FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help

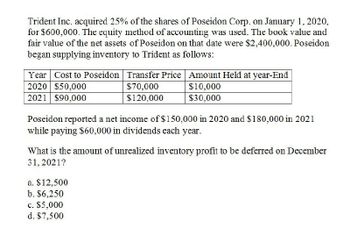

Transcribed Image Text:Trident Inc. acquired 25% of the shares of Poseidon Corp. on January 1, 2020,

for $600,000. The equity method of accounting was used. The book value and

fair value of the net assets of Poseidon on that date were $2,400,000. Poseidon

began supplying inventory to Trident as follows:

Year Cost to Poseidon Transfer Price

Amount Held at year-End

2020 $50,000

$10,000

$30,000

2021 $90,000

$70,000

$120,000

Poseidon reported a net income of $150,000 in 2020 and $180,000 in 2021

while paying $60,000 in dividends each year.

What is the amount of unrealized inventory profit to be deferred on December

31, 2021?

a. $12,500

b. $6,250

c. $5,000

d. $7,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cayman Inc. bought 25% of Maya Company on January 1, 2022 for $800,000. The equity method of accounting was used. The book value and fair value of the net assets of Maya on that date were $2,100,000. Maya began supplying inventory to Cayman as follows: Year Cost to Maya Transfer Price Amount Held by Cayman at Year-End 2022$ 30,000 $ 45,000 $ 8,400 2023$ 48,000 $ 80,000 $ 20,000 Maya reported net income of $100,000 in 2022 and $120,000 in 2023 while paying $40,000 in dividends each year. What is equity in Maya income that should be recognized by Cayman in 2023? O $25,000 Ob $28,700 O $2,000 Od $31,300 e$30,000arrow_forwardAcker Inc. bought 40% of Howell Co. on January 1, 2020 for $576,000. The equity method of accounting was used. The book value and fair value of the net assets of Howell on that date were $1,440,000. Acker began supplying inventory to Howell as follows: YEAR/ COST TO ACKER/ TRANSFER PRICE/ AMOUNT HELD BY HOWELL AT YEAR-END: 2020/ $55,000/ $75,000/ $15,000 2021/ $70,000/ $110,000/ $55,000 Howell reported net income of $100,000 in 2020 and $120,000 in 2021 while paying $40,000 in dividends each year. what is the equity in Howell income that should be reported by Acker in 2021? options are $32,000 - $41,600 - $48,000 - $49,600 - $50,600arrow_forwardQuestion: ClipRite sold ProForm inventory costing $72,000 during the last six months of 2020 for $120,000. At year-end, 30 percent remained ClipRite sold ProForm inventory costing $200,000 during 2021. At yearend, 1 percent is left. What are the consolidated balances? Proform acquired 70 percent of ClipRite on June 30, 2020, for $910,00 in cash. Based on ClipRites acquistion-date fair value, an unrecorded intangible of $400,000 was recognized and is being amortized at the rate of $10,000 per year. No goodwill was recognized in the acuisition. The noncontrolling interest fair value was assessed at $390,000 at the acquisition date. The 2021 financial statements are as follows: Proform ClipRite Sales -800,000 -600,000 Costs of goods sold 535,000 400,000 Operating expenses 100,000 100,000 Dividend Income -35,000 Net Income -200,000 -100,000 Retained earning, 1/1/21 -1,300,000 -850,000 Net Income -200,000 -100,000 Dividend declared 100,000…arrow_forward

- Pearl company acquired 80% of Coral company on January 1, 2020. On December 2021 Pearl reported sales of $1,700,000, cost of goods sold of $800,000 and operating expenses of 250,000. Coral reported sales of $900,000, cost of goods sold of $400,000 and operating expenses $120,000. Coral sold inventory costing $150,000 to Pearl for $200,000. 40% of the goods transferred remain in ending inventory at transfer price. Required: 1. Calculate consolidated cost of goods sold. 2. Prepare consolidation entry 'G'. 3. Calculate net income attributable to noncontrolling interest. 4. Explain how net income attributable to noncontrolling interest would differ assuming the transfer is downstream. NO CALCULATION IS REQUIRED.arrow_forwardwant answer with correct option please provide itarrow_forwardPal Corporation acquired a 60% interest in Sun Corporation on January 1, 2020, at a cost equal to book value and fair value. Sun reports net income of $880,000 for 2020. Sun regularly sells merchandise to Pal at 120% of Sun’s cost. The intercompany sales information for 2020 is as follows: Selling price for intercompany transaction $672,000 Value of inventory unsold by Pal 132,000 Instructions: Determined unrealized profit in Sun as at 31 December 2020 Compute Pal income from Sun as at 31 December 2020arrow_forward

