FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

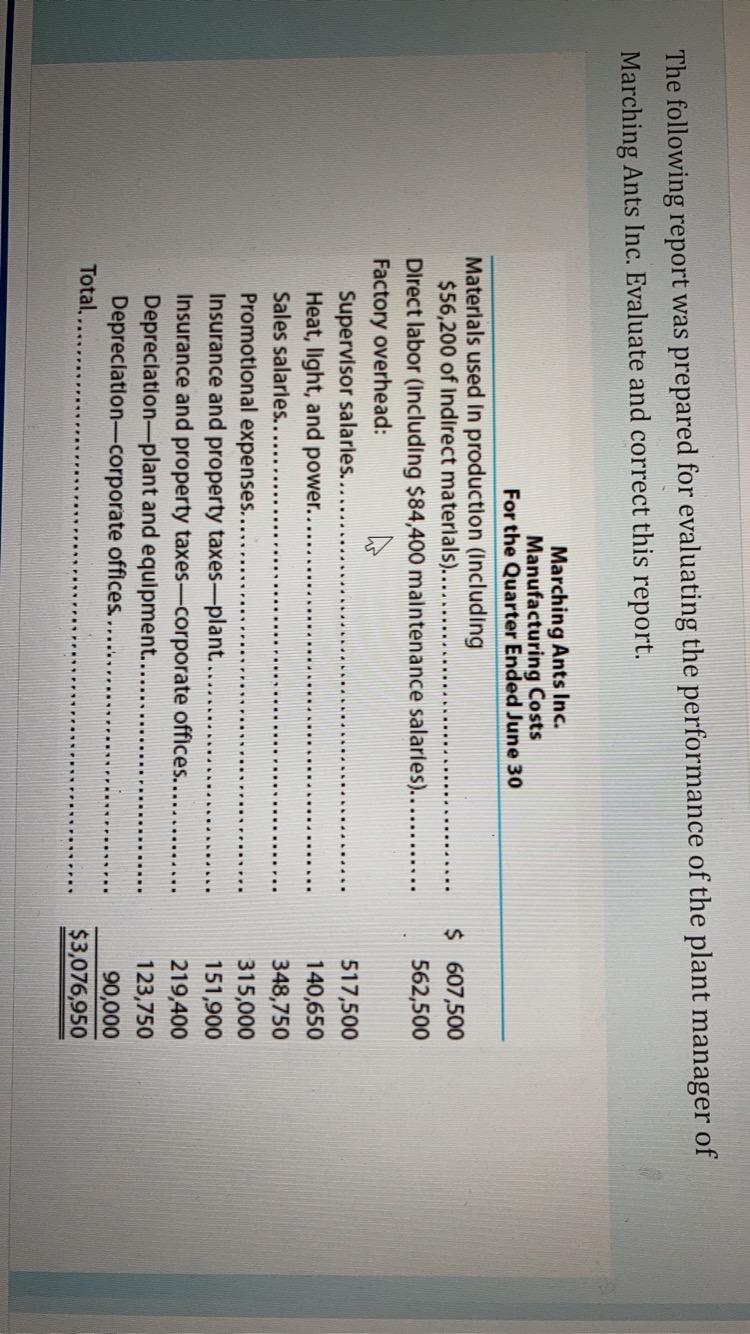

Transcribed Image Text:The following report was prepared for evaluating the performance of the plant manager of

Marching Ants Inc. Evaluate and correct this report.

Marching Ants Inc.

Manufacturing Costs

For the Quarter Ended June 30

Materlals used In production (Including

$56,200 of Indirect materials)....

Direct labor (Including $84,400 malntenance salarles).........

Factory overhead:

Supervisor salarles...

Heat, light, and power..

$ 607,500

562,500

517,500

140,650

Sales salarles......

348,750

Promotional expenses....

Insurance and property taxes-plant...

Insurance and property taxes-corporate offices.........

Depreclation-plant and equipment....

Depreclation-corporate offices...

Total,....

