FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

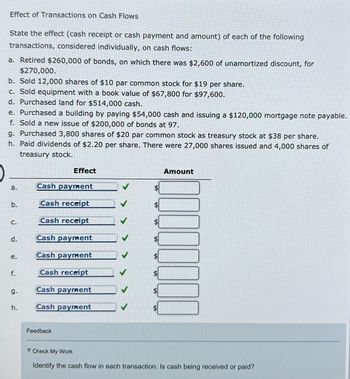

Transcribed Image Text:Effect of Transactions on Cash Flows

State the effect (cash receipt or cash payment and amount) of each of the following

transactions, considered individually, on cash flows:

a. Retired $260,000 of bonds, on which there was $2,600 of unamortized discount, for

$270,000.

b. Sold 12,000 shares of $10 par common stock for $19 per share.

c. Sold equipment with a book value of $67,800 for $97,600.

d. Purchased land for $514,000 cash.

e. Purchased a building by paying $54,000 cash and issuing a $120,000 mortgage note payable.

f. Sold a new issue of $200,000 of bonds at 97.

g. Purchased 3,800 shares of $20 par common stock as treasury stock at $38 per share.

h. Paid dividends of $2.20 per share. There were 27,0 shares issued and 4,000 shares of

treasury stock.

a.

b.

C.

d.

e.

f.

9.

h.

Effect

Cash payment

Cash receipt

Cash receipt

Cash payment

Cash payment

Cash receipt

Cash payment

Cash payment

Feedback

$

$

$

$

$

$

$

Amount

Check My Work

Identify the cash flow in each transaction. Is cash being received or paid?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For Exercise 16-2, note (1) the section of the statement the transaction would impact (0,l or F), (2) whether it is an inflow or outflow and (3) the cash amount that would be reported EXERCISE 16-2 Effect of transactions on cash flows State the effect (cash receipt or payment and amount) of each of the following tra actions, considered individually, on cash flows: trans a. Sold 5,000 shares of $30 par common stock for $45 per share. b. Sold equipment with a book value of $42,500 for $41,000. c. Purchased land for $120,000 cash. d. Purchased 5,000 shares of $30 par common stock as treasury stock at $50 per share e. Sold a new issue of $100,000 of bonds at 101. f. Paid dividends of $1.50 per share. There were 30,000 shares issued and 5,00 shares of treasury stock. g. Retired $500,000 of bonds, on which there was $2,500 of unamortized discount for $501,000. h. Purchased a building by paying $30,000 cash and issuing a $90,000 mortgage noe payable. Objective 1 /b. Cash receipt, $41,000arrow_forwardsubject :- Accountingarrow_forwardEffect of Transactions on Cash Flows State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $220,000 of bonds, on which there was $2,200 of unamortized discount, for $229,000. b. Sold 7,000 shares of $15 par common stock for $30 per share. c. Sold equipment with a book value of $51,800 for $74,600. d. Purchased land for $362,000 cash. e. Purchased a building by paying $75,000 cash and issuing a $120,000 mortgage note payable. f. Sold a new issue of $150,000 of bonds at 98. g. Purchased 4,400 shares of $15 par common stock as treasury stock at $28 per share. h. Paid dividends of $1.60 per share. There were 34,000 shares issued and 5,000 shares of treasury stock. Effect Amount a. b. C. d. e. f. g. h.arrow_forward

- Indicate the effect, if any, that each separate transaction has on financing cash flows. Note: Select "No Effect" if there is no effect. a. Long-term notes payable with a carrying value of $19,000 are retired for $22,000 cash, resulting in a $3,000 loss. b. Paid cash dividends of $15,000 to common stockholders. c. Acquired $24,000 worth of machinery in exchange for common stock. Items a. Long-term notes payable b. Dividends c. Machinery Amount Effect on financing cash flowsarrow_forwardA company reported net income of $250,000. Beginning balances in Accounts Recelvable and Accounts Payable were $20,000 and $21,000 respectively. Ending balances in these accounts were $10,500 and $29,000, respectively. Assuming that all relevant information has been presented, what is the company's net cash flows from operating activities? Multiple Cholce $259,500. $232,500. $267,500. $250,000.arrow_forwardEffect of Transactions on Cash Flows State the effect (cash receipt or cash payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $220,000 of bonds, on which there was $2,200 of unamortized discount, for $229,000. b. Sold 12,000 shares of $30 par common stock for $53 per share. c. Sold equipment with a book value of $52,900 for $76,200. d. Purchased land for $329,000 cash. e. Purchased a building by paying $75,000 cash and issuing a $120,000 mortgage note payable. f. Sold a new issue of $320,000 of bonds at 98. g. Purchased 4,900 shares of $35 par common stock as treasury stock at $63 per share. h. Paid dividends of $2.20 per share. There were 19,000 shares issued and 3,000 shares of treasury stock. Effect Amount а. b. $ С. d. е. $ f. $ g. 2$ h.arrow_forward

