FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

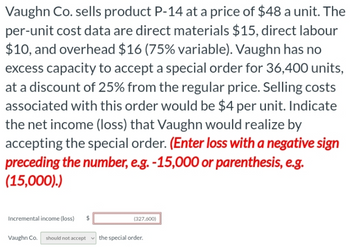

Transcribed Image Text:Vaughn Co. sells product P-14 at a price of $48 a unit. The

per-unit cost data are direct materials $15, direct labour

$10, and overhead $16 (75% variable). Vaughn has no

excess capacity to accept a special order for 36,400 units,

at a discount of 25% from the regular price. Selling costs

associated with this order would be $4 per unit. Indicate

the net income (loss) that Vaughn would realize by

accepting the special order. (Enter loss with a negative sign

preceding the number, e.g. -15,000 or parenthesis, e.g.

(15,000).)

Incremental income (loss)

Vaughn Co. should not accept the special order.

(327,600)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- - Your answer is partially correct. Sheridan Co. sells product P-14 at a price of $46 a unit. The per-unit cost data are direct materials $15, direct labour $10, and overhead $12 (75% variable). Sheridan Co. has sufficient capacity to accept a special order for 35,000 units, but at a discount of 25% from the regular price. Selling costs associated with this order would be $3 per unit. Determine whether Sheridan Co. should accept the special order. (Enter loss with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Incremental income (loss) $ Sheridan Co. should not accept the special order.arrow_forwardRooney Corporation sells products for $28 each that have variable costs of $15 per unit. Rooney's annual fixed cost is $301,600. Required Use the per-unit contribution margin approach to determine the break-even point in units and dollars. Break-even point in units Break-even point in dollarsarrow_forwardAnalyzing Income under Absorption and Variable Costing Variable manufacturing costs are $110 per unit, and fixed manufacturing costs are $112,000. Sales are estimated to be 4,200 units. If an amount is zero, enter "0". Do not round interim calculations. Round final answer to nearest whole dollar. a. How much would absorption costing income from operations differ between a plan to produce 4,200 units and a plan to produce 5,600 units? b. How much would variable costing income from operations differ between the two production plans?arrow_forward

- Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units the relevant range of production is 500 units to 1,500 units) Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 32,100 12,700 9,400 7,708 Required: a. What is the margin of safety in dollars? (Do not round intermediate calculations.) b. What is the margin of safety percentage? Margin of safetyarrow_forwardFerrante Company sells 15,000 units at $47 per unit. Variable costs are $31.96 per unit, and fixed costs are $76,700. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations. a. Contribution margin ratio (Enter as a whole number.) fill in the blank 1 % b. Unit contribution margin (Round to the nearest cent.) $fill in the blank 2 per unit c. Income from operations $fill in the blank 3arrow_forwardTherapeutic Systems sells its products for $23 per unit. It has the following costs Rent Factory labor Executives under contract Raw material $ 195,000 $9.00 per unit $365,500 $ 2.20 per unit Separate the expenses between fixed and variable costs per unit. Using this information and the sales price per unit of $23, compute the break-even point. Note: Do not round intermediate calculations. Break-even point hitsarrow_forward

- Sunn Company manufactures a single product that sells for $120 per unit and whose variable costs are $90 per unit. The company's annual fixed costs are $432.000 Management targets an annual income of $750,000. (1) Compute the unit sales to earn the target income. Numerator: 1 Denominator: (2) Compute the dollar sales to earn the target income.. Numerator: Denominator P M = Units to Achieve Target Units to achieve target Dollars to Achieve Target Dollars to achieve targetarrow_forwardVariable manufacturing costs are $123 per unit, and fixed manufacturing costs are $55,000. Sales are estimated to be 4,000 units. If an amount is zero, enter "0". Round intermediate calculations to the nearest cent and your final answers to the nearest dollar. How much would absorption costing operating income differ between a plan to produce 4,000 units and a plan to produce 5,000 units? X a. $ b. How much would variable costing operating income differ between the two production plans?arrow_forwardRooney Corporation sells products for $38 each that have variable costs of $17 per unit. Rooney's annual fixed cost is $493,500. Required Use the per-unit contribution margin approach to determine the break-even point in units and dollars. Break-even point in units Break-even point in dollarsarrow_forward

- Willie Company sells 39,000 units at $21 per unit. Variable costs are $14.70 per unit, and fixed costs are $76,200. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations. a. Contribution margin ratio (Enter as a whole number.) % b. Unit contribution margin (Round to the nearest cent.) $ per unit c. Income from operationsarrow_forwardGiven the following cost and activity observations for Bounty Company's utilities, use the high-low method to determine Bounty's variable utilities cost per machine hour. Round your answer to the nearest cent. Cost Machine Hours March $3,142 15,489 April 2,691 10,041 May 2,810 11,509 4 June 3,881 18,009 a. $0.15 b. $1.05 O c. $1.64 Od. $1.01 10:21 PM 670002 K 63°Farrow_forwardSteven Company has fixed costs of $365,640. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Product Selling Price per Unit Variable Cost per Unit Contribution Margin per Unit X $1,408 $528 $880 Y 710 380 330 The sales mix for Products X and Y is 60% and 40%, respectively. Determine the break-even point in units of X and Y. Round answers to the nearest whole number.fill in the blank 1 units of Xfill in the blank 2 units of Yarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education