EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

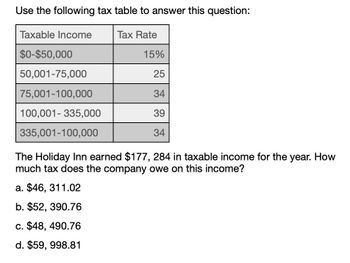

Transcribed Image Text:Use the following tax table to answer this question:

Taxable Income

$0-$50,000

50,001-75,000

75,001-100,000

100,001-335,000

335,001-100,000

Tax Rate

15%

25

34

39

34

The Holiday Inn earned $177, 284 in taxable income for the year. How

much tax does the company owe on this income?

a. $46, 311.02

b. $52, 390.76

c. $48, 490.76

d. $59,998.81

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Stone Inn earned $167,284 in taxable income for the year. How much tax does the company owe on this income? TxableIncome 60.000 Tox Rale 18% 50.001- 75.000 75.001-100.000 100.001- 35.000 335.001- 10,000,000 a. $46,311.02 b. $48,490.76 c. $54,519.27 d. $65,240.76arrow_forwardUsing the marginal tax rate below, calculate the tax liability for A.B.C Company when it has a taxable income of $ 4,500, 000 Marginal tax rate: $0 - 50,000 15% $50,000 - 75,000 25% $75,000 10,000,000 34% above 10,000,000 35% Additional: 5% on income between $100,000 - $335,000 3% on income between $15,000,000 - $18,333,333 Use the editor to format your answerarrow_forwardUse the following tax table to determine how much income tax is paid on 732000 of taxable income. Taxable Income Bracket $0 to $9,325 Total Paid = $ Rate 10% 15% $9,325 to $37,950 25% $37,950 to $91,900 28% $91,900 to $191,650 33% $191,650 to $416,700 35% 39.60% $416,700 to $418,400 $418,400+ Single Taxable Income Tax Brackets and Rates, 2017arrow_forward

- Eccentricity, Incorporated had $300,000 in 2018 taxable income. Using the tax schedule from Table 2.3, what are the company's 2018 income taxes, average tax rate, and marginal tax rate, respectively? Taxable income Pay this amount on Base income Plus this percentage on anything over the base $0 – $50,000 $ 0 15% $50,001 – $75,000 $ 7,500 25% $75,001 – $100,000 $ 13,750 34% $100,001 – $335,000 $ 22,250 39% $335,000 – $10,000,000 $ 113,900 34%arrow_forwardUse the following tax table to determine how much income tax is paid on 915000 of taxable income. Total Paid = $ Rate 10% 15% 25% 28% 33% 35% 39.60% Taxable Income Bracket $0 to $9,325 $9,325 to $37,950 $37,950 to $91,900 $91,900 to $191,650 $191,650 to $416,700 $416,700 to $418,400 $418,400+ Single Taxable Income Tax Brackets and Rates, 2017arrow_forwardNeed help with this question solution general accountingarrow_forward

- The following information pertains to Ramesh Company for the current year: Book income before income taxes $ 1,06,000 Income tax expense 45,500 Income taxes due for this year 28,000 Statutory income tax rate 35% The company has one permanent difference and one temporary difference between the book and taxable income. a. Calculate the amount of temporary difference for the year and indicate whether it causes book income to be more or less than taxable income. b. Calculate the amount of permanent difference for the year and indicate whether it causes book income to be more or less than taxable income. c. Provide the journal entry to record income tax expenses for the year. d. Compute the effective tax rate (that is, income tax expense divided by book income before taxes).arrow_forwardGive typing answer with explanation and conclusion 6. Thornton, Inc., had taxable income of $131,387 for the year. The company's marginal tax rate was 35 percent and its average tax rate was 22.8 percent. How much did the company have to pay in taxes for the year?arrow_forwardAssume that the Kelso Company operates in an industry for which NOL carryback is allowed. The Kelso Company had the following operating results: O $22,800. Year 2019 2020 2021 25% What is the income tax refund receivable? O $24,300 O $28,800. Income (loss) 54,000 57,000 (72,000) O 23,550. Tax rate 35% 30% Income tax 18,900first year of operations 17,100 0arrow_forward

- Can you please help me with this question?arrow_forwardSea Harbor, Inc. has a marginal tax rate of.... Please need answer the accounting questionarrow_forwardDiscussion Question: The average tax rate is calculated by dividing the total tax payable by the taxable income and it represents the percentage of the income that goes to pay taxes. Consider the following data for two corporations. ABC and XYZ Inc.: Particulars ABC Inc. (Rs.) XYZ Inc. (Rs.) Gross Profit 2,600,000 2.600,000 Administrative Expenses 800,000 800,000 Depreciation Other Income Taxable Income 200,000 500,000 900,000 900,000 2,500,000 2,200,000 Requirements: i. Calculate the average tax rate for both companies. ii. Briefly describe how the above calculations support the notion that depreciation acts as a tax shield. Your answers must be presented in the following format:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT