FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

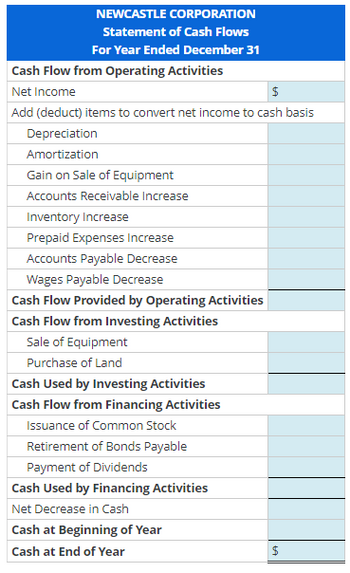

Use the following information regarding the Newcastle Corporation to prepare a statement of

| Accounts payable decrease | $9,500 |

| 13,300 | |

| Wages payable decrease | 5,700 |

| Amortization expense | 30,400 |

| Cash balance, January 1 | 57,000 |

| Cash balance, December 31 | 13,300 |

| Cash paid as dividends | 11,400 |

| Cash paid to purchase land | 190,000 |

| Cash paid to retire bonds payable at par | 142,500 |

| Cash received from issuance of common stock | 85,500 |

| Cash received from sale of equipment | 22,800 |

| 74,100 | |

| Gain on sale of equipment | 26,600 |

| Inventory increase | 24,700 |

| Net income | 182,400 |

| Prepaid expenses increase | 15,200 |

Transcribed Image Text:NEWCASTLE CORPORATION

Statement of Cash Flows

For Year Ended December 31

Cash Flow from Operating Activities

Net Income

$

Add (deduct) items to convert net income to cash basis

Depreciation

Amortization

Gain on Sale of Equipment

Accounts Receivable Increase

Inventory Increase

Prepaid Expenses Increase

Accounts Payable Decrease

Wages Payable Decrease

Cash Flow Provided by Operating Activities

Cash Flow from Investing Activities

Sale of Equipment

Purchase of Land

Cash Used by Investing Activities

Cash Flow from Financing Activities

Issuance of Common Stock

Retirement of Bonds Payable

Payment of Dividends

Cash Used by Financing Activities

Net Decrease in Cash

Cash at Beginning of Year

Cash at End of Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please show working.arrow_forwardMacrosoft Company reports net income of $73,000. The accounting records reveal depreciation expense of $88,000 as well as increases in prepaid rent, accounts payable, and income tax payable of $68,000, 11,000, and $22,000, respectively Prepare the operating activities section of Macrosoft's statement of cash flows using the indirect method(List cash outflows and any decrease in cash as negative amounts.arrow_forwardEffect of Transactions on Cash Flows State the effect (cash receipt or cash payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $220,000 of bonds, on which there was $2,200 of unamortized discount, for $229,000. b. Sold 12,000 shares of $30 par common stock for $53 per share. c. Sold equipment with a book value of $52,900 for $76,200. d. Purchased land for $329,000 cash. e. Purchased a building by paying $75,000 cash and issuing a $120,000 mortgage note payable. f. Sold a new issue of $320,000 of bonds at 98. g. Purchased 4,900 shares of $35 par common stock as treasury stock at $63 per share. h. Paid dividends of $2.20 per share. There were 19,000 shares issued and 3,000 shares of treasury stock. Effect Amount а. b. $ С. d. е. $ f. $ g. 2$ h.arrow_forward

- Use the following information to calculate the net cash provided or used by financing activities. (a) Paid $29,800 cash to settle long-term notes payable at its $29,800 maturity value. (b) Acquired machinery for $12,900 cash. (c) Paid cash dividend of $13,900. (d) Net Income was $10,900. (e) Issued common stock for $40,900 cash. Statement of Cash Flows (partial) Cash flows from financing activitiesarrow_forwardEffect of Transactions on Cash Flows State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $310,000 of bonds, on which there was $3,100 of unamortized discount, for $322,000. b. Sold 7,000 shares of $30 par common stock for $59 per share. c. Sold equipment with a book value of $48,700 for $70,100. d. Purchased land for $406,000 cash. e. Purchased a building by paying $51,000 cash and issuing a $110,000 mortgage note payable. f. Sold a new issue of $180,000 of bonds at 99. g. Purchased 2,900 shares of $25 par common stock as treasury stock at $46 per share. h. Paid dividends of $2.00 per share. There were 25,000 shares issued and 4,000 shares of treasury stock. a. b. C. d. e. f. 9. h. Effect Amountarrow_forwardHow do I prepare a statement of cash flow's using the indirect method?arrow_forward

