FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

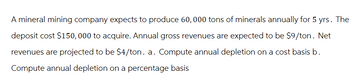

Transcribed Image Text:A mineral mining company expects to produce 60, 000 tons of minerals annually for 5 yrs. The

deposit cost $150,000 to acquire. Annual gross revenues are expected to be $9/ton. Net

revenues are projected to be $4/ton. a. Compute annual depletion on a cost basis b.

Compute annual depletion on a percentage basis

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information A potential investment has a cost of $380,000 and a useful life of 6 years. Annual cash sales from the investment are expected to be $267,382 and annual cash operating expenses are expected to be $105,332. The expected salvage value at the end of the investment's life is $40,000. The company has a before-tax discount rate of 15%. Required: Calculate the following. (Round dollar amounts to the nearest whole dollar and IRR to one decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.) Annual PMT of the investment FV of the investment NPV of the investment IRR of the investment $ 162050 GA 69 40000arrow_forwardSubject:arrow_forwardRequired information A potential investment has a cost of $425,000 and a useful life of 5 years. Annual cash sales from the investment are expected to be $225.225 and annual cash operating expenses are expected to be $88,725. The expected salvage value at the end of the investment's life is $45,000. The company has a before-tax discount rate of 18%. Required: Calculate the following. (Round dollar amounts to the nearest whole dollar and IRR to one decimal place (.e. 055-5.5%). Enter negative amounts with a minus sign) Annual PMT of the investment FV of the investment NPV of the investment IRR of the investmentarrow_forward

- Required information A potential investment has a cost of $395,000 and a useful life of 5 years. Annual cash sales from the investment are expected to be $255,338 and annual cash operating expenses are expected to be $100,588. The expected salvage value at the end of the investment's life is $50,000. The company has a before-tax discount rate of 17%. Required: Calculate the following. (Round dollar amounts to the nearest whole dollar and IRR to one decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.) Annual PMT of the investment FV of the investment NPV of the investment IRR of the investment 0000 $arrow_forwardTen investors invested an amount of P 75 million each for coal mining at Sierra Madre Mountain. It is expected that the mine contains 5, 000, 000 tons of coal ores and due to latest technology, it can mine 125, 000 tons of unprocessed ores. The management expects an annual expenses of P 35 million, an annual miscellaneous expenses of P 12 million and milling, drilling and other procedural expenses yearly costs P 815 per ton of unprocessed ores of coal. After such process, 85% of the coal ores produces an income of P 1, 750 per ton. a) Find the annual depletion cost of the mine. b) Ten years after operation, the management annual expenses decreases an amount of P 4 million, annual miscellaneous expenses becomes P13 million and procedural expenses becomes P 920 per ton of unprocessed ores. After procedural process, 75% of unprocessed ores produces an income of P 1, 850 per ton. What would then be its average depletion cost annually for the remaining years of the mine?arrow_forwardSubject: acountingarrow_forward

- Raghubhaiarrow_forwardA firm has invested $50,000 in equipment with a 5-year useful life. The machinery will have a salvage value of $5,000. The annual benefits from the machinery are $13,000 for the first year and increase by $2,000 per year. Assume a combined 30% income tax rate, and the firm uses the SOYD depreciation. Calculate the before-tax IRR. Calculate the after-tax IRR.arrow_forwardD Company is evaluating three projects. Each project has a useful life of 5 years. Relevantdata on each project are as follows. Depreciation is computed by the straight-line method with no salvage value. The company’scost of capital/interest rate is 15%. (Assume that cash flows occur evenly throughout the year.)a. Compute the cash payback period for each project. (Round to two decimals.) (25%)b. Compute the net present value for each project. (Round to nearest dollar.) (25%)arrow_forward

- Reclamation of a gravel pit is expected to begin 9 years from today with estimated end of year costs of 1.5 million dollars each year at the end of years 9, 10, 11 and 12. Part A What amount would the company need to invest or escrow today (time zero) to cover the future liabilities of 1.5 million in years 9, 10, 11, & 12? Other opportunities exist to invest available capital elsewhere and earn 10% per year compounded annually. Part B What amount would your company need to invest each year for the next 8 years (Years 1-8) to pay for the future liabilities of 1.5 million in years 9, 10, 11, & 12? Assume the same nominal 10% interest rate.arrow_forwardCalculate the expected accounting rate of return on average investment for a proposed investment of $9.000,000 in a fued asset, using straight line depreciation with a useful life of 20 years, $600,000 residual value, and is expected to increase the company's total net income (after depreciation and taxes) over the investment's 20-year useful life by $12,000,00. O 12.5% O 250.0% O 18.0% O 14.3% O 6.7%arrow_forwardA factory manager is considering the purchase of one of the following two production equipment. Cash flow estimates for equipment A are in year-zoro dollars while those of equipment B are in actual dollars Equipment A (year-zero S) Equipment B (actual $) $1,200 Initial investment $9,500 Net annual revenue $3.000 $4,000 $0 Market value at end of useful life Useful ife, years 11 11 The manager uses a market interest rate of 12% per year. If inflation rate is expected to average 5.66% per year over the next several years, determine the PW of each equipment. 1. The PW of Equipment A is OA. S14,161 OB. $14,578 OC. $12,500 OD. $0,313 2. The PW of Equipment B is O A. $20,347 OB. S15,200 OC. $20,903 OD. $12,651arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education