Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

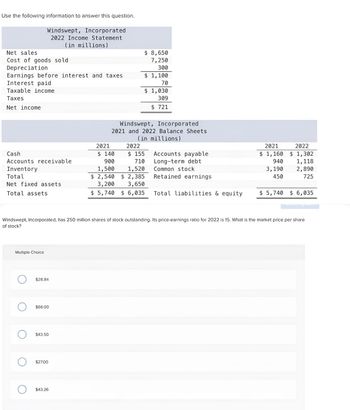

Transcribed Image Text:Use the following information to answer this question.

Windswept, Incorporated

2022 Income Statement

(in millions)

Net sales

Cost of goods sold

Depreciation

Earnings before interest and taxes

Interest paid

Taxable income

Taxes

Net income

Cash

Accounts receivable

Inventory

Total

Net fixed assets

Total assets

Multiple Choice

O

O

O

$28.84

O $43.50

O

$66.00

$27.00

2021

$43.26

Windswept, Incorporated

2021 and 2022 Balance Sheets

(in millions)

$ 140

900

$ 8,650

7,250

300

$ 1,100

70

$ 1,030

309

$ 721

2022

Windswept, Incorporated, has 250 million shares of stock outstanding. Its price-earnings ratio for 2022 is 15. What is the market price per share

of stock?

$ 155

710

1,520

1,500

$ 2,540 $2,385

3,200

3,650

$ 5,740 $ 6,035

Accounts payable

Long-term debt

Common stock

Retained earnings

Total liabilities & equity

2021

$1,160

940

3,190

450

2022

$ 1,302

1,118

2,890

725

$5,740 $ 6,035

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Calculate the FCFE of this financial statement.arrow_forwardVijoarrow_forwardSelected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in millions). Target Corporation Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Total assets Total stockholders' equity Current liabilities Total liabilities Walmart Inc. Income Statement Data for Year $65,357 $408,214 45,583 304,657 79,607 707 2,065 (94) (411) 1,384 7,139 $ 2,488 $ 14,335 Balance Sheet Data (End of Year) $18,424 $48,331 122,375 $170,706 $55,561 44,089 71,056 $170,706 15,101 26,109 $44,533 $11,327 17,859 15,347 $44,533 Beginning-of-Year Balances $44,106 $163,429 65,682 55,390 97,747 13,712 10,512 30,394 Other Dataarrow_forward

- Net sales Windswept, Incorporated 2021 Income Statement Cost of goods sold Depreciation ($ in millions) Earnings before interest and taxes Interest paid Taxable income Taxes Net income $ 10,800 7,950 420 $ 2,430 100 $ 2,330 489 $ 1,841 Windswept, Incorporated 2020 and 2021 Balance Sheets ($ in millions) 2020 2021 2020 Cash $ 280 $ 310 Accounts payable $ 1,790 2021 $ 1,842 Accounts received 1,110 1,010 Long-term debt Inventory 2,000 1,745 Common stock 1,070 3,360 1,353 3,030 Total $ 3,390 $ 3,065 Retained earnings 650 900 Net fixed assets 3,480 4,060 Total assets $ 6,870 $ 7,125 Total liabilities & equity $ 6,870 $ 7,125 What is the equity multiplier for 2021?arrow_forwardSolve for fy22 sales and depreciation a on the 2022 income statement. remember to reference the growth rate provided by Paul.of 0.141 FY21 FY22 Sales $24884886 Blank Cost of Goods Sold $19659044 Other Expenses $2735335 Depreciation $995395 Blank Taxable Income $1493092 Taxes (21%) $313549 Net Income $1179543 Dividends $500,000 Add. to Retained Earnings $679543arrow_forwardSales Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before income tax Income tax expense Net income (a) 2021 $1,595 900 695 524 171 80 Your answer is incorrect. 91 25 $66 2020 $1,387 $1,208 743 644 411 233 50 183 2019 46 596 612 402 210 40 170 43 $137 $127 Using horizontal analysis, calculate the horizontal percentage of a base-year amount, assuming 2019 is the base year. (Round answers to 1 decimal place, e.g. 5.2%. Enter negative amounts using either a negative sign preceding the number e.g. -45.1% or parentheses e.g. (45.1) %.)arrow_forward

- ect Assignment The preliminary 2024 income statement of Alexian Systems, Incorporated, is presented below: ALEXIAN SYSTEMS, INCORPORATED Income Statement. For the Year Ended December 31, 2024 ($ in millions, except earnings per share) Revenues and gains: Sales revenue Interest revenue Other income Total revenues and gains. Expenses: Cost of goods sold Selling and administrative expense Income tax expense Total expenses Net Income Earnings per share $ 435 6 128 569 247 158 41 446 $123 $ 12.30 Saved Help Additional information: 1. Selling and administrative expense includes $28 million in restructuring costs. 2. Included in other income is $120 million in income from a discontinued operation. This consists of $90 million in operating income and a $30 million gain on disposal. The remaining $8 million is from the gain on sale of investments. 3. Cost of Goods Sold in 2024 includes an increase of $10 million to correct an understatement of Cost of Goods Sold in 2023. The amount is material.…arrow_forwardConsider the following information for Handley Stores for 2020 and 2021: 2020 2021 Total assets $72,590,000 $68,832,000 Noninterest-bearing current liabilities 5,368,000 6,039,000 Net income 4,453,000 6,039,000 Interest expense 2,944,000 3,640,000 Sales 55,572,000 117,425,000 Tax rate 35% 35% X Your answer is incorrect. Compute ROI for both years. (Round answers to 2 decimal places, e.g. 15.32%.) 2020 2021 ROI 6.13 % 8.77 % * Your answer is incorrect. Break ROI down into profit margin and investment turnover. (Round answers to 4 decimal places, eg. 15.3215.) 2020 2021 Profit margin 8.01 5.14 Investment turnover 0.78 1.72arrow_forwardPartial Income Statement Excel Exercise Compute the Following ՀԱՐ Sales COGS SG&A Depreciation Debt Int. Rate Tax Rate* 2019 100 40 EBITDA EBIT 25 Interest 10 EBT 0.08 Tax 0.25 Net Income ? ? ? ? ? ? Partial Balance Sheet Debt and Loans 150 Total Equity 150 Total Assets 300 Inv. Change 10 A/R Change A/P Change 35 20 Net Profit Margin Equity Multiplier Verify Dupont ROE ? סיי ? ? ? ? ? * Assume all taxes paid in current period (no accrued taxes) for rest of course CF from Operations ROE Asset Turnover CED Tt O 24arrow_forward

- Multiple Choice Sa O 84 times 2.06 times 1.87 times 82 times. 1.22 timesarrow_forwardUse the following information to answer this question: Bayside, Incorporated 2021 Income Statement ($ in thousands) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income Cash Accounts received Inventory Total Net fixed assets Total assets 2020 $ 150 1,150 1,825 $ 3,125 3,860 $ 6,985 $ 6,270 4,640 400 $ 1,230 46 $ 1,184 249 $935 Bayside, Incorporated 2020 and 2021 Balance Sheets ($ in thousands) 2021 $ 255 990 2,140 $ 3,385 3,680 $ 7,065 Total liabilities & equity Accounts payable Long-term debt Common stock Retained earnings BOLSA- How many dollars of sales were generated from every dollar of fixed assets during 2021? دا 2020 $1,735 890 3,400 960 $ 6,985 2021 $ 1,805 690 3,360 1,210 $ 7,065arrow_forwardonly typed solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education