ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

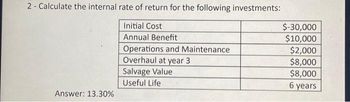

Transcribed Image Text:2- Calculate the internal rate of return for the following investments:

Initial Cost

Annual Benefit

Answer: 13.30%

Operations and Maintenance

Overhaul at year 3

Salvage Value

Useful Life

$-30,000

$10,000

$2,000

$8,000

$8,000

6

5 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1.) What are the 3 assumptions that must be considered when using the LCM approach in comparing PW of differentlife alternatives? Question 2 in image, thank you.arrow_forwardQ1).Using AW method compare between the following alternatives: Operating and maintenance Alt. F.C. Income at the Annual nd S.V. Useful life i. end of 2 yearIncome A 35000 3500 2800 7000 8 8% B. 32000 1500 4700 2500 8%arrow_forwardA cutting-edge product of Continental Fan had the following net cash flow series during its first 5-year period on the market. Find all rate of return values between 0% and 100%. (Round the final answer to three decimal places.) Year 0 1 2 3 45 5 The rate of return is %. Net Cash Flow, $ -54,000 37,000 29,000 10,000 -5,000 13,000arrow_forward

- A new bridge project is being evaluated at i = 20%. Recommend an alternative based on the capitalized cost for each. AnnualO&M Life(years) $250,000 $500,000 Construction Cost Concrete $50million Steel $40million Solution: 1. Here 2. CC concrete 50 3. CC steel 4. Choose capitalized cost (CC). million dollars; million dollars; 70 50arrow_forward1. An industrial plant is considering the purchase of a centrifugal pump. Three offers were received and basis of selection have been tabulated as follows: Offer A Offer B Offer C Price of pump P60,000 P96,000 P120,000 Economic life, years 3 5 10 Salvage value at end of economic life 5,000 10,000 8,000 Yearly maintenance cost 10,000 6,000 5,000 . If cost of money is 14%, what offer would you recommend to be purchased? Use the rate of return method, the annual cost method, present worth method and equivalent uniform annual cost method for the evaluation Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education