Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

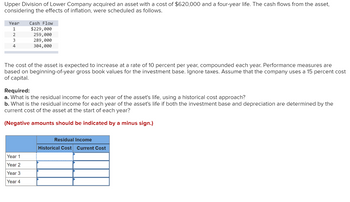

Transcribed Image Text:Upper Division of Lower Company acquired an asset with a cost of $620,000 and a four-year life. The cash flows from the asset,

considering the effects of inflation, were scheduled as follows.

Year Cash Flow

1

2

3

4

$229,000

259,000

289,000

304,000

The cost of the asset is expected to increase at a rate of 10 percent per year, compounded each year. Performance measures are

based on beginning-of-year gross book values for the investment base. Ignore taxes. Assume that the company uses a 15 percent cost

of capital.

Year 1

Year 2

Year 3

Year 4

Required:

a. What is the residual income for each year of the asset's life, using a historical cost approach?

b. What is the residual income for each year of the asset's life if both the investment base and depreciation are determined by the

current cost of the asset at the start of each year?

(Negative amounts should be indicated by a minus sign.)

Residual Income

Historical Cost Current Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- Calculate the capitalized cost of an equipment maintained at a rate of 6% every year for $10,000, replaced every 3years for $25,000 at the same rate, and bought for $110,500.arrow_forwardIn Year 1, Darw Inc. purchased equipment with an expected useful life of 5 years. The initial cost of the equipment was $85,000. Darw Inc.cost of capital is 12%. At the time it purchased the equipment, Darw Inc. projected the following cash inflows from use of the equipment: Year Projected Cash Inflow 1 $20,000 2 $30,000 3 $35,000 4 $25,000 5 $15,000 At the end of Year 5, the equipment had reached the end of its useful life. Darw Inc.determined that it had actually generated the following cash flows: Year Actual Cash Inflow $10,000 $20,000 $30,000 $30,000 $30,000 2. Calculate the net present value that the equipment achieved, based on the actual cash inflows.arrow_forwardSubject: acountingarrow_forward

- Find the book value at the beginning and end of each year by single line, double declining balance, sum-of-the-years digits, and sinking fund at 6% methods for an asset with initail cost of $2500 and with salvage of $1100 in six years.arrow_forwardIn 2018 an asset was purchased for $2,000,000. The asset qualified for Initial Allowance. The Initial Allowance (I.A) Rate was 20%. Annual Allowance (A.A) Rate was 10%. The asset was sold in 2020 for $1,000,000. Capital allowance is on the reducing balance basis. The balancing adjustment is: a.A Balancing Charge of $260,000 b.A Balancing Allowance of $134,000 c. ABalancing Allowance of $260,000 d. A Balancing charge of $200,000arrow_forwardA project requires an initial capital spending on the fixed asset of $660,330. The asset will be depreciated straight-line to zero over the project's life of 7 years. The fixed asset's book value at the end of the first year is $arrow_forward

- An investment made with an expenditure of $160,000 at the start of the project. The income from the project at the end of each year for 5 years is $80000, $90000, $85,000, $75,000 and $70,000. He made an investment of $20000 again at the end of 2nd year. The maintenance will cost 1500$ for the first year and it increments by 500$ for the second year and third year onwards it increments by 1000$. The salvage value is 70,000$. Draw a CFD for the project and give the analysis of the project based on the CFD.arrow_forwardSubject: accountingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education