Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

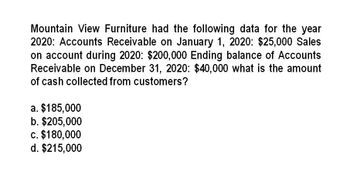

What is the amount of cash collected from customers on these general accounting question?

Transcribed Image Text:Mountain View Furniture had the following data for the year

2020: Accounts Receivable on January 1, 2020: $25,000 Sales

on account during 2020: $200,000 Ending balance of Accounts

Receivable on December 31, 2020: $40,000 what is the amount

of cash collected from customers?

a. $185,000

b. $205,000

c. $180,000

d. $215,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Starlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts receivable balance of $844,260, and an ending accounts receivable balance of $604,930. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Starlight Enterprises if the industry average is 1.5 times and the number of days sales ratio is 175 days?arrow_forwardJoseph Co. reported the following financial information for 2020: Accounts receivable, January 1, 2020 P1,200 Accounts Receivable, December 31, 2020 250 Cash collection from customer on account 1,300 Joseph Co.’s service revenue rendered on account to clients amounted toarrow_forward6. At January 1, 2020, Teal Inc. had accounts receivable of $73,000. At December 31, 2020, accounts receivable is $54,000. Sales revenue for 2020 total $451,000.Compute Teal’s 2020 cash receipts from customers. Cash receipts from customers $arrow_forward

- A company reported the following information: Accounts receivable, December 31, 2023: $122,000 Accounts receivable, December 31, 2022: $113,000 Sales (all on credit) for 2023: $850,000 Accounts receivable, December 31, 2023 $122,000 Accounts receivable, December 31, 2022 113,000 Sales (all on credit) for 2023 850,000 How much cash was collected from customers during 2023?arrow_forwardStarboy Company has the following data relating to accounts receivable for the year ended December 31, 2022: Accounts receivable, January 1, 2022 P 480,000 Allowance for doubtful accounts, 1/1/22 28,600 Cash sales 300,000Sales on account, terms: 2/10, 1/15, n/30 2,560,000 Cash received from customers during the year 2,400,000 Accounts written off during the year 17,600 Cash refunds given to cash customers for sales returns and allowances 15,000 Credit memoranda issued to credit customers for sales returns and allowances 25,000 The P2,400,000 collection is composed of the following: Collection from customers availing the 10-day discount period: Gross selling price P 1,440,000 Discount taken (1,440,000 x 2%) ( 28,800) P 1,411,200 Collection from customers availing the 15-day discount period: Gross selling price 800,000 Discount taken (800,000 x 1%) ( 8,000) 792,000 Collection from customers paying beyond the discount period: 192,000 Collection of accounts previously written and…arrow_forwardThe following information relates to Halloran Company's accounts receivable for 2024: Accounts receivable balance, 1/1/2024 $ 841,000 Credit sales for 2024 3,450,000 Accounts receivable written off during 2024 51,000 Collections from customers during 2024 2,960,000 Allowance for uncollectible accounts balance, 12/31/2024 218,000 What amount should Halloran report for accounts receivable, before allowances, at December 31, 2024?arrow_forward

- Below is information about Adam Ltd’s cash position for the month of May 2020. The general ledger Cash at Bank account had a balance of $42,400 on 30 April. The cash receipts journal showed total cash receipts of $585,408 for May. The cash payments journal showed total cash payments of $530,148 for May. The June bank statement reported a bank balance of $82,368 on 30 May. Outstanding cheques at the end of May were: no. 221, $2896; no. 225, $308; and no. 230, $820. Cash receipts of $20,180 for 31 May were not included in the May bank statement. A dishonoured cheque written by a client Jim Ltd, $272 A credit for an electronic transfer from a customer of $1,288 Interest earned, $88 Account and transaction fees, $24 Required: Update the cash receipts and cash payments journals by adding the necessary adjustments and calculate the total cash receipts and cash payments for May. Post from cash receipts and cash payments journals to the Cash at Bank ledger account and balance the account.…arrow_forwardCompany A's net credit sales in 2020 and 2021 are 21115 and 35118 respectively. Cost of sales in 2020 is 15432, and in 2021 is 17088. Company A'a account receivable in 2020 and 2021 are 500 and 1000 respectively and its inventory in 2020 and 2021 are 2839 and 3489 respectively. Company A's cash collections from customers in 2021 are:arrow_forwardPlease help me with show all calculation thankuarrow_forward

- Directions: Read each senterce carefully and determine whether the statement is TRUE or FALS E. Write your answers on the space provided before each number. 1. At the beginning of the day, you have P200 cash in your pocket. At the end of the day, you have P50 left. If you make a horizontal analysis of your cash, you would conclude that your cash has decreased by 80% during the day. 2. In 2019, Entity A reported sales of P100 and profit of P20. In a vertical analysis, a financial statement user would conclude that Entity A was able to generate 20% profit from every peso of its sales during the period. 3. Entity A reported irventory balances of P100 and P50 in 2019 and 2018, respectively. In a horizontal analysis, a financial statement user would conclude that Entity A's inventory has increased by 50% from2018 to 2019. 4. An analysis of the intenelationships of infomation in a single period, expressed as parcentages of a common denomirator, is called horizortal analysis. 5. A comparison…arrow_forwardIn 2021, Hope Company incurred sales on account of $105,000. The company also has the following information: December 31, 2021 December 31, 2020 Accounts Receivable $21,500 $53,000 Accounts Payable $72,000 $47,000 What is the amount of cash received from customers for Hope Company in 2021? Multiple Choice $114,400 $136,500 $105,000 $88,500arrow_forwardCash and accounts receivable for Adams Company are as follows: Prior Current Year Year Cash $41,208 $30,300 Accounts receivable (net) 26,313 53,700 What are the amounts and percentages of increase or decrease that would be shown with horizontal analysis? Account Dollar Change Percent Change Cash Accounts Receivable ems (Previous Next to search a. 53°F Sunny 3:28 PM (中岁 12/14/2021arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning