Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

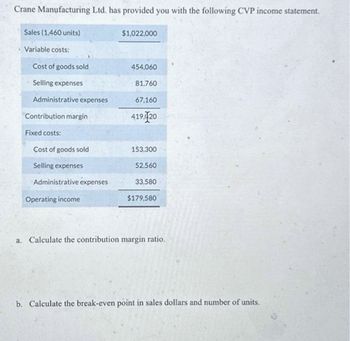

Transcribed Image Text:Crane Manufacturing Ltd. has provided you with the following CVP income statement.

Sales (1,460 units)

Variable costs:

Cost of goods sold

Selling expenses

Administrative expenses

Contribution margin

Fixed costs:

Cost of goods sold

Selling expenses

Administrative expenses

Operating income

$1,022,000

454,060

81,760

67,160

419, 20

153,300

52,560

33,580

$179,580

a. Calculate the contribution margin ratio.

b. Calculate the break-even point in sales dollars and number of units.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Provide graph in answerarrow_forwardThe following information is available for Bramble Corp.: Sales Cost of goods sold $520000 0 0 0 0 300000 Total fixed expenses A CVP income statement would report contribution gross profit of $220000. contribution gross profit of $260000. Total variable expenses margin of $260000. margin of $370000. $150000 260000arrow_forwardSkate World is a merchandising company that sells skateboards both at its retail store and its online store. Results for the most recent three months are shown below. Sales in units Sales Cost of goods sold Gross margin Selling and administrative expenses: Advertising expense Shipping expense Salaries and commissions Insurance expense Depreciation expense Total selling and administrative expenses Operating income July August 4,000 4,500 $400,000 $450,000 240,000 270,000 160,000 180,000 21,000 34,000 78,000 6,000 15,000 154,000 21,000 36,000 84,000 6,000 15,000 162,000 $ 6,000 $ 18,000 September 5,000 $ 500,000 300,000 200,000 21,000 38,000 90,000 6,000 15,000 170,000 $ 30,000arrow_forward

- help with everythingarrow_forward4. Compute gross profit earned by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal places.) Sales Less: Cost of goods sold Gross profit FIFO LIFO Weighted Average Specific Identificationarrow_forwardIdentify each cost below as variable (V), fixed (F), or mixed (M), relative to units sold. Explain your reasons Reason $ M Units Sold a. Total phone cost b. Materials cost per unit C. Manager's salary d. Depreciation cost per unit e. Total utility cost f. Total cost of goods sold 25 150 $ 35 3,000 60 400 3,125 50 200 $ 35 3,000 75 100V, F, or M 250 $ 300 35 35 3,000 3,000 2015 900 1,150 9,375 12,500 F 30 650 6,250 reasons 1. Does not change in total over wide ranges of volume/inversely proportional to the number of units produced while total cost remains constant. 2- It is directly proportional to the number of units produced. The total cost changes as volume changes and in direct proportion. 3-The total cost changes as volume changes, but not in direct proportion.arrow_forward

- Fill in the missing amounts in each of the eight case situations below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.) Required: a. Assume that only one product is being sold in each of the following four case situations: Unit sold Sales Variable expenses Foxed expenses Operating income (loss) Contribution margin per unit $ Case #1 15,000 180,000 $ 100,000 120,000 50,000 $ $ Case #2 Case #1 Case #3 10,000 Case #2 70,000 $ 32,000 8,000 $ 12,000 $ 10 $ 13 Case #4 b. Assume that more than one product is being sold in each of the following four case situations: (Enter "Contribution margin ratio" in percent. Round your final answers to the nearest whole dollar amount.) Case #3 6,000 300,000 100,000 (10,000) Case #4arrow_forwardFill in the missing amounts in each of the eight case situations below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.)arrow_forwardThe following CVP income statements are available for Blanc Company and Noir Company. Sales Variable costs Contribution margin Fixed costs Net income (a1) Blanc Company Noir Company $505,000 $505,000 303,000 252,500 252,500 242,400 $10,100 * Your answer is incorrect. Blanc Company 202,000 191,900 $10,100 Calculate Contribution margin ratio. (Round answers to 2 decimal places, e.g. 0.32.) Noir Company Contribution Margin Ratio 40% 50%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning