FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

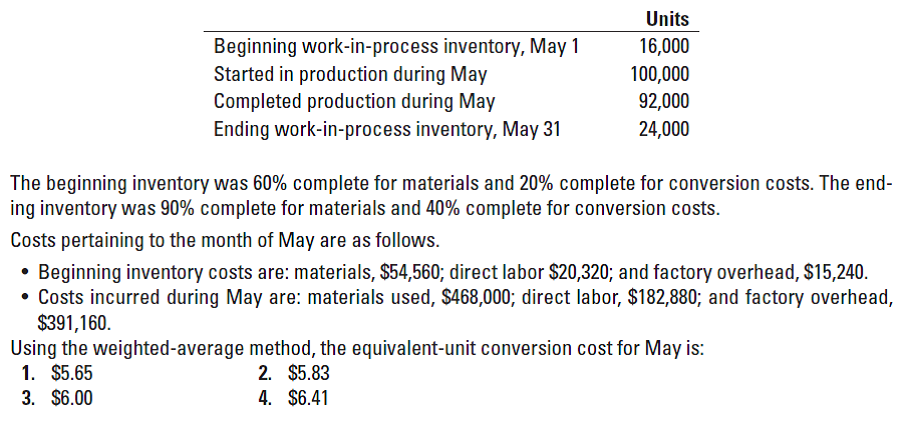

Kimberly Manufacturing uses a process-costing system to manufacture Dust Density Sensors for the mining industry. The following information pertains to operations for the month of May, Year 5.

Transcribed Image Text:Units

Beginning work-in-process inventory, May 1

Started in production during May

Completed production during May

Ending work-in-process inventory, May 31

16,000

100,000

92,000

24,000

The beginning inventory was 60% complete for materials and 20% complete for conversion costs. The end-

ing inventory was 90% complete for materials and 40% complete for conversion costs.

Costs pertaining to the month of May are as follows.

• Beginning inventory costs are: materials, $54,560; direct labor $20,320; and factory overhead, $15,240.

• Costs incurred during May are: materials used, $468,000; direct labor, $182,880; and factory overhead,

$391,160.

Using the weighted-average method, the equivalent-unit conversion cost for May is:

1. $5.65

3. $6.00

2. $5.83

4. $6.41

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During March, the following transactions/events were reported by Jerico Company that uses job- order costing for its product costing purpose: Depreciation on production machines and equipment, $10,500 Insurance on the plant assets, $2,700 Property taxes on the factory building accrued during the month, $4,000 Advertising paid with cash, $8,200 Which of the following accounts should NOT appaer in your journal entries to record the above transactions? O Depreciation Expense O Prepaid Insurance O Taxes Payable O Advertising (or Selling) Expensearrow_forwardLeMans Company produces specialty papers at its Fox Run plant. At the beginning of June, thefollowing information was supplied by its accountant: Direct materials inventory $62,400Work-in-process inventory 33,900Finished goods inventory 55,600 During June, direct labor cost was $143,000, direct materials purchases were $346,000, and thetotal overhead cost was $375,800. The inventories at the end of June were:Direct materials inventory $63,000Work-in-process inventory 37,500Finished goods inventory 50,800 Required:1. Prepare a cost of goods manufactured statement for June.2. Prepare a cost of goods sold schedule for June.arrow_forwardTernes Manufacturing produces metal products primarily used in the construction industry. The three main inputs in production are materials (metal), labor, and overhead. Data for the previous three reporting periods follow: Materials cost Labor cost Overhead Value of product produced Period 3 $ 49,000 28,150 41,050 135,930 Period 3 Period 2 Period 1 Period 2 $ 63,500 37,820 46,600 177,504 Period 1 $ 58,750 34, 200 44,850 162, 604 Required: a. Compute the total factor productivity for the previous three reporting periods. Period Total Factor Productivityarrow_forward

- larco Company shows the following costs for three jobs orked on in April. Balances on March 31 Direct materials used (in March) Direct labor used (in March) Overhead applied (March). Costs during April Direct materials used. Direct labor used Overhead applied Status on April 30 dditional Information Raw Materials Inventory has a March 31 balance of 85,200. Job 306 $ 34,200 25,200 15,200 5A 148,000 90,200 ? Finished (sold) Raw materials purchases in April are $513,000, and total actory payroll cost in April is $376,000. Actual overhead costs incurred in April are indirect materials, $53,250; indirect labor, $26,250; factory rent, 35,250; factory utilities, $22,250; and factory equipment epreciation, $54,250. Req 5B iterials process 1 goods 'entories Job 307 $ 40,200 23, 200 14,200 Predetermined overhead rate is 50% of direct labor cost. . Job 306 is sold for $648,000 cash in April. Inventories 233,000 163,000 ? Finished (unsold) Compute gross profit for April. how how the three…arrow_forwardAirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and actual results for the month of February: Revenue Technician wages Mobile lab operating expenses Office expenses Advertising expenses Insurance Miscellaneous expenses Jobs Revenue Expenses: Technician wages Mobile lab operating expenses Office expenses The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $4,700 plus $32 per job, and the actual mobile lab operating expenses for February were $9,340. The company expected to work 150 jobs in February, but actually worked 158 jobs. Advertising expenses Insurance Miscellaneous expenses Required: Prepare a flexible budget performance report showing AirQual Test Corporation's revenue and spending variances and activity variances for February. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education