Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

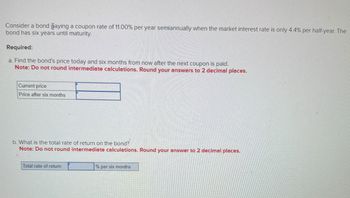

Transcribed Image Text:Consider a bond paying a coupon rate of 11.00% per year semiannually when the market interest rate is only 4.4% per half-year. The

bond has six years until maturity.

Required:

a. Find the bond's price today and six months from now after the next coupon is paid.

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Current price

Price after six months

b. What is the total rate of return on the bond?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Total rate of return

% per six months

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Calculate the Macaulay Duration for a six-year annual coupon paying bond with a coupon of 3.5 %, priced with a yield to maturity of 5.5%. Assume that you are calculating 10 days after a coupon payment where day count convention is 360 days. (Work to 4 decimal places and then present your answer to 2 decimal places).arrow_forwardSuppose that the current 6-month, 1-year, 1.5-year and 2-year interest rates are 2.2%,3%, 3.5% and 3.75%, respectively. a) Calculate the prices of a 1-year and 2-year Treasury bonds. In each case, assumethe face value of £100 and the coupon rate of 5% per annum and that coupons arepaid semi-annually. Assume continuous compounding. Compare the obtainedresults. Are they consistent with your expectations? b) Calculate the par yield on the 1-year bond with semi-annual couponsarrow_forwardYou have a 15 year maturity with a yield of 0.06 yield (in decimals), with duration of 11 years and a convexity of 116.7. The bond is currently priced at $805.76. If the interest rate were to increase 92 basis points, compute the predicted new price for the bond, including convexity. (Be mindful of whether the sign is + or -) Note: your answer should be in % this time. If your answer is 5%, please simply input 5 as your answer.arrow_forward

- Suppose the real risk-free rate of interest is 2%. Inflation is expected to be 2% for 2 years and then 3% thereafter. The maturity risk premium is 0.2% (t). where t is the number of years until maturity. The default risk premium is 2%. The liquidity premium is 1%. What is the nominal interest rate on a 4 year bond? 9.1% 7.8% 7.1%arrow_forwardSuppose the continuous forward rate is r(t) = 0.04 + 0.001t when a 8 year zero coupon bond is purchased. Six months later the forward rate is r(t) = 0.03 + 0.0013t and bond is sold. What is the return?arrow_forwardA bond pays $10,000 per year for the next 10 years. The bond costs $90,000 now. Inflation is expected to be 6 percent over the next 10 years. Answer parts (a) and (b). a. What is the current dollar internal rate of return? Use linear interpolation with x, = 1.95% and x, = 2.00% to find your answer. The current dollar internal rate of return is percent. (Type an integer or decimal rounded to two decimal places as needed.) b. What is the real internal rate of return? The real internal rate of return is percent. (Type an integer or decimal rounded to two decimal places as needed.)arrow_forward

- You will receive $100 from a savings bond in 4 years. The nominal interest rate is 7.90 %. a) What is the present value of the proceeds from the bond? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b) If the inflation rate over the next few years is expected to be 2.90%, what will the real value of the $100 payoff be in terms of today's dollars? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. c)What is the real interest rate? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. d)Calculate the real payoff from the bond [from part (b)] discounted at the real interest rate [ from part (c)]. Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardBhaarrow_forwardA 30-year maturity bond making annual coupon payments with a coupon rate of 11.00% has a ation of 13.50 years. The bond currently sells at a yield to maturity of 5.75%. Ducation a. Find the exact dollar price of the bond if its yield to maturity falls to 4.75%. What is the % change in price? b. Assume that you need to make a quick approximation using the duration rule. What is the % change in price as approximated by the duration rule when the yield to maturity falls to 4.75%? c. Does the duration-rule provide a good approximation of the % price change in this case? Why or why not?arrow_forward

- Suppose the 1 - year spot rate is 0.8%, and that a 2 - year 1.5% annual coupon, a 3 - year 2% annual coupon bonds are trading at par ($100). Calibrate a 2-year binomial interest rate model, assuming that interest rate volatility is 10%. What is the lowest rate at t = 2? Assume annual compounding. Round your answer to 4 decimal places. For example if your answer is 3.205%, then please write down 0.0321.arrow_forwardCompute the Macaulay duration under the following conditions: a. A bond with a four-year term to maturity, a 10% coupon (annual payments), and a market yield of 8%. Do not round intermediate calculations. Round your answer to two decimal places. Assume $1,000 par value. _________ years b. A bond with a four-year term to maturity, a 10% coupon (annual payments), and a market yield of 12%. Do not round intermediate calculations. Round your answer to two decimal places. Assume $1,000 par value. _________ years c. Compare your answers to Parts a and b, and discuss the implications of this for classical immunization. As a market yield increases, the Macaulay duration -(Select:declines/increases) . If the duration of the portfolio from Part a is equal to the desired investment horizon the portfolio from Part b is -(Select: no longer/still) perfectly immunized. Only typed answerarrow_forwardA bond has a face value of $25000 and pays an annual coupon rate of 5.2%. The bond is selling for $25000 now and is expected to be sold for $25080 one year from now. What is the bond's expected rate of return? Answer: % (DO NOT ROUND YOUR CALCULATIONS UNTIL YOU REACH THE FINAL ANSWER. ENTER YOUR RESPONSE ROUNDED TO TWO DECIMAL PLACES.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education