- 15. Northridge, Inc., buys 40% of Matador Company on January 1, 2019. for $550,000. The equity method of accounting is to be used, Matador's net assets on that date were $1.2 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Matador immediately begins supplying inventory to Northridge as follows: Amount Held by Northridge Year Cost to Matador Transfer Price At Year End (at transfer price)2019 $70,000 $100,000 $25,0002020 $96,000 $150,000 $45,000Inventory held at the end of one year by Northridge is sold at the beginning of the next. Matador reports net income of $100,000 in 2019 and $150.000 in 2020 and declares (and pays)…arrow_forwardWhat are the consolidated balances for? Cost of Goods Sold Net income attributable to non controlling Interest Information: ClipRite sold ProForm inventory costing $72,000 during the last six months of 2020 for $120,000. At year-end, 30 percent remained ClipRite sold ProForm inventory costing $200,000 during 2021 for 250,000. At yearend, 10% percent is left. Proform acquired 70 percent of ClipRite on June 30, 2020, for $910,00 in cash. Based on ClipRites acquistion-date fair value, an unrecorded intangible of $400,000 was recognized and is being amortized at the rate of $10,000 per year. No goodwill was recognized in the acuisition. The noncontrolling interest fair value was assessed at $390,000 at the acquisition date. The 2021 financial statements are as follows: Proform ClipRite Sales -800,000 -600,000 Costs of goods sold 535,000 400,000 Operating expenses 100,000 100,000 Dividend Income -35,000 Net Income -200,000 -100,000 Retained…arrow_forwardBlupa Ltd acquired a 25% interest in Trinity Ltd for $145,000 on 1 July 2020. At that date, shareholders' equity of Trinity Ltd consisted of: Share Capital 280,000 Retained Earnings 86,000 All identifiable assets and liabilities of Trinity Ltd were recorded at fair value except for the machinery which was recorded at $25 000 below its fair value on 1 July 2020. Machinery is depreciated at 25% straight line. Information about income and changes in equity for Trinity Ltd for the year ended 30 June 2021 is as follows: Trinity Ltd Revenue 260,000 Expenses 120,000 Profit before income tax 140,000 Income tax expense 28,000 Profit for the period 112,000 Retained earnings (1/7/20) 86,000 198,000 Dividend paid 12,000 Dividend declared 35,000 47,000 Retained earnings (30/6/21) 151,000arrow_forward

- Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on january 1, 2020. 2020 2021 2022 Purchases by Philbin Ending inventory on Philbin's books 1,200 4,000 $ ৪,000 5 12,000 $15.000 3,000 Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. 2020 2021 2022 $ 70,000 $ 85,000 $ 94,000 Dividends paid by Anderson 10,000 10,000 15,000 Anderson's net income Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2022. O $9,400. $9,375. $9,425. $8,485. $9,325.arrow_forwardQUESTION Here is the Trial Balance of Mr T Ltd as at 30 April 2020: Dr Cr K K Share capital: authorized and issued 200,000 Inventory as at 30 April 2019 102,994 Accounts receivable 227,219 Accounts payable 54,818 8% loan notes 40,000 Non-current asset replacement reserve 30,000 General reserve 15,000 Retained profits as at 30 April 2019 12,411 Loan note interest 1,600 Equipment at cost 225,000 Motor vehicles at cost 57,200 Bank 4,973 Cash 62 Sales 880,426 Purchases 419,211 Returns inwards 18,400 Carriage inwards 1,452 Wages and salaries 123,289 Rent, business rates and insurance 16,240 Discounts allowed 3,415 Directors’ remuneration 82,400 FINANCIAL STATEMENTS AND COMPANY VALUATION Provision for depreciation at 30 April 2019 Equipment 32,600 Motor vehicles 18,200 1,283,455 1,283,455 Given the following information as at 30 April 2020, draw up an income statement and statement of financial position as at that date. (i) Inventory K111,317. (ii) The share capital consisted of 300,000…arrow_forwarde of cents Price Company purchased 90% of the outstanding common stock of Score Company on January 1, 2016, for $450,000. At that time, Score Company had stockholders' equity consisting of common stock, $200,000; other com $160,000; and retained earnings, $90,000. On December 31, 2020, trial balances for Price Company and Score Company were as follows: Price $ 109,000 $ Cash Accounts Receivable Note Receivable Inventory Investment in Score Company Plant and Equipment Land Score 78,000 94,000 -0- 166,000 75,000 309,000 158,000 450,000 -0- 940,000 420,000 160,000 70,000 70,000 50,000 822,000 242,000 250,500 124,000 Dividends Declared Cost of Goods Sold Operating Expenses Total Debits Accounts Payable Notes Payable Common Stock $3,351,500 $1,236,000 $ 132,000 $ 46,000 300,000 120,000 500,000 200,000 260,000 160,000 Other Contributed Capital Retained Earnings, 1/1 Sales Dividend and Interest Income Total Credits 687,000 1,420,000 52,500 $3.351,500 $1,236,000 210,000 500,000 -0- Price…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education