FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

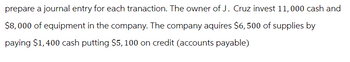

Transcribed Image Text:prepare a journal entry for each tranaction. The owner of J. Cruz invest 11,000 cash and

$8,000 of equipment in the company. The company aquires $6,500 of supplies by

paying $1,400 cash putting $5, 100 on credit (accounts payable)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 不 OA. debit Interest Expense and credit Cash for $800 OB. debit Interest Payable and credit Interest Expense for $800 OC. debit Interest Expense and credit Interest Payable for $800 OD. debit Interest Payable and credit Cash for $800 Wisconsin Bank lends Local Furniture Company $80,000 on November 1. Local Furniture Company signs a $80,000, 6%, 4-month note. The fiscal year end of Local Furniture Company is December 31. The journal entry made by Local Furniture Company on December 31 is:arrow_forwardI need to put this as a journal entries July 1 Began business by making a deposit in a company bank account of $40,000, in exchange for 4,000 shares of $10 par value common stock. July 1 Paid the premium on a 1-year insurance policy, $4,800. July 1 Paid the current month's store rent expense, $3,600. July 6 Purchased repair equipment from Paul's Pool Equipment Company, $7,800. Paid $600 down and the balance was placed on account. July 8 Purchased repair supplies from Mary's Repair Company on credit, $450. July 10 Paid telephone bill, $300. July 11 Cash pool service revenue for the first third of July, $2,650. July 18 Made payment to Mary's Repair Company, $300. July 20 Cash pool service revenue for the second third of July, $4,000. July 31 Cash pool service revenue for the last third of July, $2,250. July 31 Paid the current month's electric bill, $500. July 31 Declared and paid cash dividend of $1,100.arrow_forwardA sole trader has 100 in hand and bank balance of 2400 at the beginning of the accounting period. The closing Bala for cash in hand and bank were 150 and 5200 respectively. Cash receipt from debtors and payment to support during the year amounted to 51700 and 38200 respectively. She also paid 3400 to employees. How my drawing did she made during the yeararrow_forward

- Groro Co. Bills a client $62,000 for services provided and agrees to accept the following 3 items as full payment $10,000 cash, equipment worth $80,000 and to assume responsibility for a $28,000 note payable related to the equipment. question: record the transaction in journal entry form. date general journal debit credit general journals are either cash,equipment revenue, supplies, accounts payable, note payable, common stock or revenuearrow_forwardJournalize the following: 1. On the books & records of Company A: On May 2nd, Company A received $100 of interest income from the bank earned in April. If the books are on an accrual basis, record the entry in April and in May when cash was received April May 2. On the books & records of Company A: In January, Company A purchased Investment in XYZ for $100. Payment was made in cash. In March, Company A sold Investment in XYZ for $150. Payment was received in cash. 3. On the books & records of Company A: On April 1st, Company A paid $1,200 for insurance expense that covers the year 4/1/17-3/31/18. Record 4/1/17 entry for payment of $1,200 Record 4/30/17 journal entry 4. There are 2 parallel funds, Fund A and Fund B. Together, the funds will make an investment of $100k, with a 65/35 split. The investment will be paid in cash, however, Fund B does not currently have any cash so Fund…arrow_forwardk nces Groro Co.bills a client $62,000 for services provided and agrees to accept the following three items in full payment: (1) $10,000 cash, (2) equipment worth $80,000, and (3) to assume responsibility for a $28,000 note payable related to the equipment. (a) Analyze the transaction using the accounting equation. (b) Prepare general journal entries for the above transactions. (c) Post the entry using T-accounts to represent ledger accounts. Complete this question by entering your answers in the tabs below. Required A Required B Required C Post the entry using T-accounts to represent ledger accounts. Note Payable 245 Cash 101 Equipment 167. Revenue 404 < Required B Required Carrow_forward

