Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

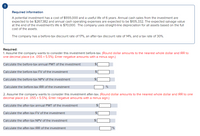

Transcribed Image Text:Required information

A potential investment has a cost of $555,000 and a useful life of 6 years. Annual cash sales from the investment are

expected to be $267,382 and annual cash operating expenses are expected to be $105,332. The expected salvage value

at the end of the investment's life is $70,000. The company uses straight-line depreciation for all assets based on the full

cost of the assets.

The company has a before-tax discount rate of 17%, an after-tax discount rate of 14%, and a tax rate of 30%.

Required:

1. Assume the company wants to consider this investment before-tax. (Round dollar amounts to the nearest whole dollar and IRR to

one decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.)

Calculate the before-tax annual PMT of the investment

Calculate the before-tax FV of the investment

$

Calculate the before-tax NPV of the investment

$

Calculate the before-tax IRR of the investment

2. Assume the company wants to consider this investment after-tax. (Round dollar amounts to the nearest whole dollar and IRR

one

decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.)

Calculate the after-tax annual PMT of the investment

Calculate the after-tax FV of the investment

2$

Calculate the after-tax NPV of the investment

Calculate the after-tax IRR of the investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Required Information A potential investment has a cost of $410,000 and a useful life of 7 years. Annual cash sales from the investment are expected to be $201,135 and annual cash operating expenses are expected to be $79,235. The expected salvage value at the end of the investment's life is $45,000. The company has a before-tax discount rate of 17%. Required: Calculate the following. (Round dollar amounts to the nearest whole dollar and IRR to one decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.) Annual PMT of the investment FV of the investment NPV of the investment IRR of the investment 0006 $arrow_forwardCrane Corp. management is considering purchasing a machine that will cost $117,250 and will be depreciated on a straight-line basis over a five-year period. The sales and expenses (excluding depreciation) for the next five years are shown in the following table. The company’s tax rate is 34 percent. Year 1 Year 2 Year 3 Year 4 Year 5 Sales $127,450 $176,875 $247,455 $254,440 $271,125 Expenses $141,410 $128,488 $137,289 $145,112 $139,556 Crane will accept all projects that provide an accounting rate of return (ARR) of at least 45 percent. (a1) Calculate accounting rate of return. (Round answer to 1 decimal place, e.g. 15.2%.) Accounting rate of return enter the Accounting rate of return in percentages rounded to 1 decimal place %arrow_forwardmgarrow_forward

- Falkland, Inc., is considering the purchase of a patent that has a cost of $51,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual Income and cash flows: Year 3 Year 4 Year 1 Year 2 $5,100 $6,500 17,200 18,700 18,050 14,650 $6,300 $3,000 Net Income Operating cash flows (Click here to see present value and future value tables) A. What is the NPV of the Investment? Round your present value factor three decimal places and final answer to the nearest dollar. B. What happens if the required rate of return Increases? If the required rate of return Increases, the NPV will be lower ✓.arrow_forwardMACRS depreciation expense and accounting cash flow Pavlovich Instruments, Inc., a maker of precision telescopes, expects to report pretax income of $ 436,000 this year. The company's financial manager is considering the timing of a purchase of new computerized lens grinders. The grinders will have an installed cost of $82,200and a cost recovery period of 5 years. They will be depreciated using the MACRS schedule . Corporate tax rates are given a. If the firm purchases the grinders before year-end, what depreciation expense will it be able to claim this year? b. If the firm reduces its reported income by the amount of the depreciation expense calculated in part a, what tax savings will result? a. The depreciation expense they will be able to claim this year is _____$enter your response here.(Round to the nearest dollar.)arrow_forwardHelp please The following details relate to a particular asset Future Cash flows (per annum) 90,000 Expected period of cash flows 3 years Discount Rate 10% Open market price of asset 210,000 Cost of asset 630,000 Accumulated depreciation 450,000 Calculate both : a)determine the recoverable amount for this asset b)Determine whether the asset is impairedarrow_forward

- Required information A potential investment has a cost of $380,000 and a useful life of 6 years. Annual cash sales from the investment are expected to be $267,382 and annual cash operating expenses are expected to be $105,332. The expected salvage value at the end of the investment's life is $40,000. The company has a before-tax discount rate of 15%. Required: Calculate the following. (Round dollar amounts to the nearest whole dollar and IRR to one decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.) Annual PMT of the investment FV of the investment NPV of the investment IRR of the investment $ 162050 GA 69 40000arrow_forwardYour firm is considering purchasing a machine with the following annual, end-of-year, book investment accounts. Gross investment Less: Accumulated depreciation Net investment AAR Year 0 Year 1 Year 2 Year 3 Year 4 $ 58,000 $58,000 $ 58,000 $ 58,000 $58,000 0 14,500 29,000 43,500 58,000 +% $ 58,000 $43,500 $ 29,000 $14,500 $ The machine generates, on average, $6,000 per year in additional net income. What is the average accounting return for this machine? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) 0arrow_forwardSubject: accountingarrow_forward

- Required information [The following information applies to the questions displayed below.] Montego Production Company is considering an investment in new machinery for its factory. Various information about the proposed investment follows: Initial investment Useful life Salvage value Annual net income generated Montego's cost of capital Assume straight line depreciation method is used. Help Montego evaluate this project by calculating each of the following: $ 860,000 6 years Net Present Value $ 20,000 $ 66,000 11% Required: 4. Recalculate Montego's NPV assuming its cost of capital is 12 percent. (Future Value of $1, Present Value of $1. Future Value Annuity of $1, Present Value Annuity of $1.) Note: Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.arrow_forwardRequired information A potential investment has a cost of $395,000 and a useful life of 5 years. Annual cash sales from the investment are expected to be $255,338 and annual cash operating expenses are expected to be $100,588. The expected salvage value at the end of the investment's life is $50,000. The company has a before-tax discount rate of 17%. Required: Calculate the following. (Round dollar amounts to the nearest whole dollar and IRR to one decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.) Annual PMT of the investment FV of the investment NPV of the investment IRR of the investment 0000 $arrow_forwardA Company is considering a proposal of installing a drying equipment. The equipment would involve a Cash outlay of 6,00,000 and net Working Capital of 80,000. The expected life of the project is 5 years without any salvage value. Assume that the company is allowed to charge depreciation on straight-line basis for Income-tax purpose. The estimated before-tax cash inflows are given below: Year Before-tax Cash inflows ('000) 1 2 3 4 5 240 275 210 180 160 The applicable Income-tax rate to the Company is 35%. If the Company's opportunity Cost of Capital is 12%, calculate the equipment's discounted payback period, payback period, net present value and internal rate of return. The PV factors at 12%, 14% and 15% are: Year 1 2 3 4 5 PV factor at 12% 0.8929 0.7972 0.7118 0.6355 0.5674 PV factor at 14% 0.8772 0.7695 0.6750 0.5921 0.5194 PV factor at 15% 0.8696 0.7561 0.6575 0.5718 0.4972 10-22arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education