FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

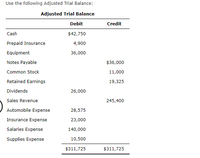

Transcribed Image Text:Use the following Adjusted Trial Balance:

Adjusted Trial Balance

Debit

Credit

Cash

$42,750

Prepaid Insurance

4,900

Equipment

36,000

Notes Payable

$36,000

Common Stock

11,000

Retained Earnings

325

Dividends

26,000

Sales Revenue

245,400

Automobile Expense

28,575

Insurance Expense

23,000

Salaries Expense

140,000

Supplies Expense

10,500

$311,725

$311,725

Transcribed Image Text:Prepare the four journal entries required to close the books. If an amount box does not require an entry, leave it blank.

А.

В.

C.

D.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Use the following financial information: Accounts Receivable Sales Tax Payable Retained Earnings Supplies Notes Payable (due in 18 months) Interest Payable $15,000 $4,500 $50,000 $4,000 $54,000 $5,000 Common Stock $75,000 Retained Earings Supplies Notes Payable (due in 18 months) Interest Payable Common Stock Accounts Payable Buildings $50,000 $4,000 $54,000 $5,000 $75.000 $12.000 $220,000 Cash $13,000 What is the amount of current assets, assuming the accounts above reflect normal activity? A $17,000. B $28,000 C $32,000. D $252,000.arrow_forwardRound answers to nearest dollararrow_forwardThe following items are reported on a company's balance sheet: Cash $258,000 Marketable securities 114,000 Accounts receivable 187,000 Inventory 204,000 Notes payable (short-term) 249,000 Determine the (a) current ratio and (b) quick ratio. Round your answers to one decimal place. a. Current ratio fill in the blank 1 b. Quick ratio fill in the blank 2arrow_forward

- On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit Cash $24,300 Accounts Receivable 42,500 Allowance for Uncollectible Accounts $2,700 Inventory 42,000 Land 79,600 Accounts Payable 29,200 Notes Payable (8%, due in 3 years) 42,000 Common Stock 68,000 Retained Earnings 46,500 Totals $188,400 $188,400 The $42,000 beginning balance of inventory consists of 420 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,050 units for $115,500 on account ($110 each). January 8 Purchase 1,150 units for $132,250 on account ($115 each). January 12 Purchase 1,250 units for $150,000 on account ($120 each). January 15 Return 160 of the units purchased on January 12 because of defects. January 19 Sell 3,600 units on account for $576,000. The cost of the units sold is determined using a FIFO…arrow_forwardThe following items are reported on a company's balance sheet: Cash $295,700 Marketable securities 231,000 Accounts receivable (net) 265,300 Inventory 132,000 Accounts payable 330,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place. a. Current ratio b. Quick ratioarrow_forwardOn January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit Cash $24,300 Accounts Receivable 42,500 Allowance for Uncollectible Accounts $2,700 Inventory 42,000 Land 79,600 Accounts Payable 29,200 Notes Payable (8%, due in 3 years) 42,000 Common Stock 68,000 Retained Earnings 46,500 Totals $188,400 $188,400 The $42,000 beginning balance of inventory consists of 420 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,050 units for $115,500 on account ($110 each). January 8 Purchase 1,150 units for $132,250 on account ($115 each). January 12 Purchase 1,250 units for $150,000 on account ($120 each). January 15 Return 160 of the units purchased on January 12 because of defects. January 19 Sell 3,600 units on account for $576,000. The cost of the units sold is determined using a FIFO…arrow_forward

- Hancock Company reported the following account balancesat December 31, 2027:Sales revenue $97,000Dividends. $11,000Supplies 13,000Accounts payable 41,000Patent $59,000Building Common stock.. $27,000Insurance expense .... $31,000Notes payable .. $39,000Income tax expense $42,000Cash . . $19,000Repair expense ?Copyright $20,000Equipment $14,000Utilities payable. $22,000Inventory $64,000Retained earnings. .. $87,000 (at Jan. 1, 2027)Interest revenue $55,000Cost of goods sold ..... .. $37,000Accumulated depreciation .... $23,000 $34,000Accounts receivable ? Trademark. ... $51,000Calculate the total intangible assets reported in HancockCompany's December 31, 2027 balance sheet. The following additional information is available:1) The note payable listed above was a 4- year bank loan taken out on September 1, 2024.2) The total P - P - E at Dec. 31, 2027 was equal to 75% of the total current liabilities at Dec. 31, 2027. ՄԴ Sarrow_forwardPresented below is the December 31 trial balance of New York Boutique. NEW YORK BOUTIQUETRIAL BALANCEDECEMBER 31 Debit Credit Cash $18,290 Accounts Receivable 40,800 Allowance for Doubtful Accounts $740 Inventory, December 31 83,150 Prepaid Insurance 6,920 Equipment 91,000 Accumulated Depreciation—Equipment 32,950 Notes Payable 28,710 Common Stock 82,710 Retained Earnings 10,870 Sales Revenue 645,350 Cost of Goods Sold 422,960 Salaries and Wages Expense (sales) 51,900 Advertising Expense 6,900 Salaries and Wages Expense (administrative) 73,110 Supplies Expense 6,300 $801,330 $801,330 Construct T-accounts and enter the balances shown. Cash Bal. Bal. Inventory Bal. Bal. Prepaid Insurance Bal. Bal. Common Stock Bal. Bal. Salaries and Wages Expense Bal. Bal. Retained…arrow_forwardThe following items are reported on a company's balance sheet: Cash $283,200 Marketable securities 83,400 Accounts receivable 251,600 Inventory 185,700 Accounts payable 315,200 Determine the (a) current ratio, and (b) quick ratio. Round your answers to one decimal place. a. Current ratio b. Quick ratioarrow_forward

- The following items are reported on a company's balance sheet: Cash $161,300 Marketable securities 126,000 Accounts receivable (net) 72,700 Inventory 144,000 Accounts payable 360,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place. a. Current ratio fill in the blank 1 b. Quick ratio fill in the blank 2arrow_forwardCash and accounts receivable for Adams Company are as follows: Current Year Prior Year Cash $64,800 $54,000 Accounts receivable (net) 58,982 76,600 What are the amounts and percentages of increase or decrease that would be shown with horizontal analysis? Account Dollar Change Percent Change Cash $fill in the blank 1 fill in the blank 2 % Accounts Receivable $fill in the blank 4 fill in the blank 5 %arrow_forwardOn January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances:Accounts Debit CreditCash $ 21,900Accounts Receivable 36,500Allowance for Uncollectible Accounts $ 3,100Inventory 30,000Land 61,600Accounts Payable 32,400Notes Payable (8%, due in 3 years) 30,000Common Stock 56,000Retained Earnings 28,500Totals $150,000 $150,000The $30,000 beginning balance of inventory consists of 300 units, each costing…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education