FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

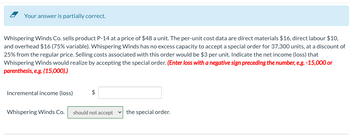

Transcribed Image Text:Your answer is partially correct.

Whispering Winds Co. sells product P-14 at a price of $48 a unit. The per-unit cost data are direct materials $16, direct labour $10,

and overhead $16 (75% variable). Whispering Winds has no excess capacity to accept a special order for 37,300 units, at a discount of

25% from the regular price. Selling costs associated with this order would be $3 per unit. Indicate the net income (loss) that

Whispering Winds would realize by accepting the special order. (Enter loss with a negative sign preceding the number, e.g. -15,000 or

parenthesis, e.g. (15,000).)

Incremental income (loss)

$

Whispering Winds Co. should not accept the special order.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Zachary Company makes a product that sells for $32 per unit. The company pays $23 per unit for the variable costs of the product and incurs annual fixed costs of $76,500. Zachary expects to sell 22,100 units of product. Required Determine Zachary’s margin of safety expressed as a percentagearrow_forwardDrake Company produces a single product. Last year's income statement is as follows: Sales (25,000 units) $1,532,500 Less: Variable costs 1,027,500 Contribution margin $505,000 Less: Fixed costs 273,600 Operating income $231,400 Required: 1. Compute the break-even point in units and sales revenue. In your computations, round the contribution margin per unit to the nearest cent and round the contribution margin ratio to four decimal places. Round your final answers to the nearest whole unit or dollar. Break-even units units Break-even dollars $ 2. What was the margin of safety in dollars for Drake Company last year? Round your final answer to the nearest whole dollar. 3. Suppose that Drake Company is considering an investment in new technology that will increase fixed costs by $216,600 per year, but will lower variable costs to 50 percent of sales. Units sold will remain unchanged. Prepare a budgeted income statement assuming Drake makes this…arrow_forwardVinubhaiarrow_forward

- Franklin Company incurs annual fixed costs of $133,500. Variable costs for Franklin's product are $29.70 per unit, and the sales price is $45.00 per unit. Franklin desires to earn an annual profit of $45,000. Required Use the contribution margin ratio approach to determine the sales volume in dollars and units required to earn the desired profit. Note: Do not round intermediate calculations. Round your final answers to the nearest whole number. Sales in dollars Sales volume in unitsarrow_forwardGarrett Company provided the following information: Common fixed cost totaled $46,000. Garrett allocates common fixed cost to Product 1and Product 2 on the basis of sales. If Product 2 is dropped, which of the following is true?a. Sales will increase by $300,000.b. Overall operating income will increase by $2,600.c. Overall operating income will decrease by $25,000.d. Overall operating income will not change.e. Common fixed cost will decrease by $27,600.arrow_forwardMunoz Company incurs annual fixed costs of $121,320. Variable costs for Munoz's product are $22.40 per unit, and the sales price is $35.00 per unit. Munoz desires to earn an annual profit of $45,000. Required Use the contribution margin ratio approach to determine the sales volume in dollars and units required to earn the desired profit. Note: Do not round intermediate calculations. Round your final answers to the nearest whole number. Sales in dollars Sales volume in unitsarrow_forward

- Zhao Company has fixed costs of $455,600. Its single product sells for $191 per unit, and variable costs are $124 per unit. If the company expects sales of 10,000 units, compute its margin of safety (a) in dollars and (b) as a percent of expected sales. $ a. Margin of safety (in dollar) 611,200 b. Margin of safety (%)arrow_forwardRakoarrow_forwardBlanchard Company manufactures a single product that sells for $180 per unit and whose total variable costs are $126 per unit. The company's annual fixed costs are $842,400. Management targets an annual pretax income of $1,350,000. Assume that fixed costs remain at $842,400. (1) Compute the unit sales to earn the target income. Choose Numerator: Choose Denominator: Units to Achieve Target Units to achieve target %3D (2) Compute the dollar sales to earn the target income. Choose Numerator: Choose Denominator: Dollars to Achieve Target Dollars to achieve target %3Darrow_forward

- Vaughn Co. sells product P-14 at a price of $48 a unit. The per-unit cost data are direct materials $15, direct labour $10, and overhead $16 (75% variable). Vaughn has no excess capacity to accept a special order for 36,400 units, at a discount of 25% from the regular price. Selling costs associated with this order would be $4 per unit. Indicate the net income (loss) that Vaughn would realize by accepting the special order. (Enter loss with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Incremental income (loss) Vaughn Co. should not accept the special order. (327,600)arrow_forwardBlossom Company sells product 1976NLC for $15 per unit. The cost of one unit of 1976NLC is $17, and the replacement cost is $16. The estimated cost to dispose of a unit is $4, and the normal profit is 20% of selling price. At what amount per unit should product 1976NLC be reported, applying lower-of-cost-or-market? $17. $8. $16. $11.arrow_forwardSimmons Corp. has a selling price of $11, variable costs of $2 per unit, and fixed costs of $24,852. Simmons net income is $44,370. How many units did Simmons sell? Round your units to nearest whole numberarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education