FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

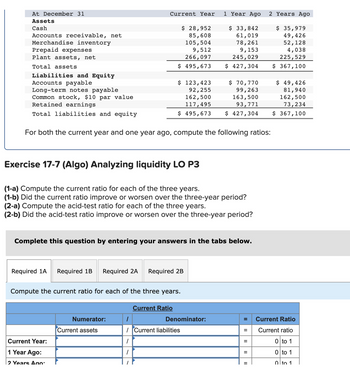

Transcribed Image Text:At December 31

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Liabilities and Equity

Accounts payable

Current Year 1 Year Ago

$ 28,952

85,608

105,504

9,512

266,097

$ 33,842

61,019

78,261

9,153

245,029

$ 427,304

$ 495,673

$ 123,423

$ 70,770

Long-term notes payable

Common stock, $10 par value

Retained earnings

92,255

162,500

117,495

Total liabilities and equity

$ 495,673

$ 427,304

99,263

163,500

93,771

For both the current year and one year ago, compute the following ratios:

2 Years Ago

$ 35,979

49,426

52,128

4,038

225,529

$ 367,100

$ 49,426

81,940

162,500

73,234

$ 367,100

Exercise 17-7 (Algo) Analyzing liquidity LO P3

(1-a) Compute the current ratio for each of the three years.

(1-b) Did the current ratio improve or worsen over the three-year period?

(2-a) Compute the acid-test ratio for each of the three years.

(2-b) Did the acid-test ratio improve or worsen over the three-year period?

Complete this question by entering your answers in the tabs below.

Required 1A

Required 1B Required 2A

Required 2B

Compute the current ratio for each of the three years.

Current Ratio

Numerator:

Denominator:

=

Current Ratio

Current assets

/ Current liabilities

=

Current ratio

Current Year:

=

0 to 1

1 Year Ago:

=

0 to 1

2 Years Ago

||

=

0 to 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Introduce Of Current Ratio And Acid-Test Ratio

VIEW Step 2: Current Ratio -

VIEW Step 3: Working Notes - Calculation Of The Current Assets -

VIEW Step 4: Current Ratio Improve Or Worsen Over The Three-Years Period.

VIEW Step 5: Acid-Test Ratio -

VIEW Step 6: Quick Assets For Each Of The Three Years -

VIEW Step 7: Acid-Test Ratio Improve Or Worsen Over The Three-Year Period.

VIEW Solution

VIEW Step by stepSolved in 8 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cash and accounts receivable for Adams Company are as follows: Current Year Prior Year Cash $88,172 $65,800 Accounts receivable (net) 32,424 57,900 What are the amounts and percentages of increase or decrease that would be shown with horizontal analysis? Account Dollar Change Percent Change Cash $fill in the blank 1 fill in the blank 2 % Accounts Receivable $fill in the blank 4 fill in the blank 5 %arrow_forwardAccounts payable 919 Accounts receivable 631 Accumulated depreciation 1,813 Cash 729 Common stock 1,387 Cost of goods sold 7,578 Current portion of long-term debt 24 Depreciation expense 108 Dividends 13 Goodwill and other long-term assets 2,627 Income tax expense 24 Income taxes payable 12 Interest expense 54 Interest revenue 11 Inventories 930 Long-term liabilities 1,585 Prepaid expenses and other current assets 65 Property and equipment 2,389 Retained earnings 825 Sales 9,710 Selling, general, and administrative expenses 2,276 Unearned revenue 990 Wages payable 148 Prepare two closing journal entriesarrow_forwardComparative Balance Sheet Current Year Previous Year Year Before Current Assets Cash $50,000 $100,000 $90,000 Accounts Receivable, net $275,000 $150,000 $100,000 Inventory $580,000 $400,000 $250,000 Prepaid Expenses $25,000 $30,000 $10,000 Total Current Assets $930,000 $680,000 $450,000 Property & Equipment, net $115,000 $150,000 $140,000 Total Assets $1,045,000 $830,000 $590,000 Liabilities & Owner's Equity Current Liabilities Accounts Payable $410,000 $265,000 $190,000 Short-term Payables $175,000 $90,000 $50,000 Total Current Liabilities $585,000 $355,000 $240,000 Long Term Bonds Payable (12%) $50,000 $150,000 $150,000 Total Liabilities $635,000 $505,000 $390,000 Stockholder's Equity Common Stock (100,000 shares) $200,000 $200,000 $200,000…arrow_forward

