FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

[The following information applies to the questions displayed below.]

The transactions of Belle Company appear below.

- D. Belle created a new business and invested $6,400 cash, $7,100 of equipment, and $10,400 in web servers in exchange for common stock.

- The company paid $4,100 cash in advance for prepaid insurance coverage.

- The company purchased $900 of supplies on credit.

- The company paid $800 cash for selling expenses.

- The company received $5,900 cash for services provided.

- The company paid $900 cash toward accounts payable.

- The company paid $2,600 cash for equipment.

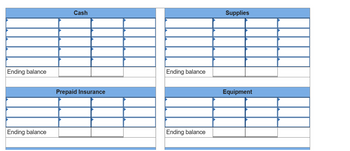

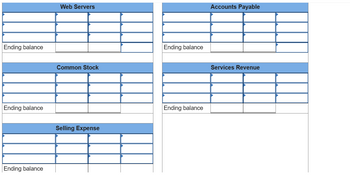

Fill in each of the following T-accounts for Belle Company’s seven transactions listed here. The T-accounts represent Belle Company’s general ledger. Code each entry with transaction number 1 through 7 (in order) for reference.

Transcribed Image Text:Ending balance

Ending balance

Cash

Prepaid Insurance

Ending balance

Ending balance

Supplies

Equipment

Transcribed Image Text:Ending balance

Ending balance

Ending balance

Web Servers

Common Stock

Selling Expense

Ending balance

Ending balance

Accounts Payable

Services Revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- [The following information applies to the questions displayed below.] Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $35,000 cash from the issue of common stock. 2. Borrowed $35,000 cash from National Bank. 3. Earned cash revenues of $53,000 for performing services. 4. Paid cash expenses of $47,500. 5. Paid a $1,500 cash dividend to the stockholders. 6. Acquired an additional $25,000 cash from the issue of common stock. 7. Paid $9,000 cash to reduce the principal balance of the bank note. 8. Paid $58,000 cash to purchase land. 9. Determined that the market value of the land is $81,000. c. Identify the asset source transactions and related amounts for Year 1. Sources of Assets Event Total sources of assets Amountarrow_forwardRequired information Use the following information for Exercises 13-14 below. (Algo) [The following information applies to the questions displayed below) The transactions of Spade Company appear below, a. Kacy Spade, owner, Invested $16,000 cash in the company in exchange for common stock b. The company purchased supplies for $464 cash, c. The company purchased $8,848 of equipment on credit d. The company received $1,888 cash for services provided to a customer. e. The company paid $8.848 cash to settle the payable for the equipment purchased in transaction c. f. The company billed a customer $3,392 for services provided. g. The company paid $525 cash for the monthly rent. h. The company collected $1,425 cash as partial payment for the account receivable created in transaction f L. The compony paid a $1,200 cashydividend to the owner (sole shareholder). Exercise 2-13 (Algo) Recording effects of transactions in T-accounts LO A1 Required: 1. Prepare general journal entries to record the…arrow_forward! Required information Use the following information for Exercises 13-14 below. (Algo) [The following information applies to the questions displayed below.] The transactions of Spade Company appear below. a. K. Spade, owner, invested $17,750 cash in the company in exchange for common stock. b. The company purchased supplies for $515 cash. c. The company purchased $9,816 of equipment on credit. d. The company received $2,095 cash for services provided to a customer. e. The company paid $9,816 cash to settle the payable for the equipment purchased in transaction c. f. The company billed a customer $3,763 for services provided. g. The company paid $525 cash for the monthly rent. h. The company collected $1,580 cash as partial payment for the account receivable created in transaction f i. The company paid a $1,200 cash dividend to the owner (sole shareholder). Exercise 2-14 (Algo) Preparing a trial balance LO P1 Prepare the Trial Balance. Use May 31 as its report date. Note: Hint: Accounts…arrow_forward

