Concept explainers

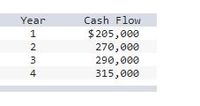

Upper Division of Lower Company acquired an asset with a cost of $560,000 and a four-year life. The

| Year | Cash Flow | ||

| 1 | $ | 205,000 | |

| 2 | 270,000 | ||

| 3 | 290,000 | ||

| 4 | 315,000 | ||

The cost of the asset is expected to increase at a rate of 10 percent per year, compounded each year. Performance measures are based on beginning-of-year gross book values for the investment base. Ignore taxes.

Required:

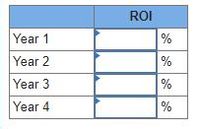

a. What is the ROI for each year of the asset's life, using a historical cost approach? (Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1).)

b. What is the ROI for each year of the asset's life if both the investment base and

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- LO, Inc., is considering an investment of $440,000 in an asset with an economic life of five years. The firm estimates that the nominal annual cash revenues and expenses at the end of the first year will be $279,500 and $88,000, respectively. Both revenues and expenses will grow thereafter at the annual inflation rate of 2 percent. The company will use the straight-line method to depreciate its asset to zero over five years. The salvage value of the asset is estimated to be $60,000 in nominal terms at that time. The one-time net working capital investment of $17,500 is required immediately and will be recovered at the end of the project. The corporate tax rate is 25 percent. What is the project's total nominal cash flow from assets for each year? (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Cash flowarrow_forward2. If an asset costs $70,950 and is expected to have a salvage value of $949 at the end of five year life, and generates annual cash net cash inflows of $4,447 each year, the cash payback period rounding to two decimal places isarrow_forwardIn Year 1, Darw Inc. purchased equipment with an expected useful life of 5 years. The initial cost of the equipment was $85,000. Darw Inc.cost of capital is 12%. At the time it purchased the equipment, Darw Inc. projected the following cash inflows from use of the equipment: Year Projected Cash Inflow 1 $20,000 2 $30,000 3 $35,000 4 $25,000 5 $15,000 At the end of Year 5, the equipment had reached the end of its useful life. Darw Inc.determined that it had actually generated the following cash flows: Year Actual Cash Inflow $10,000 $20,000 $30,000 $30,000 $30,000 1) What was the net present value that Darw Inc. calculated for the equipment when the company purchased the asset?arrow_forward

- Stenback, Inc. is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available: Initial capital investment Estimated useful life Estimated residual value Estimated annual net cash inflow for 10 years Required rate of return Compute the payback period for each investment. Show your calculations and round to one decimal place. $ Investment A Investment B 280,000 $ 210,000 7 years 13 years 12,000 25,000 45,000 85,000 14% 11% Investment A Investment B Select the formula, then enter the amounts to calculate the payback period for each investment. + = Payback (in years) = =arrow_forwardRihanna Company is considering purchasing new equipment for $440,000. It is expected that the equipment will produce net annual cash flows of $55,000 over its 10-year useful life. Annual depreciation will be $44,000. Compute the cash payback period. (Round answer to 1 decimal place, e.g. 10.5.) Cash payback period yearsarrow_forwardCalculate the capitalized cost of an equipment maintained at a rate of 6% every year for $10,000, replaced every 3years for $25,000 at the same rate, and bought for $110,500.arrow_forward

- Upper Division of Lower Company acquired an asset with a cost of $580,000 and a four-year life. The cash flows from the asset, considering the effects of inflation, were scheduled as follows. Year Cash Flow 1 $ 210,000 2 250,000 3 285,000 4 320,000 The cost of the asset is expected to increase at a rate of 20 percent per year, compounded each year. Performance measures are based on beginning-of-year gross book values for the investment base. Ignore taxes. Required: a. What is the ROI for each year of the asset's life, using a historical cost approach? b. What is the ROI for each year of the asset's life if both the investment base and depreciation are determined by the current cost of the asset at the start of each year?arrow_forwardA division is considering the acquisition of a new asset that will cost $2,960,000 and have a cash flow of $790,000 per year for each of the four years of its life. Depreciation is computed on a straight-line basis with no salvage value. Ignore taxes. Required: a. & b. What is the ROI for each year of the asset's life if the division uses beginning-of-year asset balances and net book value for the computation? What is the residual income each year if the cost of capital is 8 percent? (Enter "ROI" answers as a percentage rounded to 1 decimal place (i.e., 32.1). Negative amounts should be indicated by a minus sign.) Year Investment Base ROI Residual Income 1 $2,960,000 % 2 % 3 % 4 %arrow_forwardIn Year 1, Darw Inc. purchased equipment with an expected useful life of 5 years. The initial cost of the equipment was $85,000. Darw Inc.cost of capital is 12%. At the time it purchased the equipment, Darw Inc. projected the following cash inflows from use of the equipment: Year Projected Cash Inflow 1 $20,000 2 $30,000 3 $35,000 4 $25,000 5 $15,000 At the end of Year 5, the equipment had reached the end of its useful life. Darw Inc.determined that it had actually generated the following cash flows: Year Actual Cash Inflow $10,000 $20,000 $30,000 $30,000 $30,000 2. Calculate the net present value that the equipment achieved, based on the actual cash inflows.arrow_forward

- Explain how knowledge of managerial accounting can assist a manager with regard to the following concerns: He is deciding whether to push through with a project. He is determining whether a branch is profitable or not. He is deciding whether to process a certain product further before selling. He would like to show to the Board of Directors how the business is financially performing and how cash is being used. He would like to plan for the year so that he will be prepared to deal with shortage of cash fund.arrow_forwardFind the book value at the beginning and end of each year by single line, double declining balance, sum-of-the-years digits, and sinking fund at 6% methods for an asset with initail cost of $2500 and with salvage of $1100 in six years.arrow_forwardThe following data are from an after-tax cash flow analysis in year 1 for anew MACRS 5-year property. How much money would be saved in year 1 if 100% bonus depreciation is used? Initial Investment = $180,000 Regular MACRS Depreciation Deduction in Year 1 = $36,000 Before-Tax-and-Loan Cash Flow = $280,000 Loan Principal Payment = $17,500 Interest on Loan = $5,650. a. $30,240 b. $75,600 c. $37,800 d. $36,000.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education