Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting Question please answer

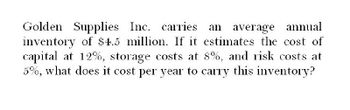

Transcribed Image Text:Golden Supplies Inc. carries an average annual

inventory of $4.5 million. If it estimates the cost of

capital at 12%, storage costs at 8%, and risk costs at

5%, what does it cost per year to carry this inventory?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume Palmer Corp. markers uses 1,440,000 gallons of ink each year. Assume Palmer will order the ink at a rate of P2 per gallon plus a fixed cost of P100 per order. At cost, the firm's carrying cost is 20% of the inventory value. What is Palmer's minimum costs of ordering and holding inventory?arrow_forwardA company wishes to establish an EOQ for an item for which the annual demandis $800,000, the ordering cost is $32, and the cost of carrying inventory is 20%.Calculate the following:a. The EOQ in dollars.b. Number of orders per year.c. Cost of ordering, cost of carrying inventory, and total cost.d. How do the costs of carrying inventory compare with the costs of ordering?arrow_forwardA retailer has annual sales of $500,000 and an average finished-goods inventory of$15,000. If the retailer sells each unit for an average of $25 and purchases the units for$15, what is its annual inventory turnover?arrow_forward

- What is the inventory conversion period for O'Brian's if it has sales of $320,000, an average inventory of $5,333 and a cash conversion cycle of 20 days? Assume the cost of sales is 55% of sales.arrow_forwarda. EFG reports annual sales of $ 30 million. Annual costs of goods sold is $ 15 million. Inventory is $ 5 million. Net income is $ 2 million. What is the months of supply of EFG ? Show all formulas used, calculations and results. Do on Blk Bd b. RST has monthly turns of 4, annual cost of goods sold $ 12 million, annual revenue of $ 36 million. What is its average inventory ? Show all formulas used, calculations and results. Do on Blk Bd For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). I U S Paragraph Arial 14px = v = v A ...arrow_forwardZane Corporation has an inventory conversion period of 64 days,an average collection period of 28 days, and a payables deferral period of 41 days.a. What is the length of the cash conversion cycle?b. If Zane’s annual sales are $2,578,235 and all sales are on credit, what is the investmentin accounts receivable?c. How many times per year does Zane turn over its inventory? Assume that the cost ofgoods sold is 75% of sales. Use sales in the numerator to calculate the turnover ratio.arrow_forward

- If the annual cost of goods sold is $30,000,000 and the average inventory is$5,000,000,a. What is the inventory turns ratio?b. What would be the reduction in average inventory if, through better materialsmanagement, inventory turns were increased to 10 times per year?c. If the cost of carrying inventory is 25% of the average inventory, what is the annual savings?arrow_forwardWhat is the firm's estimated EOQ?arrow_forwardThe purchase price of an item of inventory is $25 per unit. In each three month period the usage of the item is 20,000 units. The annual holding costs associated with one unit equate to 6% of its purchase price. The cost of placing an order for the item is $20. What is the Economic Order Quantity (EOQ) for the inventory item to the nearest whole unit?arrow_forward

- What is the company's estimated EOQ on these general accounting question?arrow_forwardGiven the following percentage costs of carrying inventory, calculate the annual carrying cost if the average inventory is $1 million. Capital costs are 10%, storage costsare 6%, and risk costs are 9%.arrow_forwardBegusarai enterprises has...Accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT