FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

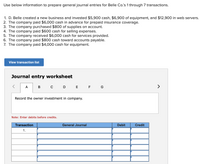

Transcribed Image Text:Use below information to prepare general journal entries for Belle Co.'s 1 through 7 transactions.

1. D. Belle created a new business and invested $5,900 cash, $6,900 of equipment, and $12,900 in web servers.

2. The company paid $6,000 cash in advance for prepaid insurance coverage.

3. The company purchased $800 of supplies on account.

4. The company paid $600 cash for selling expenses.

5. The company received $6,000 cash for services provided.

6. The company paid $800 cash toward accounts payable.

7. The company paid $4,000 cash for equipment.

View transaction list

Journal entry worksheet

A

в с

D

E F G

>

Record the owner investment in company.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1.

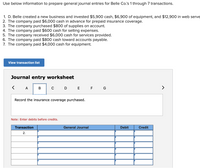

Transcribed Image Text:Use below information to prepare general journal entries for Belle Co's 1 through 7 transactions.

1. D. Belle created a new business and invested $5,900 cash, $6,900 of equipment, and $12,900 in web serve

2. The company paid $6,000 cash in advance for prepaid insurance coverage.

3. The company purchased $800 of supplies on account.

4. The company paid $600 cash for selling expenses.

5. The company received $6,000 cash for services provided.

6. The company paid $800 cash toward accounts payable.

7. The company paid $4,000 cash for equipment.

View transaction list

Journal entry worksheet

< A

D E E G

>

Record the insurance coverage purchased.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information for Exercises 13-14 below. (Algo) Skip to question [The following information applies to the questions displayed below.]The transactions of Spade Company appear below. K. Spade, owner, invested $13,500 cash in the company in exchange for common stock. The company purchased supplies for $392 cash. The company purchased $7,466 of equipment on credit. The company received $1,593 cash for services provided to a customer. The company paid $7,466 cash to settle the payable for the equipment purchased in transaction c. The company billed a customer $2,862 for services provided. The company paid $535 cash for the monthly rent. The company collected $1,202 cash as partial payment for the account receivable created in transaction f. The company paid a $1,100 cash dividend to the owner (sole shareholder).arrow_forwardThe following events apply to Sally's Gift Shop for Year 1, its first year of operation: 1. Acquired $60,000 cash from the issue of common stock. 2. Issued common stock to Sally Quin, one of the owners, in exchange for merchandise inventory worth $3,200 Sally had acquired prior to opening the shop. 3. Purchased $56,200 of inventory on account. 4. Paid $4,500 for advertising expense. 5. Sold inventory for $98,300 cash. 6. Paid $12,000 in salary to a part-time salesperson. 7. Paid $47,000 on accounts payable (see Event 3). 8. Physically counted inventory, which indicated that $16,000 of inventory was on hand at the end of the accounting period. Requirements: a. Record each of the transactions in the general journal, assuming Sally's uses the periodic inventory system. b. Post the transactions to T-Accounts. c. Prepare financial statements for Sally's. d. Record the necessary closing entries for year-end. e. Post the closing entries to T-Accounts. f. Prepare a post-closing trial balance.arrow_forwardUse below information to prepare general journal entries for Belle Co's 1 through 7 transactions. 1. D. Belle created a new business and invested $5,900 cash, $6,900 of equipment, and $12,900 in web servers 2. The company paid $6,000 cash in advance for prepaid insurance coverage. 3. The company purchased $800 of supplies on account. 4. The company paid $600 cash for selling expenses. 5. The company received $6,000 cash for services provided. 6. The company paid $800 cash toward accounts payable. 7. The company paid $4,000 cash for equipment. View transaction list Journal entry worksheet A В C D E F G > Record the cash received from customer for services provided. Note: Enter debits before credits. Transaction General Journal Debit Credit 5.arrow_forward

- Krespy Corp. has a cash balance of $7,500 before the following transactions occur:- received customer payments of $965 supplies purchased on account $435 services worth $850 performed, 25% is paid in cash the rest will be billed corporation pays $275 for an ad in the newspaper bill is received for electricity used $235. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?arrow_forwardThe following events occurred for Favata Company: a. Received $14,000 cash from owners and issued stock to them. b. Borrowed $11,000 cash from a bank and signed a note due later this year. c. Bought and received $1,200 of equipment on account. d. Purchased land for $20,000; paid $1,800 in cash and signed a long-term note for $18,200. e. Purchased $7,000 of equipment; paid $1,800 in cash and charged the rest on account. Required: For each of the above events, prepare journal entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 Transaction a 2 Received $14,000 cash from owners and issued stock to them. Record the transaction. Note: Enter debits before credits. 3 4 Record entry 5 General Journal Clear entry Debit Credit View general journalarrow_forwardRequired information [The following information applies to the questions displayed below.] The transactions of Belle Company appear below. 1. D. Belle created a new business and invested $5,600 cash, $6,000 of equipment, and $11,100 in web servers in exchange for common stock. 2. The company paid $4,600 cash in advance for prepaid insurance coverage. 3. The company purchased $800 of supplies on credit. 4. The company paid $600 cash for selling expenses. 5. The company received $5,200 cash for services provided. 6. The company paid $800 cash toward accounts payable. 7. The company paid $3,300 cash for equipment. Use above information to prepare general journal entries for Belle Company's 1 through 7 transactions. View transaction list Journal entry worksheet A C D F G > Record the owner investment.arrow_forward

- Submit correct and complete solutions. give propriate Explanation. Provide step-by-step detailed explanations.arrow_forwardRequired Information View transaction list Journal entry worksheet A в . с Transaction 1. CD Record the owner Investment. Note: Enter debits before credits. Record entry DE F General Journal Clear entry G Debit Credit View general Journalarrow_forwardJOURNAL ENTRIES, LEDGERS, AND TRIAL BALANCE After opening their computer sales and service store, the Millers completed the following four transactions: 1. They invested $100,000 in cash in the business. 2. They purchased on credit $10,000 worth of goods from several suppliers. 3. They sold on a cash basis $13,000 worth of products and services. 4. They paid $3,000 for salaries. Use the above information to prepare the following: 1. Journal entries 2. Ledgers 3. Trial balancearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education