FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

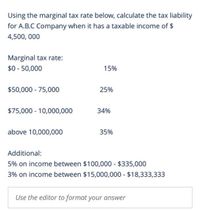

Transcribed Image Text:Using the marginal tax rate below, calculate the tax liability

for A.B.C Company when it has a taxable income of $

4,500, 000

Marginal tax rate:

$0 - 50,000

15%

$50,000 - 75,000

25%

$75,000 10,000,000

34%

above 10,000,000

35%

Additional:

5% on income between $100,000 - $335,000

3% on income between $15,000,000 - $18,333,333

Use the editor to format your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- need answer in step by steparrow_forwardWoods Company reports income before taxes in the amount of $925,000. The current tax expense is $365,375 and the effective tax rate is 27%. What is the conservatism ratio for Woods Company? Group of answer choices 0.45 0.19 0.40 0.68arrow_forwardFranklin Corporation just paid taxes of $152,000 on taxable income of... Franklin Corporation just paid taxes of $152,000 on taxable income of $512,000. The marginal tax rate is 35% for the company. What is the average tax rate for the Franklin Corporation?arrow_forward

- Nonearrow_forwardYou have calculated the adjusted profit for the company to be $2,000,000. Capital Allowance was $20,000. The tax rate is 25%.Estimated tax paid during the year is $750,000. Employment Tax Credit available (which is nonrefundable)is $700,000. The tax refundable for this company is.a. $950,000b. $500,000c. $250,000d. $200,000arrow_forwardThe Stone Inn earned $167,284 in taxable income for the year. How much tax does the company owe on this income? TxableIncome 60.000 Tox Rale 18% 50.001- 75.000 75.001-100.000 100.001- 35.000 335.001- 10,000,000 a. $46,311.02 b. $48,490.76 c. $54,519.27 d. $65,240.76arrow_forward

- Z (Corporate income tax) Meyer Inc. has taxable income (earnings before taxes) of $319,000. Calculate Meyer's federal income tax liability using the tax table shown in the popup window: What are the firm's average and marginal tax rates? The firm's tax liability for the year is $. (Round to the nearest dollar.) 2 30 F2 W S Data table iple X भ command Taxable Income $0-$50,000 $50,001-$75,000 $75,001-$100,000 $100,001-$335,000 39% $335,001-$10,000,000 34% $10,000,001-$15,000,000 35% $15,000,001-$18,333,333 38% 35% Over $18,333,333 (Click on the icon in order to copy its contents into a spreadsheet.) # 3 Get more help - 80 E D $ 4 C 000 000 F4 R Print F % 5 Marginal Tax Rate 15% 25% 34% V F5 T Done G MacBook Air A 6 P F6 B Y & 7 H 44 F7 U N X 00 * 8 J DII FB 1 1 M 9 K MOSISO BB F9 O 1 O < I H L F10 Clear all P 11 • V command : ; FIX { + + 11 Check answer = 1 ? option 14 1 F12 } 1 A delete 1arrow_forwarda) Tax BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. FUTA SUTA b) Tax b. c. Compute BMX's amounts for each of these four taxes as applied to the employee's gross earnings for September under each of three separate situations (a), (b), and (c). Note: Round your answers to 2 decimal places. FICA-Social Security FICA-Medicare FUTA SUTA c) Tax Gross Pay through August 31 $ 6,500 2,100 131,500 FICA-Social Security FICA-Medicare FUTA SUTA FICA-Social Security FICA-Medicare Gross Pay for September $ 900 2,200 8,100 September Earnings Subject to Tax September Earnings Subject to Tax September Earnings Subject to Tax Tax Rate Tax Rate Tax Rate Tax Amount Tax Amount Tax Amountarrow_forwardG. R. Edwin Inc. had sales of $5.88 million during the past year. The cost of goods sold amounted to $2.8 million. Operating expenses totaled $2.57 million, and interest expense was $30,000. Use the corporate tax rates shown in the popup window, Taxable Income Marginal Tax Rate $0−$50,000 15% $50,001−$75,000 25% $75,001−$100,000 34% $100,001−$335,000 39% $335,001−$10,000,000 34% $10,000,001−$15,000,000 35% $15,000,001−$18,333,333 38% Over $18,333,333 35% , to determine the firm's tax liability. What are the firm's average and marginal tax rates?arrow_forward

- Need Help with this Questionarrow_forwardThe tax rates are as shown below: Taxable Income Tax Rate $ 0 - 50,000 15 % 50,001 - 75,000 25 % 75,001 - 100,000 34 % 100,001 - 335, 000 39 % Your firm currently has taxable income of $81,600. How much additional tax will you owe if you increase your taxable income by $22, 800 ?arrow_forwardHelparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education