Repaying Loan 10,000 Cash Payment to Purchase Land 12,000 Cash Received for Sale of Equipment 15,000 Gain on Sale of Equipment 5,000 Cash Received for Issuance of Stock…arrow_forwardSituation A: A company has revenues of P200,000 and operating expenses of P110,000 in its 1st year of operations, 2019. For the purpose ignore income taxes.Accounts receivable and accounts payable at year end were P71,000 and P29,000, respectively. Assume that the accounts payable related to operating expenses. Using the direct method, compute net cash provided by operating activities. Situation B:Cost of goods sold were at P310,000 and operating expenses (exclusive of depreciation) P230,000. The comparative balance sheet for the year shows that inventory increased P26,000, prepaid expenses decreased P8,000, accounts payable (related to merchandise) decreased P17,000, and accrued expenses payable increased P11,000. Compute (a) cash payments to suppliers and (b) cash payments for operating expenses.arrow_forward

- Required: Using the direct method, compute the net cash flows from operations for Liu Company for 2018.arrow_forward9.Hong Kong Clothiers reported revenue of $5,150,000 for its year ended December 31, 2021. Accounts receivable at December 31, 2020 and 2021, were $321,400 and $354,300, respectively. Using the direct method for reporting cash flows from operating activities, Hong Kong Clothiers would report cash collected from customers of: Group of answer choices $5,117,100 $5,150,000 $5,192,900 $5,182,900arrow_forwardn its CASH BASIS income statement for the year ended June 30, 2020, Selena Corp. reported revenue of $142,000 (i.e., total cash receipts from sales). Additional information was as follows: Accounts receivable June 30, 2019 $40,000 Accounts receivable June 30, 2020 $45,600 Under the ACCRUAL basis, Selena Corp. should report sales revenue of A. $147,600 B. $102,000 C. $182,000 D. $136,400arrow_forward

- 12. Aqua Ltd has operating profit for the year ended 30 June 2020 of £56,300, after charging depreciation of £18,500 and making a profit on the disposal of a car of £1,000. The balance sheet shows the following: InventoryTrade Receivables Trade Payables 2019 2020 ££ 8,500 13,200 17,000 15,500 12,600 14,200 What is the net cash from operating activities? a) £71,200 b) £72,200 c) £78,100 d) £77,100arrow_forwardGiven the financial data for New Electronic World, Inc. (NEW), compute the following measures of cash flows for the NEW for the year ended December 31, 2021 Required: Compute for the operating cash flow Compute for the free cash flowarrow_forwardProvide a Market Share Ratio Analysis based on the Per Share Data given. (PER) and (PBR).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education