College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

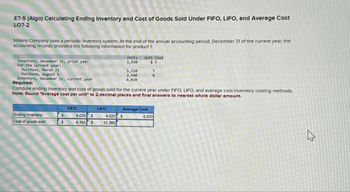

Transcribed Image Text:E7-5 (Algo) Calculating Ending Inventory and Cost of Goods Sold Under FIFO, LIFO, and Average Cost

L07-2

Nittany Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the

accounting records provided the following information for product 1:

Inventory, December 31, prior year

For the current year:

Purchase, March 21

Units

1,950

Unit Cost

$ 5

5,110

2,940

4,020

8

Inventory, December 31, current year

Required:

Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods.

Note: Round "Average cost per unit" to 2 decimal places and final answers to nearest whole dollar amount.

Purchase, August 1

FIFO

LIFO

Average Cost

Ending inventory

Cost of goods sold

$

4,020 S

9,163 $

4,020 $

13,360

4,020

13

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- RE7-8 Johnson Company uses a perpetual inventory system. On October 23, Johnson purchased 100,000 of inventory on credit with payment terms of 1/15, net 45. Using the net price method, prepare journal entries to record Johnsons purchases on October 23 and the subsequent payment on October 31. Using the information from RE7-8, prepare journal entries to record Johnsons purchase on October 23 and the subsequent payment on November 30.arrow_forwardLower-of-cost-or market inventory Data on the physical inventory of Moyer Company as of December 31, 20Y9, are presented below. Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the inventory at cost and at the lower of cost or market, using the first-in, first-out method. Record the appropriate unit costs on an inventory sheet and complete the pricing of the inventory. When there are two different unit costs applicable to an item, proceed as follows: 1. Draw a line through the quantity, and insert the quantity and unit cost of the last purchase. 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase. 3. Total the cost and market columns and insert the lower of the two totals in the LCM column. The first item on the inventory sheet has been completed below as an example.arrow_forwardBasga Company uses the periodic inventory system. Beginning inventory amounted to 241,072. A physical count reveals that the latest inventory amount is 256,339. Record the adjusting entries, using T accounts.arrow_forward

- Refer to the information for Morgan Inc. above. If Morgan uses a perpetual inventory system, what is the cost of ending inventory under FIFO at April 30? a. $32,500 b. $38,400 c. $63,600 d. $69,500arrow_forwardCalculate the cost of goods sold dollar value for A74 Company for the sale on March 11, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average (AVG).arrow_forwardCalculate the cost of goods sold dollar value for B74 Company for the sale on November 20, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average (AVG).arrow_forward

- Beginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the October 22 purchase, (b) the cost of the merchandise sold on October 29, and (c) the inventory on October 31.arrow_forwardRefer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the allowance method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forwardBeginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the October 22 purchase, (b) the cost of goods sold on October 29, and (c) the inventory on October 31.arrow_forward

- Carla Company uses the perpetual inventory system. The following information is available for January of the current year when Carla sold 1,600 units of inventory on January 14. Using the FIFO method, calculate Carlas cost of goods sold for January and its January 31 inventory.arrow_forwardRefer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the direct method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forwardFIFO perpetual inventory The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Instructions 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 3, using the first-in, first-out method. 2. Determine the total sales and the total cost of goods sold for the period. Journalize the entries in the sales and cost of goods sold accounts. Assume that all sales were on account. 3. Determine the gross profit from sales for the period. 4. Determine the ending inventory cost on June 30. 5. Based upon the preceding data, would you expect the ending inventory using the last-in, first-out method to be higher or lower?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College