FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I need help with 7, 8,9

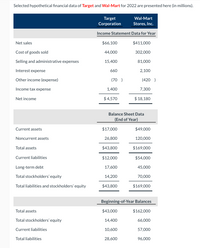

Transcribed Image Text:# Financial Data Analysis: Target Corporation vs. Wal-Mart Stores, Inc. (2022)

## Income Statement Data for Year (in millions)

### Target Corporation

- **Net Sales:** $66,100

- **Cost of Goods Sold:** $44,000

- **Selling and Administrative Expenses:** $15,400

- **Interest Expense:** $660

- **Other Income (Expense):** $(70)

- **Income Tax Expense:** $1,400

- **Net Income:** $4,570

### Wal-Mart Stores, Inc.

- **Net Sales:** $411,000

- **Cost of Goods Sold:** $302,000

- **Selling and Administrative Expenses:** $81,000

- **Interest Expense:** $2,100

- **Other Income (Expense):** $(420)

- **Income Tax Expense:** $7,300

- **Net Income:** $18,180

## Balance Sheet Data (End of Year)

### Target Corporation

- **Current Assets:** $17,000

- **Noncurrent Assets:** $26,800

- **Total Assets:** $43,800

- **Current Liabilities:** $12,000

- **Long-Term Debt:** $17,600

- **Total Stockholders' Equity:** $14,200

- **Total Liabilities and Stockholders’ Equity:** $43,800

### Wal-Mart Stores, Inc.

- **Current Assets:** $49,000

- **Noncurrent Assets:** $120,000

- **Total Assets:** $169,000

- **Current Liabilities:** $54,000

- **Long-Term Debt:** $45,000

- **Total Stockholders' Equity:** $70,000

- **Total Liabilities and Stockholders’ Equity:** $169,000

## Beginning-of-Year Balances

### Target Corporation

- **Total Assets:** $43,000

- **Total Stockholders' Equity:** $14,400

- **Current Liabilities:** $10,600

- **Total Liabilities:** $28,600

### Wal-Mart Stores, Inc.

- **Total Assets:** $162,000

- **Total Stockholders' Equity:** $66,000

- **Current Liabilities:** $57,000

- **Total Liabilities:** $96,000

---

## Analysis and Insights

### Income Statement Analysis

- **Net Sales Comparison:** Wal

Transcribed Image Text:### Financial Ratios for Target and Wal-Mart

Below is the financial data for Target and Wal-Mart, which will be used to compute various financial ratios:

#### Other Data

| | Target | Wal-Mart |

|---|---|---|

| Average net accounts receivable | $7,900 | $4,200 |

| Average inventory | 7,200 | 33,700 |

| Net cash provided by operating activities | 5,800 | 26,200 |

| Capital expenditures | 1,700 | 12,400 |

| Dividends | 460 | 3,600 |

**Instructions:** For each company, compute the following ratios. *Round current ratio answers to 2 decimal places (e.g., 15.50). Round debt to assets ratio and free cash flow answers to 0 decimal places (e.g., 5,275) and all answers to 1 decimal place (e.g., 1.8 or 1.83%).*

#### Ratios to Compute

| Ratio | Target | Wal-Mart |

|---|---|---|

| (1) Current ratio | | :1 | | :1 |

| (2) Accounts receivable turnover | | times | | times |

| (3) Average collection period | | days | | days |

| (4) Inventory turnover | | times | | times |

| (5) Days in inventory | | days | | days |

| (6) Profit margin | | % | | % |

| (7) Asset turnover | | times | | times |

| (8) Return on assets | | % | | % |

| (9) Return on common stockholders' equity | | % | | % |

| (10) Debt to assets ratio | | % | | % |

| (11) Times interest earned | | times | | times |

| (12) Free cash flow | $ | $ | $ | $ |

The financial ratios above provide a snapshot of each company's financial health, efficiency, and profitability, which are essential for making informed business decisions and comparative analysis.

**Graphs or Diagrams:**

No graphs or diagrams are present in the image; however, the table is set up for easy calculation and comparison of financial ratios. Each row represents a different ratio, with columns for Target and Wal-Mart to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi I need help, it says my answer is wrong but I read over and over and over. Please helparrow_forwardHow did COVID-19 chnage medical supplies where they're needed during emergencies. How can that be changed now?arrow_forwardent II - Chapter 5 Saved Help Save & E 13 1.46853 0.68095 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 15.6178 10.63496 16.0863 10.95400 17.0863 11.29607 18.5989 11.93794 17.5989 11.63496 19.1569 12.29607 20.1569 12.56110 20.7616 12.93794 Monica wants to sell her share of an investment to Barney for $140,000 in 4 years. If money is wOrth 6% compounded semiannually, what would Monica accept today? Multiple Choice 110,517 $ 109.263 ( Prev 7 of 15 Next>arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education