- A company was recently formed with $ 50,000 cash contributed to the company by stock-holders. The company then borrowed $ 20,000 from a bank and bought $ 10,000 of supplies on account. The company also purchased $ 50,000 of equipment by paying $ 20,000 in cash and issuing a note for the remainder. What is the amount of total assets to be reported on the balance sheet? $ 110,000 $ 90,000 $ 100,000 $120,000arrow_forwardDuring the first month of operations, the following transactions occur for Orison Supply Store. The owner invested $105,000 into the Business. Equipment worth $84,000 was purchased in part by a $63,000 bank loan. Supplies totalling $10,500 were purchased by cash. Inventory of $42,000 was purchased on credit. Rent for the following three months of $31,500 was paid. What are the total assets after these transactions? (Ignore GST for this question)arrow_forwardThe following transactions occurred during March 2016 for the Wainwright Corporation. The company owns and operates a wholesale warehouse. [These are the same transactions analyzed in Exercise 2–1, when we determined their effect on elements of the accounting equation.] 1. Issued 30,000 shares of capital stock in exchange for $300,000 in cash. 2. Purchased equipment at a cost of $40,000. $10,000 cash was paid and a note payable was signed for the balance owed. 3. Purchased inventory on account at a cost of $90,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $120,000. The cost of the goods sold was $70,000. 5. Paid $5,000 in rent on the warehouse building for the month of March. 6. Paid $6,000 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2016. 7. Paid $70,000 on account for the merchandise purchased in 3. 8. Collected $55,000 from customers on account. 9. Recorded depreciation expense of…arrow_forward

- Lita Lopez started Biz Consulting, a new business, and completed the following transactions during its first year of operations. a. Lita Lopez invested $63,000 cash and equipment valued at $39,000 in the company. b. The company purchased a building for $41,000 cash. c. The company purchased equipment for $5,400 cash. d. The company purchased $3,100 of supplies and $1,100 of equipment on credit. e. The company paid $870 cash for advertising expenses. f. The company completed a financial plan for a client and billed that client $4,600 for the service. g. The company designed a financial plan for another client and immediately collected a $8,400 cash fee. h. L. Lopez withdrew $1,400 cash from the company for personal use. i. The company received $3,600 cash as partial payment from the client described in transaction f j. The company made a partial payment of $550 cash on the equipment purchased in transaction d k. The company paid $1,800 cash for the secretary's wages for this period.…arrow_forwardYou are the bookkeeper for Harley Inc., a newly formed corporation. Harley had the following transactions for their business: * Four shareholders contributed $40,000 ($10,000 each) in exchange for Harley common stock. * Harley purchased inventory for $5,000. Harley received an invoice for the inventory that is due in 30 days. What are the effects on Harley's accounting equation? A B D Based on the two transactions, Assets increased by $40,000, Liabilities decreased by $5,000 and Shareholder Equity increased by $45,000. Based on the two transactions, Assets increased by $45,000, Liabilities increased by $5,000 and Shareholder Equity increased by $40,000. C Based on the two transactions, Assets increased by $15,000, Liabilities increased by $5,000 and Shareholder Equity increased by $10,000. Based on the two transactions, Assets increased by $35,000, Liabilities decreased by $5,000 and Shareholder Equity increased by $40,000.arrow_forwardA company has posted the following transaction: Debit Equipment 7000; Credit Accounts Payable 2000; Credit Cash 4000; and Credit Bank 1000. Which of the following best describes the actual transaction? Select one: a. The company purchased equipment for 7000, paying 4000 in cash, 1000 in cheque, and the remaining on credit. b. The company sold equipment worth 7000, receiving 4000 in cash and 2000 still owed. c. The company purchased equipment for 7000, paying 4000 in cash and the remaining 2000 is to be paid later. ↓ d. The company purchased equipment for 7000 entirely on credit.arrow_forward

- Required information [The following information applies to the questions displayed below.] The transactions of Spade Company appear below. a. K. Spade, owner, invested $19,750 cash in the company in exchange for common stock. b. The company purchased supplies for $573 cash. c. The company purchased $10,922 of equipment on credit. d. The company received $2,331 cash for services provided to a customer. e. The company paid $10,922 cash to settle the payable for the equipment purchased in transaction c. f. The company billed a customer $4,187 for services provided. g. The company paid $510 cash for the monthly rent. h. The company collected $1,759 cash as partial payment for the account receivable created in transaction f. i. The company paid a $1,100 cash dividend to the owner (sole shareholder). Required: 1. Prepare general journal entries to record the transactions of Spade Company by using the following accounts: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; Common…arrow_forwardes Pinkerton & Sons is a new start up that plans to offer cryptocurrency financial advice. The company experienced the following events during its first year of operations: Required: Classify each event as an asset source, use, or exchange transaction or as not applicable. 1. Acquired $400,000 from the issuance of common stock to finance initial operations. 2. Purchased an office building for $350,000 to serve as the headquarters for the company. 3. Provided financial planning services to clients for $25,000 cash. 4. Paid employees $15,000 in salary expense for services provided to clients. Event 1. 2. 3. 4. Classificationarrow_forwardNeed Answer please providearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education