Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

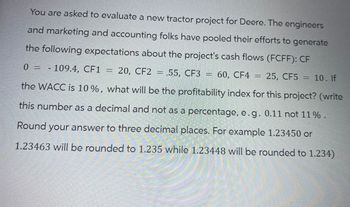

Transcribed Image Text:You are asked to evaluate a new tractor project for Deere. The engineers

and marketing and accounting folks have pooled their efforts to generate

the following expectations about the project's cash flows (FCFF): CF

0 = - 109.4, CF1 = 20, CF2 =,55, CF3 = 60, CF4

=

60, CF4 = 25, CF5 = 10. If

the WACC is 10%, what will be the profitability index for this project? (write

this number as a decimal and not as a percentage, e.g. 0.11 not 11 %.

Round your answer to three decimal places. For example 1.23450 or

1.23463 will be rounded to 1.235 while 1.23448 will be rounded to 1.234)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Salsa Company is considering an investment in technology to improve its operations. The investment costs $250,000 and will yield the following net cash flows. Management requires a 7% return on Investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Year Net cash Flow 1 $ 48,400 2 52,500 3 76,200 4 94,700 5 125,100 Required: 1. Determine the payback period for this Investment. 2. Determine the break-even time for this Investment. 3. Determine the net present value for this Investment. 4. Should management invest in this project based on net present value? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Determine the break-even time for this investment. (Enter cash outflows with a minus sign. Round your break-even time answer to 1 decimal place.) 1 at 7% Year Net Cash Flows Present Value of Present Value of Net Cash Flows per Year Initial investment $ (250,000) Year 1…arrow_forwardCompany XYZ is considering an investment project that is expected to generate the following cash flows: Year 1: $500,000 Year 2: $700,000 Year 3: $800,000 Year 4: $900,000 Year 5: $1,200,000 The cost of capital for the company is 10%. Calculate the Firm's Present Value (FPV) of the cash flows. To calculate the Firm's Present Value (FPV) of the cash flows, you need to discount each cash flow to its present value using the cost of capital, and then sum up the present values of all cash flows.arrow_forwardUse the information below to answer Question#40: GIVEN: The XYZ Company is considering the following project with its corresponding financial data. The Company requires a 9% return from its investments. $ 500,000 $ 200,000 $ 225,000 $ 245,000 Initial investment: Expected Cash in-flow Year 1: Expected Cash in-flow Year 2: Expected Cash in-flow Year 3: Present Value Factor of 1 at 9%: n=1: 0.91743 n=2: 0.84168 n=3: 0.77218 40) Choose from one of the following that accurately depicts this decision: A) This investment should not be considered because NPV is a negative $62,048 B) This învestment should be considered because NPV equals positive $62,048 C) This investment should be considered because the IRR for this investment is obviously less than its Required Rate of Return D) B and Care both correctarrow_forward

- Use the format in the figure below to perform a financial analysis. Create a spreadsheet to perform the analysis and show the NPV, ROI, and year in which payback occurs. + Perform a financial analysis for a project using the format provided in Figure 4-5. Assume that the projected costs and benefits for this project are spread over four years as fol- lows: Estimated costs are $200,000 in Year 1 and $30,000 each year in Years 2, 3, and 4. Estimated benefits are $0 in Year 1 and $100,000 each year in Years 2, 3, and 4. Use a 9 percent discount rate, and round the discount factors to two decimal places. Create a spreadsheet or use the business case financials template on the companion website to cal- culate and clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis. Discount rate 8% Assume the project is completed in Year 0 0 Costs Discount factor…arrow_forwardCarmen, Inc. is considering three different independent investment opportunities. The present value of future cash flows, initial investment, net present value, and profitability index for each of the projects are as follows: Project A Project B Project C Present value of future cash flows $450,100 $313,100 $405,000 Initial investment 200,000 155,000 190, еее Net present value $250, 100 $158,100 $215,000 Profitability index 2.25 2.02 2.13 In what order should Carmen prioritize investment in the projects? Multiple Cholce С, В, А O A, B, C А, С, В C, A, Barrow_forwardPlease help mearrow_forward

- You are a financial analyst for the Brittle Company. The director of capital budgeting has asked you to analyze two proposed capital investments: Projects X and Y. Each project has a cost of $10,000, and the cost of capital for each is 12%. The projects' expected net cash flows are shown in the table below. Expected Net Cash Flows Year Project X Project Y 0 – $10,000 – $10,000 1 6,500 3,500 2 3,000 3,500 3 3,000 3,500 4 1,000 3,500 Which project or projects should be accepted if they are independent? Which project or projects should be accepted if they are mutually exclusive?arrow_forwardHook Industries is considering the replacement of one of its old metal stamping machines. Three alternative replacement machines are under consideration. The cash flows associated with each are shown in the following table attached: . The firm's cost of capital is 10%. d. Calculate the profitability index (PI) for each press. e. Rank the presses from best to worst using PI.arrow_forwardYou are a financial analyst for the Hittle Company. The director of capital budgeting has asked you to analyze two proposed capital investments, Projects X and Y. Each project has a cost of $10,000, and the cost of capital for each is 12%. The projects’ expected net cash flows are as follows: Expected Net Cash Flows Year Project X Project Y 0 −$10,000 −$10,000 1 6,500 3,500 2 3,000 3,500 3 3,000 3,500 4 1,000 3,500 a. Calculate each project’s payback period, net present value (NPV), internal rate of return (IRR), modified internal rate of return (MIRR), and profitability index (PI). b. Which project or projects should be accepted if they are independent? c. Which project should be accepted if they are mutually exclusive? d. How might a change in the cost of capital produce a conflict between the NPV and IRR rankings of these two projects? Would this conflict exist if r were 5%? (Hint: Plot the NPV profiles.) e. Why does the conflict exist?arrow_forward

- Salsa Company is considering an investment in technology to improve its operations. The investment costs $241,000 and will yield the following net cash flows. Management requires a 10% return on investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Year Net cash Flow 1 $ 48, 200 2 53,900 3 76, 400 4 95,500 5 126,500 Required: Determine the payback period for this investment. Determine the break - even time for this investment. Determine the net present value for this investment. Should management invest in this project based on net present value?arrow_forwardbased on information on the image attached, Calculate the initial investment required for the project and then Discuss the significance of each ratio in evaluating the project.arrow_forward1. John approached you with a business proposition to invest in a project. The Annual Cash Flows (CF) are uncertain. However, the following probability distribution provides you with expectations: Probability P(CF) Probable Cash Flow (CF) $80.000 $140,000 $180,000 15 55 30 What is the expected Annual Cash Flow from this project? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). ... BIUS Paragraph Arial 10pt A 10:49 PM a 60F Cloudy 5/16/2022 P Type here to search 5 6. 8Oarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education