ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

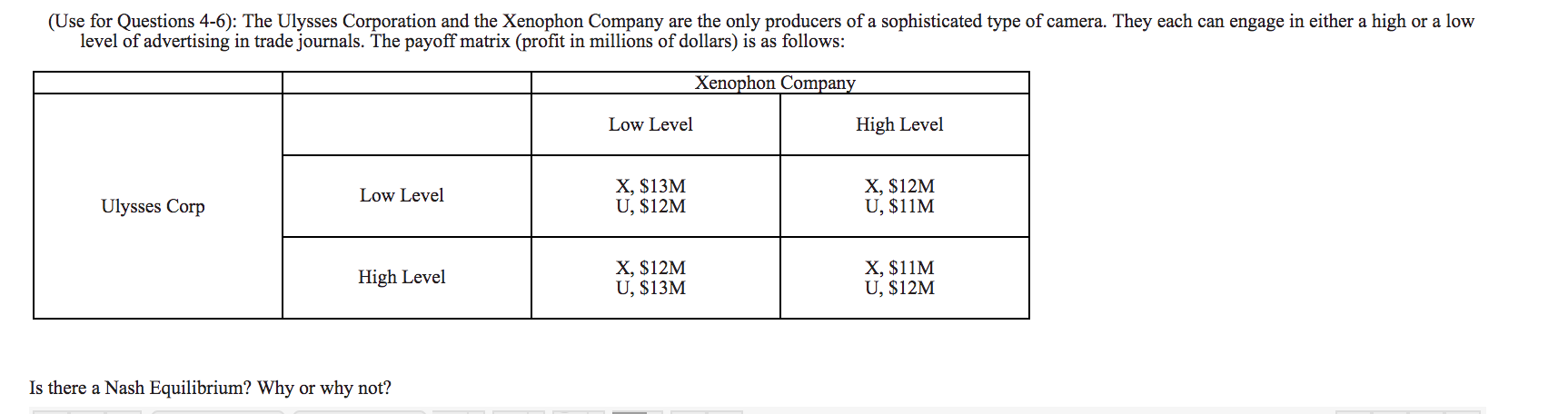

Transcribed Image Text:(Use for Questions 4-6): The Ulysses Corporation and the Xenophon Company

level of advertising in trade journals. The payoff matrix (profit in millions of dollars) is as follows:

are the only producers of a sophisticated type of camera. They each can engage in either a high

or a low

Xenophon Company

Low Level

High Level

Х, $13M

U, $12M

X, $12M

U, $11M

Low Level

Ulysses Corp

Х, S12M

U, $13M

X, $11M

U, $12M

High Level

Is there a Nash Equilibrium? Why or why not?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please no written by hand solutionsarrow_forwardNonearrow_forward(a) Suppose Fiat recently entered into an Agreement and Plan of Merger with Case for $4.3 billion. Prior to the merger, the market for four-wheel-drive tractors consisted of five firms. The market was highly concentrated, with a Herfindahl- Hirschman index of 2,765. Case's share of that market was 22 percent, while Fiat comprised just 12 percent of the market. If approved, by how much would the postmerger Herfindahl-Hirschman index increase?arrow_forward

- Explain all option compulsary......you will not explain all option then I will give you down upvote...arrow_forward4. Imagine a market with demand P = 420 – Q in each period. Two firms are thinking about colluding. They each have cost C(Qi) = 60Qi. If they cooperate and behave as a monopoly, then they have a marginal revenue curve, MRm = 420 – 2Q, and a marginal cost curve, MCm = 60. If they are in a cartel, then the firms will split the monopoly production and profits. If they compete, then they face MRi = 420 – 2Qi – Q-I and MCi = 60. a. If the firms stick to their agreement (cooperate), how much per-period profit do they each make? b. If they are not able to maintain their agreement (compete), what is their per-period profit? c. If one firm cheats on their agreement (deviate), how much does each firm make? Be sure to specify both the profit for the cheater and the firm cheated-on. d. Suppose the firms assume that their interaction will last forever (r = 1) and they share the common discount value R. What is the lowest value of R such that both firms are willing to continue with the cartel…arrow_forward14. Study Questions and Problems #14 Suppose that the for soda only has a few large producers, each producing a similar brand of soda. True or False: This market is most similar to an oligopoly market structure. True Falsearrow_forward

- 1arrow_forwardAssume that the market for oil is made up of two firms: Exxon Mobil and Chevron. Also assume that New England has dozens of breweries and each of these make beers with different tastes, colors, and aromas. Which of the following statements is true? The market structure for oil is an oligopoly, and the one for beer is monopolistic competition. The market structure for oil is monopolistic competition, and the one for beer is an oligopoly. The market structure for both oil and beer is an oligopoly. The market structure for both oil and beer is monopolistic competition.arrow_forwardD2) Explain this concept and give one practical example(oligopoly)arrow_forward

- Step 1 of 2: Use the following table with the sample data to calculate the four-firm concentration ratio for the U.S. auto market. Round your answer to the nearest whole number if necessary. Market Shares in the U.S. Auto Market GM 18%18% Ford 16%16% Toyota 14%14% Chrysler 10%arrow_forward8)Consider a market in which 5 companies operate, whose marginal and average costs are equal to c. The demand function is given by P(Q)= 1-Q, where P is the price and Q indicates the total quantity. Assume that companies compete with Cournot in choosing production levels. Assume that the game is repeated an infinite number of periods, that companies adopt trigger strategies and that the punishment is represented by Nash Reversion. 1)What is the value of the discount factor that allows companies to sustain tacit collusion in a balanced situation? 2) Assume now that companies are able to discover the defection of a rival company with K periods of delay. What do you think the effect on the sustainability of collusion can be? 3) Do you think that in this market collusion would be more easily sustainable if the companies compete with Bertrand? 4) If in a price-competitive market (Bertrand) N symmetrical companies operate, what would be the critical value of the discount factor that would…arrow_forward4. We assume that there are two countries, X and Y, each has a monopolistically competitive Home Appliance Market. By using the data of the Table below, define and specify the main effects of the Krugman's Model. Home Appliance Home Appliance Market Market in Integrated Market in Country X Before Trade Country Y Before Trade After Trade Total Sales of Home 700,000 1,300,000 2,000,000 Appliance Number of firms Sales per firm Axarage Cost Price 8. 116,000 162,500 222,000 15,000 12,000 10,000 15,000 12,000 10,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education