ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

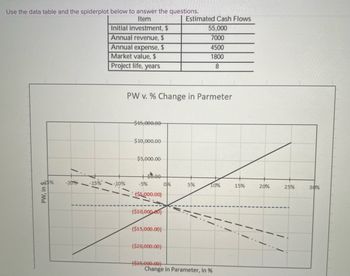

Transcribed Image Text:Use the data table and the spiderplot below to answer the questions.

Item

Initial investment, $

Annual revenue, $

Annual expense, $

Market value, $

Project life, years

PW, in

-20%

-15%

-10%

PW v.% Change in Parmeter

$15,000.00

$10,000.00

$5,000.00

ههای

-5%

($5,000.00)

($10,000,00)

($15,000.00)

($20,000.00)

($25,000.00)

Estimated Cash Flows

55,000

7000

4500

1800

8

0%

5%

10%

Change in Parameter, in %

15%

20%

25%

30%

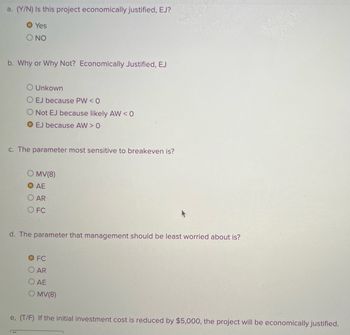

Transcribed Image Text:a. (Y/N) Is this project economically justified, EJ?

O Yes

NO

b. Why or Why Not? Economically Justified, EJ

O Unkown

O EJ because PW < 0

Not EJ because likely AW<0

O EJ because AW > 0

c. The parameter most sensitive to breakeven is?

MV(8)

AE

OAR

O FC

d. The parameter that management should be least worried about is?

O FC

O AR

O AE

OMV(8)

e, (T/F) If the initial investment cost is reduced by $5,000, the project will be economically justified.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer question 9.69 using excel and show steps clearly pleasearrow_forward2- Calculate the internal rate of return for the following investments: Initial Cost Annual Benefit Answer: 13.30% Operations and Maintenance Overhaul at year 3 Salvage Value Useful Life $-30,000 $10,000 $2,000 $8,000 $8,000 6 5 yearsarrow_forwardN3arrow_forward

- 14. The time line represents which investment scenario? Today 12 18 24 months months months months months months 30 36 on $2500 $2500 $2500 $2500 $2500 $2500 $2500 $2500 $2500 $2500 $2500 $2500 d or cre $2500.00 follow he qu $2500(1.029) = $2572.50 k as done $2500(1.029)? = $2647.10 $2500(1.029) = $2723.87 $2500(1.029) = $2802.86 $2500(1.029)5 = $2884.14 $2500(1.029) = $2967.78 $2500(1.029) = $3053.85 $2500(1.029)8 = $3142.41 $2500(1.029)° = $3233.54 $2500(1.029)10 = $3327.31 $2500(1.029)11 = $3423.81 answ ge on %3D %3D ou've be abl aments %3D %3D our rou o Renee Sau %3D your ha %! Total = $35 279.17 a. Future Value of $2500 invested monthly for 3 years in a fund that pays 2.9% per year, compounded monthly b. Future Value of $2500 invested monthly for 3 years in a fund that pays 34.3% per year, compounded monthly c. Future Value of $2500 invested quarterly for 3 years in a fund that pays 11.6% per year, compounded quarterly d. Present Value of $2500 invested monthly for 3 years in a…arrow_forwardCorrect answer is D . I neees steps how to get that anarrow_forward9-83 Assume a cost improvement project has only a first cost of $100,000 and a monthly net savings, M. There is no salvage value. Graph the project's IRR for payback periods from 6 months to the project's life of N years. The firm accepts projects with a 2- year payback period or a 20% IRR. When are these standards consistent and when are they not? (a) Assume that N = 3 years. (b) Assume that N = 5 years. (c) Assume that N = 10 10 years. (d) What recommendation do you have for the firm about its project acceptance criteria?arrow_forward

- It’s time to get a new laptop that is $2500. If you finance it, you will be charged 8% annual interest and it will take you two years to pay it off, paying each month. (A)How much will you pay each month for this laptop? (B)What are your total acquisition costs of financing the laptop?arrow_forward1. The maintenance cost for a certain machine is $1,000 per year for the first 5 years and $2,000 per year for the next 5 years. At an interest rate (compounded) of 10% per year, the present worth of the maintenance is closest to: A. Less than $7,000 B. $7,450 C. $8,500 D. More than $9,000arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Problem 2 Consider the following sets of investment projects n(years) A($) B($) C($) D($) 0 -3,500 -5,800 -5,200 -40,000 1 600 3,000 2,000 12,000 2 600 2,000 4,000 14,000 3 1,000 1,000 2,000 18,000 4 1,000 500 4,000 18,000 5 1,000 500 2,000 14,000 Compute the equivalent annual worth of each project at i-10% and determine the acceptability of each project.arrow_forward1.) What are the 3 assumptions that must be considered when using the LCM approach in comparing PW of differentlife alternatives? Question 2 in image, thank you.arrow_forward2 - Calculate the internal rate of return for the following investments: Initial Cost Annual Benefit Answer: 13.30% Operations and Maintenance Overhaul at year 3 Salvage Value Useful Life $-30,000 $10,000 $2,000 $8,000 $8,000 6 yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education