315,000

151,900

219,400

123,750

90,000

$3,076,950

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A partial listing of costs incurred during February at Urfer Corporation appears below: Factory supplies...... $9,000 Administrative wages and salaries.... Direct materials....... Sales staff salaries Factory depreciation.......... Corporate headquarters building rent Indirect labor ........ Marketing... Direct labor...... O $379,000 O $277,000 O $61,000 O $318,000 C Previous GEORHIGHWA permane HON D O DELICIO FEINHE avere Junien C The total of the period costs listed above for February is: CONTA F A $106.000 $142.000 $53,000 $28.000 $30.000 $24.000 $129,000 $74,000 Nextarrow_forwardSubject-accountarrow_forwardMarching Ants Inc. Manufacturing Costs For the Quarter Ended June 30 Cost of direct materials used in production Direct labor Factory overhead: Maintenance salaries Indirect materials Supervisor salaries Heat, light, and power Insurance and property taxes-plant Depreciation-plant and equipment Total manufacturing costs incurred 000000arrow_forward

- Manufacturing overhead is currently assigned to products based on their direct labor costs. For the most recent month, manufacturing overhead was $321,600. During that time, the company produced 14,600 units of the M-008 and 2,200 units of the M-123. The direct costs of production were as follows. Direct materials Direct labor M-008 M-123 $116,800 $ 88,000 116,800 44,000 Management determined that overhead costs are caused by three cost drivers. These drivers and their costs for last year were as follows. Cost Driver Number of machine-hours Number of production runs Number of inspections. Total overhead Total $204,800 160,800 Costs $156, 600 70,000 95,000 $321,600 Activity Level M-898 M-123 2,000 8,000 20 30 20 20 Total 10,000 40 50 Required: a. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product? b. How much of the overhead will be assigned to each product if direct…arrow_forwardThe following information was gathered for the Greensprings Corporation for the most recent year. Manufacturing overhead is allocated using machine hours, Actual machine hours Allocated manufacturing overhead. Estimated manufacturing overhead costs Actual manufacturing overhead costs By how much is manufacturing overhead over or underallocated? A. $82,000 overallocated B. $82,000 underallocated OC. $8,000 underallocated OD. $8,000 overallocated 139,000 $1,130,000 $1,056,000 $1,138,000arrow_forwardBobby Pte Ltd charges manufacturing overhead to products by using a pre-determined overhead rate, computed on the basis of labour hours. The following data pertain to the current year:Budgeted manufacturing overhead $480,000Actual manufacturing overhead $440,000Budgeted labour hours 20,000Actual labour hours 16,000How much is overhead over-applied or under-applied, stating clearly whether it is over or under applied.arrow_forward

- Q) If July's estimated machine-hours are 4,500, calculate the total estimated operating costs of the Machining Department using the cost function in (a)?arrow_forwardThe following report was prepared for evaluating the performance of the plant manager of Marching Ants Inc. Evaluate and correct this report. Marching Ants Inc.Manufacturing CostsFor the Quarter Ended June 30 Materials used in production (including $56,200 of indirect materials) $607,500 Direct labor (including $84,400 maintenance salaries) 562,500 Factory overhead: Supervisor salaries 517,500 Heat, light, and power 140,650 Sales salaries 348,750 Promotional expenses 315,000 Insurance and property taxes—plant 151,900 Insurance and property taxes—corporate offices 219,400 Depreciation—plant and equipment 123,750 Depreciation—corporate offices 90,000 Total $3,076,950 Marching Ants Inc.Manufacturing CostsFor the Quarter Ended June 30 $- Select - - Select - Factory overhead: $- Select - - Select - - Select - - Select - - Select - - Select - - Select - Total…arrow_forwardAll information includedarrow_forward

- 2arrow_forwardPlease solve all questionsarrow_forwardThe following report was prepared for evaluating the performance of the plant manager of Marching Ants Inc. Marching Ants Inc. Manufacturing Costs For the Quarter Ended June 30 1 Materials used in production (including $52,800 of indirect materials) $616,000.00 2 Direct labor (including $83,800 maintenance salaries) 565,500.00 3 Factory overhead: 4 Supervisor salaries 521,000.00 5 Heat, light, and power 140,800.00 6 Sales salaries 347,800.00 7 Promotional expenses 320,000.00 8 Insurance and property taxes—plant 151,500.00 9 Insurance and property taxes—corporate offices 218,600.00 10 Depreciation—plant and equipment 124,750.00 11 Depreciation—corporate offices 85,000.00 12 Total $3,090,950.00 Evaluate and correct this report. Refer to the Labels and Amount Descriptions list provided for the exact wording of the answer choices for text entries. Be sure…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education