ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

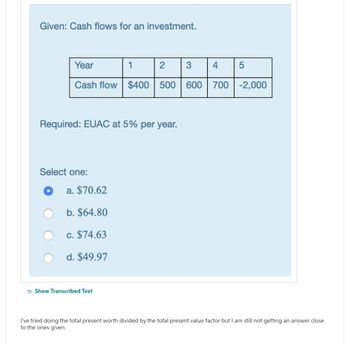

Transcribed Image Text:Given: Cash flows for an investment.

Year

Cash flow $400 500

Select one:

Required: EUAC at 5% per year.

a. $70.62

b. $64.80

c. $74.63

d. $49.97

1

Show Transcribed Text

2 3

4

5

600 700 -2,000

I've tried doing the total present worth divided by the total present value factor but I am still not getting an answer close

to the ones given.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Mr. and Mrs. Lacks want to collect money for college expenses in a bank at 9% interest Q5. rate compounued monthly for their new-born daughter Henrietta. Mr. and Mrs Lacks transfer 7% and 5% of their salaries, respectively, to the savings account every month. Henrietta will go to college at her 18. Each year expense for the college is $40 000 for 5 years and the minimum accepted rate of return is 3%. Mr. Lacks expects to get raise once in every 2 years at about 8% of his salary. If monthly salary of Mrs. Lacks is $ 1500, how much money Mr. Lacks should make during the first 2 years to cover the 5-year college expenses? Ps. Raise will be applied in the first month at every second year. Yearly college expenses will be paid at the end of the year.)arrow_forward9. The company buys a vehicle, n=18 first cost=60000 on 1st 7th and 14th years earning from the vehicle is 12000 and other years earnings are annual equally amount of x, i=8%, what is x that reach equilibrium on the cash flow series over the life of the vehicle?arrow_forward14 Calculate the term of each annuity: Future Value Present Value Size of Payment a. $0 $8,500 $675 b. $23,500 $0 $491.25 c. $0 $962 $100 d. $85,000 $0 $2,500 Interest Rate 10.75% 8.25% 10.00% 13.00% Payment and Conversion Period 3 months 1 month 1 week 6 months Term (N) ? ? ? ?arrow_forward

- 3arrow_forwardK Consider the following two mutually exclusive projects. Net Cash Flow End of year Project A Project B 0 - $1,400 - $1,400 1 $960 $292 $720 $584 $480 $876 $240 $1,168 2 3 4 Click the icon to view the interest factors for discrete compounding when i = 25% per year. (a) At an interest rate of 25%, which project would you recommend choosing? The present worth of Project A is S (Round to the nearest cent)arrow_forwardCurrent Attempt in Progress A small manufacturer has net annual cash flows as follows over the first 4 years of business. The applicable interest rate varies from year to year. End of Year Cash Flow Interest Rate During Year 0 Present Worth -$100,000 Future Worth Click here to access the TVM Factor Table calculator. $ 1 $ $80,000 Uniform Series Annual Equivalents $ 4% 2 3 -$15,000 $70,000 6% Determine the present worth, future worth, and uniform series annual equivalents for each of the 5 flows in the series. Determine a uniform series from t=0 to t=4. 5% 4 $130,000 4%arrow_forward

- No excel, full work thanksarrow_forwardReq#2: Use Aw analysis to find the best alternative for your company starting one of the following projects. Your company MARR is 9.1 %. Draw the cashflow diagram. Projects data First cost, $ Annual cost, $/year Annual revenue, $/year Life, years Project-1 -85,000 -23, 100 54,000 5 I Project-2 -135,000 -11,000 55, 100 10 Project-3 -77,000 -21, 100 37, 100 5 Project-4 -90,000 -26, 100 47, 100 5arrow_forwardA young engineer borrowed P10,000 at 12% interest and paid P2,000 per annum for the first 4 years. What does he have to pay at the end of the fifth year in order to pay off the loan? a. P6074.00 b. P3925.00 c. P6074.00 d. P5674.00arrow_forward

- 19. Mr Arguillonis considering building a 25-unit apartment in a place near a progressive commercial center. He felt that because of the location of the apartment, it will be occupied 90% at all time. He desires a rate of return of 20%. Other pertinent data are the following: Land investment P 5,000,000 7,000,000 Building investment Study period Cost of land after 20 years Rent per unit per month Upkeep per unit per year Property taxes Insurance 20 years 2,000,000 W & 6,000 500 1% 0.50% Is this a good investment?arrow_forward3arrow_forward8. With solution pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education