FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

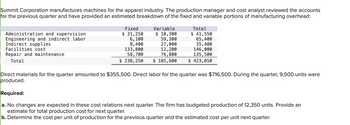

Transcribed Image Text:Summit Corporation manufactures machines for the apparel industry. The production manager and cost analyst reviewed the accounts

for the previous quarter and have provided an estimated breakdown of the fixed and variable portions of manufacturing overhead:

Administration and supervision

Engineering and indirect labor

Indirect supplies

Facilities cost

Repair and maintenance

Total

Fixed

$ 31,250

6,100

8,400

133,800

58,700

$ 238,250

Variable

$ 10,300

59,300

27,000

12, 200

76,800

$ 185,600

Total

$ 41,550

65,400

35,400

146,000

135,500

$ 423,850

Direct materials for the quarter amounted to $355,500. Direct labor for the quarter was $716,500. During the quarter, 9,500 units were

produced.

Required:

a. No changes are expected in these cost relations next quarter. The firm has budgeted production of 12,350 units. Provide an

estimate for total production cost for next quarter.

b. Determine the cost per unit of production for the previous quarter and the estimated cost per unit next quarter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mason Company has two manufacturing departments—Machining and Assembly. The company considers all of its manufacturing overhead costs to be fixed costs. It provided the following estimates at the beginning of the year as well as the following information with respect to Jobs A and B: Estimated Data Machining Assembly Total Manufacturing overhead $ 20,184,000 $ 841,000 $ 21,025,000 Direct labor hours 29,000 696,000 725,000 Machine hours 696,000 24,000 720,000 Job A Machining Assembly Total Direct labor hours 5 10 15 Machine hours 11 2 13 Job B Machining Assembly Total Direct labor hours 4 5 9 Machine hours 12 3 15 Required: 1. If Mason Company uses a plantwide predetermined overhead rate with direct labor-hours as the allocation base, how much manufacturing overhead cost would be applied to Job A? Job B? (Round your answers to the nearest whole dollar amount.) 2. Assume that Mason Company uses departmental…arrow_forwardThe following report was prepared for evaluating the performance of the plant manager of Marching Ants Inc. Evaluate and correct this report. Marching Ants Inc.Manufacturing CostsFor the Quarter Ended June 30 Materials used in production (including $56,200 of indirect materials) $607,500 Direct labor (including $84,400 maintenance salaries) 562,500 Factory overhead: Supervisor salaries 517,500 Heat, light, and power 140,650 Sales salaries 348,750 Promotional expenses 315,000 Insurance and property taxes—plant 151,900 Insurance and property taxes—corporate offices 219,400 Depreciation—plant and equipment 123,750 Depreciation—corporate offices 90,000 Total $3,076,950 Marching Ants Inc.Manufacturing CostsFor the Quarter Ended June 30 $- Select - - Select - Factory overhead: $- Select - - Select - - Select - - Select - - Select - - Select - - Select - Total…arrow_forward2arrow_forward

- Lastly: Determine the costs of goods sold for January:arrow_forwardMason Company provided the following data for this year: Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventories Beginning Ending $ Raw materials $ 8,100 10,900 Work in $ $ 5,100 process Finished goods 20,400 $ $ 70,000 25, 200 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement. Complete this question by entering your answers in the tabs below. Required Required Required 1 2 3 Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. Mason Company Schedule of Cost of Goods Manufactured Direct materials: Total raw materials available $ 652,000 $ 88,000 $…arrow_forwardTernes Manufacturing produces metal products primarily used in the construction industry. The three main inputs in production are materials (metal), labor, and overhead. Data for the previous three reporting periods follow: Materials cost Labor cost Overhead Value of product produced Period 3 $ 49,000 28,150 41,050 135,930 Period 3 Period 2 Period 1 Period 2 $ 63,500 37,820 46,600 177,504 Period 1 $ 58,750 34, 200 44,850 162, 604 Required: a. Compute the total factor productivity for the previous three reporting periods. Period Total Factor Productivityarrow_forward

- Primare Corporation has provided the following data concerning last month's manufacturing operations. Purchases of raw materials Indirect materials used in production Direct labor Manufacturing overhead applied to work in process Underapplied overhead Inventories Raw materials Work in process Finished goods Beginning $ 11,500 $ 54,800 $ 33,480 Ending $ 18,600 $ 66,400 $ 42,200 Required: 1. Prepare a schedule of cost of goods manufactured for the month. 2. Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Primare Corporation Schedule of Cost of Goods Sold $ 31,000 $ 4,530 $ 59,900 $ 88,600 $ 4,190 Required 1 Required 2 Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold. Beginning finished goods inventory Add: Cost of goods manufactured Cost of goods…arrow_forwardWilmington Company has two manufacturing departments--Assembly and Fabrication. It considers all of its manufacturing overhead costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set of data relates to one particular job completed during the year-Job Bravo. Estimated Data Manufacturing overhead costs Direct labor-hours Machine-hours Job Bravo Direct labor-hours Machine-hours Assembly $1,400,000 70,000 28,000 Assembly Fabrication 15 7 7 10 Fabrication Total $1,680,000 $3,080,000 Total 22 17 42,000 140,000 112,000 168,000 Required: 1. If Wilmington used a plantwide predetermined overhead rate based on direct labor-hours, how much manufacturing overhead would be applied to Job Bravo? 2. If Wilmington uses departmental predetermined overhead rates with direct labor-hours as the allocation base in Assembly and machine-hours as the allocation base in Fabrication, how much manufacturing overhead would be applied…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education