- How do I prepare a statement of cash flow's using the indirect method?arrow_forwardIndicate the effect, if any, that each separate transaction has on financing cash flows. (Select "No Effect" if there is no effect.) a. Long-term notes payable with a carrying value of $15,800 are retired for $17,200 cash, resulting in a $1,400 loss. b. Paid cash dividends of $11,800 to common stockholders. c. Acquired $20,800 worth of machinery in exchange for common stock. Effect on financing Items Amount cash flows a. Long-term notes payable b. Dividends c. Machineryarrow_forwardIndicate the effect, if any, that each separate transaction has on financing cash flows. Note: Select "No Effect" if there is no effect. a. Long-term notes payable with a carrying value of $15,000 are retired for $16,000 cash, resulting in a $1,000 loss. b. Paid cash dividends of $11,000 to common stockholders. c. Acquired $20,000 worth of machinery in exchange for common stock. Items a. Long-term notes payable b. Dividends c. Machinery Amount Effect on financing cash flowsarrow_forward

- a. Net income was $476,000. b. Issued common stock for $80,000 cash. c. Paid cash dividend of $18,000. d. Paid $100,000 cash to settle a long-term notes payable at its $100,000 maturity value. e. Paid $117,000 cash to acquire its treasury stock. f. Purchased equipment for $93,000 cash. Use the above information to determine cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.) F3 Statement of Cash Flows (partial) Cash flows from financing activities E5 *8 F8 F9 F10 Connec B CAP F11 THE O Parrow_forwardEffect of Transactions on Cash Flows State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $220,000 of bonds, on which there was $2,200 of unamortized discount, for $229,000. b. Sold 12,000 shares of $15 par common stock for $23 per share. c. Sold equipment with a book value of $47,400 for $68,300. d. Purchased land for $436,000 cash. e. Purchased a building by paying $58,000 cash and issuing a $110,000 mortgage note payable. f. Sold a new issue of $240,000 of bonds at 97. g. Purchased 3,300 shares of $25 par common stock as treasury stock at $48 per share. h. Paid dividends of $2.50 per share. There were 28,000 shares issued and 4,000 shares of treasury stock. a. b. C. d. e. f. Effect Cash payment Cash receipt Cash receipt Cash payment ✓ Cash payment - ✓ Cash receipt ✔ ✓ ✓ g. Cash payment -✔ h. Cash payment Amount 229,000 ✓ 161,000 X 100000arrow_forwardStatement of Cash Flows (Indirect Method)Use the following information regarding the Newcastle Corporation to prepare a statement of cash flows using the indirect method: Accounts payable decrease $7,000 Accounts receivable increase 9,800 Wages payable decrease 4,200 Amortization expense 22,400 Cash balance, January 1 42,000 Cash balance, December 31 9,800 Cash paid as dividends 8,400 Cash paid to purchase land 140,000 Cash paid to retire bonds payable at par 105,000 Cash received from issuance of common stock 63,000 Cash received from sale of equipment 16,800 Depreciation expense 54,600 Gain on sale of equipment 19,600 Inventory increase 18,200 Net income 134,400 Prepaid expenses increase 11,200 Remember to use negative signs with answers when appropriate. NEWCASTLE CORPORATIONStatement of Cash FlowsFor Year Ended December 31 Cash Flow from Operating Activities Net Income Answer Add (deduct) items to convert net income to cash basis…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education