ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

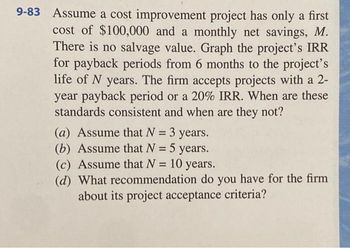

Transcribed Image Text:9-83 Assume a cost improvement project has only a first

cost of $100,000 and a monthly net savings, M.

There is no salvage value. Graph the project's IRR

for payback periods from 6 months to the project's

life of N years. The firm accepts projects with a 2-

year payback period or a 20% IRR. When are these

standards consistent and when are they not?

(a) Assume that N = 3 years.

(b) Assume that N = 5 years.

(c) Assume that N = 10

10 years.

(d) What recommendation do you have for the firm

about its project acceptance criteria?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer the problems on the basis of the above graph and the most likely estimates given as follows: If the profit (R−E) is decreased by 5%, this projectis not profitable. (a) True (b) False.arrow_forwardKaneb is evaluating two alternative pipeline welders. Welder A costs $310,000, has a /-year life, and is expected to generate net cash inflows of $78,000 in each of the 7 years. Welder B costs $320,000, has a 5-year life, and is expected to generate annual net cash inflows of $68,900 in each of the 5 years. Kaneb's cost of capital is 16%. Using the equivalent annual annuity method, which alternative should be chosen and what is its NPV?arrow_forwardWhat Term goes with what Conceptarrow_forward

- Use annual wortharrow_forwardplease answer in text form and in proper format answer with must explanation , calculation for each part and steps clearlyarrow_forward1. A pharmaceutical company that manufactures ascorbic acid tablets is investigating two production options that have the estimated cash flows shown ($10 million units). Which one should be selected based on a present worth analysis (in million units) at 10% per year? In- outsourced house Initial Investment -30 Annual cost, $ per year 24 -5 -2 Annual Revenue, $ per 13 year 2 N/A Salvage Value, $ Lifearrow_forward

- Q1:A person wants to have (5000 CU) pay for his education at the end of each year for (6 years). If the bank rate of interest is (11.5%), how much money has to be deposit at present. Q2:A company invests in one of three alternatives, the life of all alternatives is estimated to be (5 years) with the following investments, annual returns, and salvage value: Alternatives 3 200000 CU 70000 CU 50000 CU Details Alternatives 1 Alternatives 2 Investment 150000 CU 175000 CU Annual equal return 60000 CU 70000 CU 15000 CU 25000 CU Salvage value Determine the best alternative based on Net Present Worth Comparison (NPW) by assuming i=10%. نوںarrow_forwardA sportswear factory has two alternative machines for producing jerseys. Costs are shown below. Minimum acceptable rate of return is 8%.What is the annual cost for machine Y?arrow_forwardYou have been asked to perform a sensitivity analysis on a plant modernization plan. The initial investment is $30,000. Expected annual savings is $13,000. Salvage value is $7,000 after a 7 year planning horizon. The MARR is 12%. Determine the AW if the annual savings change by the following percentages from the initial estimate: b. -80%c. -60%d. -40%e. -20%f. +20%g. +40%h. Determine the percentage change in net annual savings that causes a reversal in the decision regarding the attractiveness of the projectarrow_forward

- What is MARR value?arrow_forwardAlternative X Alternative Y Capital Investment Useful life $5,000 20 $200 $6,000 15 $800 in year 10 and decreasing by a constant amount of $50 per year Annual Expenses thereafter Salvage Value $1,000 (a) What is the annual worth (AW) of alternative X? Show all the steps of calculation. (4 marks) (b) What is the annual worth (AW) of alternative Y? Show all the steps of calculation. (5 marks) (c) Based on your answers in part (a) and (b), explain which alternative should be selected. (2 marks) LE10 Mec)arrow_forwardQ.1 Find the capitalised cost of an investment at 15% interest rate. The investment has initial cost $200000 and operating annual cost is $40000 for life time.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education