Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

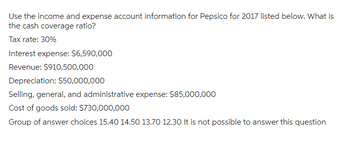

Transcribed Image Text:Use the income and expense account information for Pepsico for 2017 listed below. What is

the cash coverage ratio?

Tax rate: 30%

Interest expense: $6,590,000

Revenue: $910,500,000

Depreciation: $50,000,000

Selling, general, and administrative expense: $85,000,000

Cost of goods sold: $730,000,000

Group of answer choices 15.40 14.50 13.70 12.30 It is not possible to answer this question

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What does this say about the company?arrow_forwardTotal Assets for Wendy's Pumpkins on 1 January 2020 was $650,000 and on 31 December 2020 was $850,000. Profit (before tax) for 2020 was $70,000, and the interest expense of the period was $20,000. What was the 2020 Rate of Return on Total Assets for Wendy's Pumpkins? formula: Rate of Return on Total Assets = Profit before Interest and Tax / Average Total Assets Select one: а. 4% O b. 9% О с. 16% O d. 12%arrow_forwardElgin Battery Manufacturers had sales of $840,000 in 2021 and their cost of goods sold is 562,800 Selling and administrative expenses were 75,600 Depreciation expense was $19,000 and interest expense for the year was $12,000. The firm's tax rate is 35 percent. What is the dollar amount of taxes paid in 2021? Multiple Choice $172.974 $59.710 $198,400 $63,910arrow_forward

- Consider the following income statement: Sales Costs $ 602,184 391,776 Depreciation 89,100 Taxes Calculate the EBIT. EBIT 21% Calculate the net income. Net incomearrow_forwardProvide Answer with calculationarrow_forwardUse the following information to answer this question: Net sales Windswept, Incorporated 2021 Income Statement Cost of goods sold Depreciation ($ in millions) Earnings before interest and taxes Interest paid Taxable income Taxes Net income $ 9,050 7,540 430 $ 1,080 96 $ 984 344 $ 640 Windswept, Incorporated 2020 and 2021 Balance Sheets ($ in millions) 2020 Cash $ 180 2021 $ 210 2020 Accounts payable $ 1,190 Accounts received Inventory 900 1,670 800 1,610 Long-term debt Common stock 1,070 3,280 2021 $ 1,335 1,285 2,970 Total $ 2,750 $ 2,620 Retained earnings 560 810 Net fixed assets. Total assets 3,350 $6,100 3,780 $6,400 Total liabilities & equity $ 6,100 $ 6,400 What is the days' sales in receivables for 2021?arrow_forward

- Please do not give solution in image format thankuarrow_forwardGiven the following information, prepare an income statement for Jonas Brothers Cough Drops. Note: Input all your answers as positive values. Selling and administrative expense $ 301,000 Depreciation expense 198,000 Sales 2,050,000 Interest expense 128,000 Cost of goods sold 521,000 Taxes 167,000arrow_forwardA company has the following income statement. What is its net operating profit after taxes (NOPAT)? Round it to a whole dollar. Sales $ 1,200 Costs 600 Depreciation 170 EBIT $ ? Interest expense 50 EBT $ ? Taxes (20%) ? Net income $ ?arrow_forward

- Crane Manufacturing Ltd's sales for the year ended December 31, 2022 are $1.24 million. The expenses for 2022 are as follows: Cost of goods sold Selling expenses Variable Fixed $416,000 $234.000 34,320 46,800 72,800 Administrative expenses 36,320 Prepare a detailed CVP income statement for the year ended December 31, 2022. Crane Manufacturing Ltd. CVP Income Statementarrow_forwardPlease provide correct answerarrow_forwardNeed help about this Questionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education