- Illustration: Roth Contractor Corporation was incorporated on December 1, 2019 and had following transactions during December 1 Dec Issued Capital for 5000 cash 3 Dec Paid 1200 cash for three months rent in advance 4 Dec Purchased a used truck for 10,000 on credit 4 Dec Purchased Supplies of 1000 on credit 6 Dec Paid 1800 for a one-year truck insurance policy 7 Dec Billed a customer 4500 for work completed to date 8 Dec Collected 800 for work completed to date 12 Dec Paid the following expense in cash Advertisement 350 Interest 100 Telephone 75 truck operating 425 Wages 2500 15 Dec Collected 2000 of the amount billed on 7 dec 18 Dec Billed Customer 6500 for work completed to date 19 Dec Signed a 9000 contract for work to be performed in Jan 2017 22 Dec Paid the following Expenses Advertisement 200 Interest 150 Truck Operating 375 Wages 2500 27 Dec Collected advance on work to be done in January 28 Dec Received a bill for 100 for electricity used during the…arrow_forwardCould you please help Me with this question?arrow_forwardPrepare an income statement for the month ended January 31,2018 General Entries: Jan5 Received $60,000 from Shophia Lebron and issued 12,000 common shares of $5 par value. Jan5 Paid $6,000 of general liability and property insurance. The disbursement by Check No. 100 was for a complete year of service. Jan6 Rented an office and furniture for $2,000 per month. Issued Check No. 101 for $6,000, representing the first and last month's rent and the security deposit.[ the security deposit (debit deposit), the last month's rent, and the current rent are to be classified separately.] Jan7 Issued Check No. 102 for $1,600 for the purchase of office supplies. Jan7 Issued Check No. 103 for $7,000 for advertising to be run in local nespaper and magazines in the month of Jan Jan10 Roxana Perini engaged My Place, House of Decor to renovate her oceanfront condominium. Received $10,000 from Roxana Perini after services were completed. Jan12 Recorded $6,000 (net 30) decorating fees earned on account…arrow_forward

- a. Received $16,600 cash for consulting services rendered in January. b. Issued common stock to investors for $15,000 cash. c. Purchased $16,100 of equipment, paying 25 percent in cash and owing the rest on a note due in 2 years. d. Received $12,500 cash for consulting services to be performed in February. e. Bought and received $1,550 of supplies on account. f. Received utility bill for January for $1,960, due February 15. g. Consulted for customers in January for fees totaling $19,600, due in February. h. Received $14,300 cash for consulting services rendered in December. i. Paid $775 toward supplies purchased in (e). E3-19 (Algo) Creating an Unadjusted Trial Balance [LO 3-4) Required: Prepare an unadjusted trial balance for Tongo, Incorporated for the month ended January 31. Account Name TONGO, INCORPORATED Unadjusted Trial Balance Debit Credit +arrow_forwardYi Min started an engineering firm called Min Engineering. He began operations and completed seventransactions in May, which included his initial investment of $18,000 cash. After those seven transactions,the ledger included the following accounts with normal balances. Cash . . . . . . . . . . . . . . . . . . $37,600Office supplies. . . . . . . . . . 890Prepaid insurance. . . . . . . 4,600Office equipment. . . . . . . $12,900Accounts payable. . . . . . . 12,900Y. Min, Capital. . . . . . . . . . 18,000Y. Min, Withdrawals . . . . . . . . . . . $ 3,370Engineering fees earned. . . . . . . 36,000Rent expense. . . . . . . . . . . . . . . . 7,540 Required 1. Prepare a trial balance for this business as of the end of May. 2. The following seven transactions produced the account balances shown above. a. Y. Min invested $18,000 cash in the business. b. Paid $7,540 cash for monthly rent expense for May. c. Paid $4,600 cash in advance for the annual insurance premium beginning the next period. d.…arrow_forward1) journal entries Transferred cash from a personal bank account in exchange for stock, $50,000 Purchased $8,000 of merchandise inventory by issuing a 90 day, 10% 2 interest paying note. 3 Paid cash for three months advertising in advance, $3,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education