- Baird Incorporated presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from the company's Year 2 and Year 1 year-end balance sheets. Account Title Accounts receivable Year 2 $15,000 Accounts payable $ 8,400 Year 1. $19,500 $10, 150 The Year 2 income statement showed net income of $28,700. Required a. Prepare the operating activities section of the statement of cash flows. (Amounts to be deducted should be indicated with minus sign.) Cash flows from operating activities Net cash flow from operating activities $ 0arrow_forwardNot Graded Statement of Cash Flows (Indirect Method)Use the following information regarding the Newcastle Corporation to prepare a statement of cash flows using the indirect method: Accounts payable decrease $5,000 Accounts receivable increase 7,000 Wages payable decrease 3,000 Amortization expense 16,000 Cash balance, January 1 30,000 Cash balance, December 31 7,000 Cash paid as dividends 6,000 Cash paid to purchase land 100,000 Cash paid to retire bonds payable at par 75,000 Cash received from issuance of common stock 45,000 Cash received from sale of equipment 12,000 Depreciation expense 39,000 Gain on sale of equipment 14,000 Inventory increase 13,000 Net income 96,000 Prepaid expenses increase 8,000 Remember to use negative signs with answers when appropriate. NEWCASTLE CORPORATIONStatement of Cash FlowsFor Year Ended December 31 Cash Flow from Operating Activities Net Income Answer Add (deduct) items to convert net income to…arrow_forwardUsing the Exhibit below, assume that the balance of Accounts Payable was $60,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Payable is $65,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts payable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on disposal of…arrow_forward

- The item listed below belongs on the Statement of Cash Flows. Using formulas and cell links, complete the Statement of Cash Flows. Items for the Statement of Cash Flowws 01/01/21 12/31/21 Increase (Decrease) Davidson Company Statment of Cash Flow For the Year Ended Dec, 31,2021 Cash 42,000 60,000 Accounts Recevable 254,000 314,200 Cash Flows from operation activities Inventory 78,500 117,100 Accounts Payable 164,200 204,800 Net Cash Provided used by operating Activities Short-term notes Payable 65,000 27,200 Cash Flows from investing Activities Net income for 2021 230,200 Purchase of Equipment 84,000 Net Cash Provided used by investing Activities Depreciation Expense 26,600 Payments of Cash Dividends 91,600 Cash Flows from Financing…arrow_forwardEffect of Transactions on Cash Flows State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $220,000 of bonds, on which there was $2,200 of unamortized discount, for $229,000. b. Sold 12,000 shares of $15 par common stock for $23 per share. c. Sold equipment with a book value of $47,400 for $68,300. d. Purchased land for $436,000 cash. e. Purchased a building by paying $58,000 cash and issuing a $110,000 mortgage note payable. f. Sold a new issue of $240,000 of bonds at 97. g. Purchased 3,300 shares of $25 par common stock as treasury stock at $48 per share. h. Paid dividends of $2.50 per share. There were 28,000 shares issued and 4,000 shares of treasury stock. a. b. C. d. e. f. Effect Cash payment Cash receipt Cash receipt Cash payment ✓ Cash payment - ✓ Cash receipt ✔ ✓ ✓ g. Cash payment -✔ h. Cash payment Amount 229,000 ✓ 161,000 X 100000arrow_forwardStatement of Cash Flows (Indirect Method)Use the following information regarding the Newcastle Corporation to prepare a statement of cash flows using the indirect method: Accounts payable decrease $7,000 Accounts receivable increase 9,800 Wages payable decrease 4,200 Amortization expense 22,400 Cash balance, January 1 42,000 Cash balance, December 31 9,800 Cash paid as dividends 8,400 Cash paid to purchase land 140,000 Cash paid to retire bonds payable at par 105,000 Cash received from issuance of common stock 63,000 Cash received from sale of equipment 16,800 Depreciation expense 54,600 Gain on sale of equipment 19,600 Inventory increase 18,200 Net income 134,400 Prepaid expenses increase 11,200 Remember to use negative signs with answers when appropriate. NEWCASTLE CORPORATIONStatement of Cash FlowsFor Year Ended December 31 Cash Flow from Operating Activities Net Income Answer Add (deduct) items to convert net income to cash basis…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education