SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

please answer in text form and in proper format answer with must explanation , calculation for each part and steps clearly

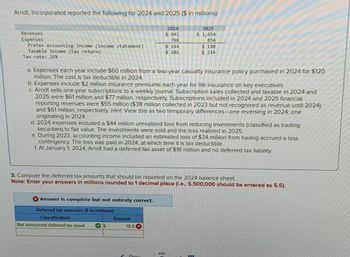

Transcribed Image Text:Arndt, Incorporated reported the following for 2024 and 2025 ($ in millions):

Revenues

Expenses

2024

$ 942

798

Pretax accounting income (income statement)

Taxable income (tax return)

$ 144

2025

$ 1,034

854

$ 180

$ 102

$ 214

Tax rate: 25%

a. Expenses each year include $60 million from a two-year casualty insurance policy purchased in 2024 for $120

million. The cost is tax deductible in 2024.

b. Expenses include $2 million insurance premiums each year for life insurance on key executives.

c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and

2025 were $61 million and $77 million, respectively. Subscriptions included in 2024 and 2025 financial

reporting revenues were $55 million ($38 million collected in 2023 but not recognized as revenue until 2024)

and $61 million, respectively. Hint. View this as two temporary differences-one reversing in 2024; one

originating in 2024.

d. 2024 expenses included a $44 million unrealized loss from reducing investments (classified as trading

securities) to fair value. The investments were sold and the loss realized in 2025.

e. During 2023, accounting income included an estimated loss of $34 million from having accrued a loss

contingency. The loss was paid in 2024, at which time it is tax deductible.

f. At January 1, 2024, Arndt had a deferred tax asset of $18 million and no deferred tax liability.

3. Compute the deferred tax amounts that should be reported on the 2024 balance sheet.

Note: Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).

Answer is complete but not entirely correct.

Deferred tax amounts (S in millions)

Classification

Amount

Net noncurrent deferred tax asset

$

10.0 x

S

Drov

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ashvinarrow_forwardArndt, Incorporated reported the following for 2024 and 2025 ($ in millions): Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $ 940 796 $ 144 $ 104 2025 $ 1,032 852 a. Expenses each year include $58 million from a two-year casualty insurance policy purchased in 2024 for $116 million. The cost is tax deductible in 2024. $ 180 $ 214 b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $59 million and $75 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $53 million ($36 million collected in 2023 but not recognized as revenue until 2024) and $59 million, respectively. Hint. View this as two temporary differences-one reversing in 2024; one originating in 2024. d. 2024 expenses included a $42 million unrealized loss from…arrow_forwardArndt, Incorporated reported the following for 2024 and 2025 ($ in millions): 2025 $ 1,024 844 $180 $ 214 Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $932 788 a. Expenses each year include $50 million from a two-year casualty insurance policy purchased in 2024 for $100 million. The cost is tax deductible in 2024. $144 $ 112 b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $51 million and $67 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $45 million ($28 million collected in 2023 but not recognized as revenue until 2024) and $51 million, respectively. Hint. View this as two temporary differences-one reversing in 2024; one originating in 2024. d. 2024 expenses included a $34 million unrealized loss from…arrow_forward

- Arndt, Incorporated reported the following for 2024 and 2025 ($ in millions): 2025 $ 1,020 840 $180 $ 214 Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $928 784 $144 $ 116 a. Expenses each year include $46 million from a two-year casualty insurance policy purchased in 2024 for $92 million. The cost is tax deductible in 2024. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $47 million and $63 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $41 million ($24 million collected in 2023 but not recognized as revenue until 2024) and $47 million, respectively. Hint. View this as two temporary differences-one reversing in 2024; one originating in 2024. d. 2024 expenses included a $30 million unrealized loss from…arrow_forwardDinesh bhaiarrow_forwardArndt, Incorporated reported the following for 2024 and 2025 ($ in millions): Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $888 760 $128 $ 116 2025 $ 980 800 $ 180 $ 200 a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2024 for $60 million. The cost is tax deductible in 2024. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $33 million and $35 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $25 million ($10 million collected in 2023 but not recognized as revenue until 2024) and $33 million, respectively. (Hint: View this as two temporary differences-one reversing in 2024; one originating in 2024.) d. 2024 expenses included a $14 million unrealized loss from…arrow_forward

- Arndt, Incorporated reported the following for 2024 and 2025 ($ in millions): Revenues. Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $888 760 $128 $116 a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2024 for $60 million. The cost is tax deductible in 2024. Answer is complete but not entirely correct. Deferred tax amounts ($ in millions) Classification Net noncurrent deferred tax asset ✔ $ Net noncurrent deferred tax liability X $ 2025 $980 800 b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $33 million and $35 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $25 million ($10 million collected in 2023 but not recognized as revenue until 2024) and $33 million,…arrow_forwardS Arndt, Incorporated reported the following for 2024 and 2025 ($ in millions): 2024 $932 788 $ 144 $ 112 Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2025 $ 1,024 844 $ 180 $ 214 a. Expenses each year include $50 million from a two-year casualty insurance policy purchased in 2024 for $100 million. The cost is tax deductible in 2024. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $51 million and $67 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $45 million ($28 million collected in 2023 but not recognized as revenue until 2024) and $51 million, respectively. Hint. View this as two temporary differences-one reversing in 2024; one originating in 2024. d. 2024 expenses included a $34 million unrealized loss…arrow_forwardArndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses 760 800 Pretax accounting income (income statement) $ 128 $ 180 Taxable income (tax return) $ 116 $ 200 Tax rate: 25% Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. Expenses include $2 million insurance premiums each year for life insurance on key executives. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint: View this as two temporary differences—one reversing in 2021; one originating in 2021. 2021…arrow_forward

- Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses Pretax accounting income (income statement) Taxable income (tax return) 760 800 $ 128 $ 116 $ 180 $ 200 Tax rate: 25% a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint View this as two temporary differences-one reversing in 2021; one originating in 2021. d. 2021 expenses included a $14 million unrealized loss from reducing…arrow_forwardRequired information [The following information applies to the questions displayed below.] Arndt, Incorporated reported the following for 2024 and 2025 ($ in millions): Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $936 792 $144 $ 108 2025 $ 1,028 848 $ 180 $ 214 a. Expenses each year include $54 million from a two-year casualty insurance policy purchased in 2024 for $108 million. The cost is tax deductible in 2024. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $55 million and $71 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $49 million ($32 million collected in 2023 but not recognized as revenue until 2024) and $55 million, respectively. Hint. View this as two temporary differences-one reversing in…arrow_forwardRequired information [The following information applies to the questions displayed below.] Arndt, Incorporated reported the following for 2024 and 2025 ($ in millions): 2024 $918 774 2025 $ 1,010 830 Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% $ 144 $126 a. Expenses each year include $36 million from a two-year casualty insurance policy purchased in 2024 for $72 million. The cost is tax deductible in 2024. $ 180 $ 214 b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $37 million and $53 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $31 million ($14 million collected in 2023 but not recognized as revenue until 2024) and $37 million, respectively. Hint. View this as two temporary differences-one reversing in…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you