FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

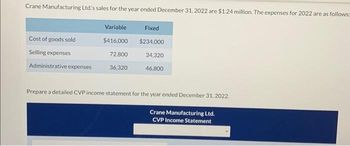

Transcribed Image Text:Crane Manufacturing Ltd's sales for the year ended December 31, 2022 are $1.24 million. The expenses for 2022 are as follows:

Cost of goods sold

Selling expenses

Variable

Fixed

$416,000 $234.000

34,320

46,800

72,800

Administrative expenses 36,320

Prepare a detailed CVP income statement for the year ended December 31, 2022.

Crane Manufacturing Ltd.

CVP Income Statement

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sellall Department Stores reported the following amounts as of its December 31 year-end: Administrative Expenses, $2,400; Cost of Goods Sold, $22,728; Income Tax Expense, $3,000; Interest Expense, $1,600; Interest Revenue, $200; General Expenses, $2,600; Net Sales, $37,880; and Delivery (freight-out) Expense, $300. Required: 1. Calculate the gross profit percentage. 2. How has Sellall performed, relative to the 24.5 percent gross profit percentage reported for Walmart in 2019? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.)check all that apply Sellall Department Stores earned a higher gross profit percentage than Walmart. Walmart earned a higher gross profit percentage than Sellall Department Stores. Sellall includes more mark-up in the prices it charges customers than Walmart. Walmart includes more mark-up in prices it…arrow_forwardIn its income statement for the year ended December 31, 2022, Splish Brothers Inc. reported the following condensed data. Prepare a multiple step income statement , and then calculate the profit margin and gross profit rate. Salaries and wages expenses $576,600 Loss on disposal of plant assets $103,540 Cost of goods sold 1,223,880 Sales revenue 2,740,400 Interest expense 89,460 Income tax expense 31,000 Interest revenue 80,600 Sales discounts 198,400 Depreciation expense 384,400 Utilities expense 136,400arrow_forwardA company reports the following amounts at the end of the year: Sales revenue Cost of goods sold Net income $ 310,000 210,000 53,000 Compute the company's gross profit ratio. (Round your final answe Gross profit ratio %arrow_forward

- Revenue and expense data for the current calendar year for Sorenson Electronics Company and for the electronics industry are as follows. Sorenson Electronics Company data are expressed in dollars. The electronics industry averages are expressed in percentages. SorensonElectronicsCompany ElectronicsIndustryAverage Sales $2,690,000 100 % Cost of goods sold (1,829,200) (74) Gross profit $860,800 26 % Selling expenses $(484,200) (10) % Administrative expenses (188,300) (10) Total operating expenses $(672,500) (20) % Operating income $188,300 6 % Other revenue and expense: Other revenue 53,800 4 Other expense (26,900) (3) Income before income tax $215,200 7 % Income tax expense (80,700) (5) Net income $134,500 2 %arrow_forwardPortions of the financial statements for Peach Computer are provided below. PEACH COMPUTER Income Statement For the year ended December 31, 2024 Net sales Expenses: Cost of goods sold Operating expenses Depreciation expense Income tax expense Total expenses Net income Cash Accounts receivable Inventory Prepaid rent Accounts payable Income tax payable $1,100,000 610,000 55,000 45,000 PEACH COMPUTER Selected Balance Sheet Data December 31 2024 $107,000 45,500 80,000 3,500 50,000 5,500 2023 $87,500 51,500 57,500 6,000 39,500 12,500 $1,925,000 1,810,000 $115,000 Increase (I) or Decrease (D) $19,500 (I) (D) 6,000 22,500 (I 2,500 (D) 10,500 (I) 7,000 (D)arrow_forwardCochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forward

- Manero Company included the following information in its annual report: 2018 2017 Sales Cost of goods sold Operating expenses Net income $188,400 115,000 50,000 23,400 $162,500 102,500 50,000 10,000 2016 $150,500 100,000 45,000 5,500 In a common size income statement for 2017, the cost of goods sold are expressed as OA. 115.0% OB. 61.0% OC. 100.0% O D. 63.7%arrow_forwardAssume the following sales data for a company: Line Item Description Amount Current year $883,993 Preceding year 542,076 What is the percentage increase in sales from the preceding year to the current year? a. 63.08% b. 61.32% c. 163.08% d. 38.68%arrow_forwardC. Paxton Company provided the following income statement for last year: P 87,021,000 (62,138,249) P 24,882,751 (19,371,601) P 5,511,150 (875,400) P 4,635,750 (1,854,300) P 2.781.450 Sales Cost of Goods Sold Gross Margin Operating Expenses Operating Income Interest Expense Income Before Taxes Income Taxes Net Income Required: Calculate the times interest earned ratio. (Round your answer to one decimal place.arrow_forward

- At the fiscal year ended June 30, 2020, the following information is available for Shein Company: Cost of goods sold. . .$167,400 Sales returns and allowances... 4,000 Sales revenue. 243,200 Interest expense... 5,000 Operating expenses... 88,700 Shein's net income/(net loss) for the period is Select one: a. Net income of $21,900 O b. Net income of $11,900 O c. Net loss of $11,900 O d. Net loss of $21,900arrow_forwardCalculate Swifty's gross profit percentage and percentage markup on cost for each fiscal year. (Round answers to 2 decimal places, eg. 52.75.) Percentage gross profit Percentage markup on cost Fiscal 2023 35.74 % 3.43 % Fiscal 2022 36.13 % 5.67 %arrow_forwardThe following information is available for Skysong Corp. for the year ended December 31, 2025. Other revenues and gains $21,600 Other expenses and losses 3,000 Cost of goods sold 281,000 Sales discounts 3,200 Sales revenue 746,000 Operating expenses 210,000 Sales returns and allowances 8,800 Prepare a multiple-step income statement for Skysong Corp. The company has a tax rate of 25%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education