FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

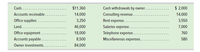

On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $84,000 in assets to launch the business. On October 31, the company’s records show the following items and amounts. Use this information to prepare an October income statement for the business.

Transcribed Image Text:Cash....

$11,360

Cash withdrawals by owner.........

$ 2,000

Accounts receivable.

14,000

Consulting revenue.

14,000

Office supplies

3,250

Rent expense...

3,550

Land......

46,000

Salaries expense.

7,000

Office equipment .

18,000

Telephone expense..

760

Accounts payable.

8,500

Miscellaneous expenses.

580

Owner investments.

84,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marcie Davies owns and operates Gemini Advertising Services. On January 1, 2018, Marcie Davies, Capital had a balance of $622,000. During the year, Marcie invested an additional $36,000 and withdrew $14,500. For the year ended December 31, 2018, Gemini Advertising Services reported a net income of $92,510.arrow_forwardon january 1, john write invested $10,000 to begin his computer services consulting firm. the business entity was named complete computer service what would be the journal entry to record this transactionarrow_forwardAS Company is a company dedicated to removals. Its owner, Andrés Santiago, began operations in November. Analyze and record the following business transactions in the accounting equation (indicates increase + and decrease -) and in the Jornal (General Journal) (account affected by debit and credit): 1. Andrés Santiago made an investment of $ 12,000 in the business. 2. He paid $ 3,600 for business insurance for a full year. 3. He collected $ 5,000 in cash from his clients, for services already performed at the moment. 4. He offered credit services of $ 2,500, and billed clients. 5. He paid $ 1,000 for the monthly water and electricity bills. 6. Withdrew $ 200 from the business account for personal use. 7. Charged $ 1,000 for services billed on Day 4. 8. He bought a land valued at $ 30,000, for which he paid $ 10,000 in cash and the rest was on credit with a guaranteed note. 9. Bought office equipment for $ 2,500 in cash. 10. Purchased weighing equipment for $ 5,000, on creditarrow_forward

- Expeditions Incorporated and BookltNow compete as online travel agencies. The following amounts were reported by the two companies in the three months ended June 30, 2019. (in millions) Expeditions Incorporated BookItNow Net Income $ 980 2,820 Total Assets $ 8,770 8,250 Total Liabilities $ 6,200 4,070 Total Revenues $ 6,130 7,360 Required: 1. Calculate each company's net profit margin expressed as a percent. 2. Which company has generated a greater return of profit from each revenue dollar?arrow_forwardAn analysis of the transactions of Canary Cola Inc. yields the following information: service revenue, $78,000; supplies expense, $33,200; rent expense, $20,500; and dividends, $7,000.Required:What is the amount of net income reported by Canary Cola?arrow_forwardOn December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,470 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable office supplies Office equipment Land Accounts payable Common stock $ 9,750 Cash dividends 15,620 3,710 18,450 45,970 8,900 84,470 Consulting revenue Rent expense Salaries expense Telephone expense Miscellaneous expenses $ 2,530 15,620 4,070 7,450 810 630arrow_forward

- J. Clancy owns Clancy Consulting. On December 31 of the prior year, the J. Clancy, Capital account balance was $27,500. During the current year, Clancy invests an additional $16,500 in assets, but withdrew $14,000 cash. Clancy Consulting reports net income of $35,000 for the current year. Prepare a statement of owner's equity for Clancy Consulting for the current year ended December 31. CLANCY CONSULTING Statement of Owner's Equity J. Clancy, Capital, December 31 prior year J. Clancy, Capital, December 31 current yeararrow_forwardAs of December 31 of the current year, Armani Company’s records show the following. Hint: The owner invested $2,700 cash during the year. Required:Prepare the income statement for Armani Company for the current year ended December 31. Cash $ 11,700 Accounts receivable 10,700 Supplies 7,700 Equipment 6,700 Accounts payable 14,400 Armani, Capital, December 31, prior year 17,700 Armani, Capital, December 31, current year 22,400 Armani, Withdrawals 14,700 Consulting revenue 36,400 Rental revenue 25,400 Salaries expense 21,700 Rent expense 13,700 Selling and administrative expenses 9,700arrow_forwardPractice Help, please.arrow_forward

- Amy is a sole trader and had assets of $569,400 and liabilities of $412,840 on 1 January During the year ended 31 December 20X8 she paid $65,000 capital into the business and she paid herself wages of $800 per month. At 31 December 20X8, Amy had assets of $614,130 and liabilities of $369,770. Find the profit for the year Decemeber 31 20X8arrow_forwardExpeditions Incorporated and BookltNow compete as online travel agencies. The following amounts were reported by the two companies in the three months ended June 30, 2019. Total Total Total (in millions) Expeditions Incorporated $ 1,130 Net Income Assets Liabilities Revenues $ 9,130 B,610 $ 6,500 4,370 $ 6,580 7,810 BookItNow 3,120 Required: 1. Calculate each company's net profit margin expressed as a percent. 2. Which company has generated a greater return of profit from each revenue dollar? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate each company's net profit margin expressed as a percent. (Round your answers to 1 decimal place.) Expeditions Incorporated BookltNow Net Profit Marginarrow_forwardCyrus Bautista owns and operates Aquarius Advertising Services. On January 1, 20Y3, Cyrus Bautista, Capital had a balance of $615,300. During the year, Cyrus invested an additional $45,000 and withdrew $14,500. For the year ended December 31, 20Y3, Aquarius Advertising Services reported a net income of $94,220. Prepare a statement of owner’s equity for the year ended December 31, 20Y3. Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education