FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Vishnu

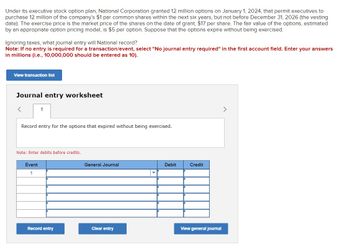

Transcribed Image Text:Under its executive stock option plan, National Corporation granted 12 million options on January 1, 2024, that permit executives to

purchase 12 million of the company's $1 par common shares within the next six years, but not before December 31, 2026 (the vesting

date). The exercise price is the market price of the shares on the date of grant, $17 per share. The fair value of the options, estimated

by an appropriate option pricing model, is $5 per option. Suppose that the options expire without being exercised.

Ignoring taxes, what journal entry will National record?

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers

in millions (i.e., 10,000,000 should be entered as 10).

View transaction list

Journal entry worksheet

1

Record entry for the options that expired without being exercised.

Note: Enter debits before credits.

Event

1

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Under its executive stock option plan, National Corporation granted 30 million options on January 1, 2024, that permit executives to purchase 30 million of the company's $ 1 par common shares within the next six years, but not before December 31, 2026 (the vesting date). The exercise price is the market price of the shares on the date of grant, $19 per share. The fair value of the options, estimated by an appropriate option pricing model, is $3 per option. Suppose that unexpected turnover during 2025 caused the forfeiture of 5% of the stock options. Compute the amount of compensation expense for 2025 and 2026. Note: Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50)arrow_forwardUnder its executive stock option plan, National Corporation granted 12 million options on January 1, 2024, that permit executives to purchase 12 million of the company's $1 par common shares within the next six years, but not before December 31, 2026 (the vesting date). The exercise price is the market price of the shares on the date of grant, $17 per share. The fair value of the options, estimated by an appropriate option pricing model, is $5 per option. Suppose that unexpected turnover during 2025 caused the forfeiture of 5% of the stock options. Compute the amount of compensation expense for 2025 and 2026. Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Compensation expense ($ in millions) 2025 2026arrow_forwardUnder its executive stock option plan, National Corporation granted 12 million options on January 1, 2018, thatpermit executives to purchase 12 million of the company’s $1 par common shares within the next six years, butnot before December 31, 2020 (the vesting date). The exercise price is the market price of the shares on the dateof grant, $17 per share. The fair value of the options, estimated by an appropriate option pricing model, is $5 peroption. No forfeitures are anticipated. Ignoring taxes, what is the total compensation cost pertaining to the stockoptions? What is the effect on earnings in the year after the options are granted to executives?arrow_forward

- Under its executive stock option plan, ABC Corp. granted 30 million options on January 1, 2021, that permit executives to purchase 30 million of the company's $1 par common shares within the next six years, but not before December 31, 2023. • The exercise price is the market price of the shares on the date of grant, $30 per share. • The fair value of the options as of grant date, estimated by an appropriate option pricing model, is $2 per option. • Assume no forfeitures. Required: 1. Provide the journal entry for compensation expense on December 31, 2021. 2. Provide the journal entry for compensation expense on December 31, 2022. 3. Provide the journal entry for compensation expense on December 31, 2023. 4. Suppose that all 30 million options are exercised on April 3, 2024, when the market price is $35 per share. Provide the journal entry for exercise of the options. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter…arrow_forwardUnder its executive stock option plan, National Corporation granted 29 million options on January 1, 2021, that permit executives to purchase 29 million of the company’s $1 par common shares within the next eight years, but not before December 31, 2023 (the vesting date). The exercise price is the market price of the shares on the date of grant, $33 per share. The fair value of the options, estimated by an appropriate option pricing model, is $5 per option. Suppose that the options expire without being exercised. Ignoring taxes, what journal entry will National record? Record entry for the options that expired without being exercised.arrow_forwardUnder its executive stock option plan, National Corporation granted 30 million options on January 1, 2021, that permit executives to purchase 30 million of the company’s $1 par common shares within the next six years, but not before December 31, 2023 (the vesting date). The exercise price is the market price of the shares on the date of grant, $31 per share. The fair value of the options, estimated by an appropriate option pricing model, is $4 per option. Suppose that the options are exercised on April 3, 2024, when the market price is $38 per share. Ignoring taxes, what journal entry will National record? Record entry for options exercised on April 3, 2024, when the market price is $38 per share.arrow_forward

- Hanshabenarrow_forwardUnder its executive stock option plan, National Corporation granted 10 million options on January 1, 2021, that permit executives to purchase 10 million of the company’s $1 par common shares within the next six years, but not before December 31, 2023 (the vesting date). The exercise price is the market price of the shares on the date of grant, $14 per share. The fair value of the options, estimated by an appropriate option pricing model, is $3 per option. No forfeitures are anticipated. 1. Ignoring taxes, what is the total compensation cost pertaining to the stock options?2. Ignoring taxes, what is the effect on earnings in the year after the options are granted to executives?arrow_forwardUnder its executive stock option plan, National Corporation granted 21 million options on January 1, 2021, that permit executives to purchase 21 million of the company’s $1 par common shares within the next six years, but not before December 31, 2023 (the vesting date). The exercise price is the market price of the shares on the date of grant, $26 per share. The fair value of the options, estimated by an appropriate option pricing model, is $4 per option. Suppose that unexpected turnover during 2022 caused the forfeiture of 5% of the stock options. Compute the amount of compensation expense for 2022 and 2023. (Enter your answers in millions rounded to 2 de Answer is not complete. Compensation expense ($ in millions) 2022 2023 cimal places (i.e., 5,500,000 should be entered as 5.50))arrow_forward

- Under its executive stock option plan, Mining Co. granted options on January 1, 2021, that permit executives to purchase 15 million of the company's $1 par common shares within the next eight years, but not before December 31, 2023 (the vesting date). The exercise price is the market price of the shares on the date of grant, $22 per share. The fair value of the options, estimated by an appropriate option pricing model, is $4 per option. No forfeitures are anticipated. The options are exercised on April 2, 2024, when the market price is $21 per share. By what amount will the shareholders' equity increase when 100% of those options are exercised? O $60 million $270 million O $315 million. O $330 millionarrow_forwardUnder its executive stock option plan, National Corporation granted 12 million options on January 1, 2018, that permit executives to purchase 12 million of the company's $1 par common shares within the next six years, but not before December 31, 2020 (the vesting date). The exercise price is the market price of the shares on the date of grant, $17 per share. The fair value of the options, estimated by an appropriate option pricing model, is $5 per option. Suppose that the options are exercised on April 3, 2021, when the market price is $19 per share. Ignoring taxes, what journal entry will National record? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) View transaction list Journal entry worksheet 1 Record entry for options exercised on April 3, 2021, when the market price is $19 per share. Note: Enter debits before credits. Date April 03, 2021…arrow_forwardUnder its executive stock option plan, Boston Corporation granted options on January 1, 2021, that permit executives to purchase 15 million of the company's $1 par common shares within the next eight years, but not before December 31, 2023 (the vesting date). The exercise price is the market price of the shares on the date of grant, $18 per share. The fair value of the options, estimated by an appropriate option pricing model, is $4 per option. No forfeitures were anticipated; however, unexpected turnover during 2022 caused the forfeiture of 5% of the stock options. Ignoring taxes, what is the effect on earnings in 2022? Multiple Choice -$18.5 million. -$18 million. -$19 million. -$20 million.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education