- is: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash $70,720 $47,940 Accounts receivable (net) 207,230 188,190 Inventories 298,520 289,850 Investments 0 102,000 Land 295,800 0 Equipment 438,600 358,020 Accumulated depreciation—equipment (99,110) (84,320) Total assets $1,211,760 $901,680 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $205,700 $194,140 Accrued expenses payable (operating expenses) 30,600 26,860 Dividends payable 25,500 20,400 Common stock, $1 par 202,000 102,000 Paid-in capital: Excess of issue price over par—common stock 354,000 204,000 Retained earnings 393,960 354,280 Total liabilities and stockholders' equity $1,211,760 $901,680 The income statement for the year ended December 31, 20Y9, is as follows: Sales $2,023,898 Cost of goods sold 1,245,476 Gross profit $778,422 Operating…arrow_forwardInstructions This assignment is designed for practicing both the retailer/merchandiser accounting cycle and your basic excel skills. Below are select sales transactions for two companies. You will need to enter the missing pieces of each transaction on the journal entry tab. Each missing piece of information is highlighted in yellow. The only cell where an actual number is to be input is on the journal entries worksheet. Please note: not every yellow cell requires input (it could be left blank if appropriate). After completing the journal entries, you must then complete the missing pieces of the T accounts, trial balance, and statements highlighted in yellow. Only excel functions may be used to calculate the appropriate cell value on these pages. DO NOT INPUT THE ACTUAL NUMBER INTO THE T ACCOUNTS, TRIAL BALANCE, OR STATEMENTS. Use excel functions (such as making a cell equal another from the journal entry page, summing numbers together, or using the plus or minus symbols to help you…arrow_forwardCash Accounts receivable Equipment, net Land Total assets Current Year $7,440 $4,000 44,000 91,680 $197.120 Percent change Prior Year Required: Compute the annual dollar changes and percent changes for each of the following items $8,000 18,000 40,000 66,000 $132.000 (Use cells A2 to C7 from the given information to complete this question. Decreases should be entered with a minus sign. Round your percentage answers to one decimal place.) Cash Accounts receivable Equipment, net Horizontal Analysis Calculation of Percent Change Numerator: Current Year $7,440 54,000 44,000 Prior Year $8,000 18,000 40,000 Denominator: Dollar Change Changearrow_forward

- Cash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $137,500. Depreciation recorded on store equipment for the year amounted to $22,700. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Endof Year Beginningof Year Cash $53,350 $48,550 Accounts receivable (net) 38,250 35,880 Merchandise inventory 52,230 54,620 Prepaid expenses 5,870 4,610 Accounts payable (merchandise creditors) 49,990 45,930 Wages payable 27,320 30,000 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.arrow_forwardSimons Industries reported net income of $69,000 for the current year. The balances and activity in its accounts receivable accounts follow. In addition, the company recorded $3,400 of bad debt expense and wrote off $2,500 of uncollectible accounts. E (Click the icon to view the balances and activity in accounts receivable accounts.) Prepare the operating section of the cash flow statement under the indirect method. (Use a minus sign or parentheses for any amounts to be subtracted. If an input field is not used in the statement, leave the field empty; do not select a label or enter a zero.) Simons Industries Partial Statement of Cash Flows (Indirect Method) Operating Activities: Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Net Cash Provided (Used) by Operating Activitiesarrow_forwardCash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $154,700. Depreciation recorded on store equipment for the year amounted to $25,500. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Endof Year Beginningof Year Cash $61,730 $56,790 Accounts receivable (net) 44,260 41,970 Merchandise inventory 60,430 63,890 Prepaid expenses 6,790 5,400 Accounts payable (merchandise creditors) 57,840 53,720 Wages payable 31,610 35,100 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: - Net income $ Adjustments to reconcile net income to net cash flows from (used for) operating…arrow_forward

- Estimating Uncollectible Accounts and Reporting Accounts Receivable LaFond Company analyzes its accounts receivable at December 31, and arrives at the age categories below along with the percentages that are estimated as uncollectible. Accounts Estimated Receivable Loss % $ 90,000 20,000 11,000 6,000 Over 180 days past due 4,000 Total accounts receivable $ 131,000 Age Group 0-30 days past due 31-60 days past due 61-120 days past due 121-180 296 4 The balance of the allowance for uncollectible accounts is $520 on December 31, before any adjustments. Transaction Record bad debts expense 5 10 25 (a) What amount of bad debts expense will LaFond report in its income statement for the year? $0 Cash Asset (b) Use the financial statement effects template to record LaFond's bad debts expense for the year. Use negative signs with your answers, when appropriate. Noncash Assets Balance Sheet Liabilities Contributed Capital (c) What is the balance of accounts receivable on it December 31 balance…arrow_forwardCash and accounts receivable for Adams Company are as follows: Current Year Prior Year Cash $64,800 $54,000 Accounts receivable (net) 58,982 76,600 What are the amounts and percentages of increase or decrease that would be shown with horizontal analysis? Account Dollar Change Percent Change Cash $fill in the blank 1 fill in the blank 2 % Accounts Receivable $fill in the blank 4 fill in the blank 5 %arrow_forwardYear-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Inventory Prepaid rent Current Year 1 Year Ago 2 Years Ago $ 26,725 77,457 $ 31,858 95,459 8,436 240,403 30,967 41,290 43,529 52,503 73,671 8,200 220,389 3,372 193,642 $ 312,800 $ 42,115 69,129 162,500 Machinery, net Total assets $ 448,480 $ 386,621 Liabilities and Equity Accounts payable $ 110,555 Long-term notes payable 83,471 $ 65,992 88,034 Common stock 162,500 Retained earnings 91,954 162,500 70,095 39,056 Total liabilities and equity $ 448,480 $ 386,621 $ 312,800 Complete this question by entering your answers in the tabs below. Required 3A Required 3B Compute times interest earned for the current year and one year ago. Current Year 1 Year Ago Times Interest Earned Choose Numerator: / Choose Denominator: I II 11 Times interest earned times timesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education