EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

What is the return on equity on these general accounting question?

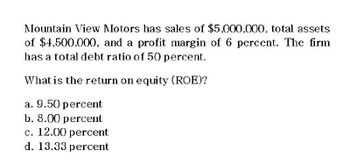

Transcribed Image Text:Mountain View Motors has sales of $5,000,000, total assets

of $4,500,000, and a profit margin of 6 percent. The firm

has a total debt ratio of 50 percent.

What is the return on equity (ROE)?

a. 9.50 percent

b. 8.00 percent

c. 12.00 percent

d. 13.33 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please give me answerarrow_forwardProvide answerarrow_forward9. The Merriam Company has determined that its return on equity is 15 percent. Management is interested in the various components that went into this calculation. You are given the following information: total 0.35 and total assets turnover = 2.8. What is the profit margin? debt/total assets = a. b. C. d. e. 3.48% 5.42% 6.96% 2.45% 12.82% 'c qurrent assets?arrow_forward

- QUESTION: CATHERINE'S CONSULTING HAS NET INCOME OF $4,400 AND TOTAL EQUITY OF $39,450. THE DEBT-EQUITY RATIO IS 1 AND THE PLOWBACK RATIO IS 40 PERCENT. WHAT IS THE RETURN ON ASSETS? QUESTION: AL'S MARKETS EARNS $0.12 IN PROFIT FOR EVERY $1 OF EQUITY AND BORROWS $0.65 FOR EVERY $1 OF EQUITY. WHAT IS THE FIRM'S RETURN ON ASSETS? A) 12.00 PERCENT B) 7.27 PERCENT C) 8.33 PERCENT D) 15.15 PERCENT E) 13.75 PERCENTarrow_forwardQuestion: Lee Sun's has sales of $3,500, total assets of $3,200, and a profit margin of 5 percent. The firm has a total debt ratio of 41 percent. What is the return on equity?arrow_forwardNeed Help with this Questionarrow_forward

- Need helparrow_forward12 Gates Appliances has a return-on-assets (investment) ratio of 20 percent. a. If the debt-to-total-assets ratio is 25 percent, what is the return on equity? (Input your answer as a percent rounded to 2 decimal places.) Return on equity % b. If the firm had no debt, what would the return-on-equity ratio be? (Input your answer as a percent rounded to 2 decimal places.) Return on equityarrow_forwardQuinn company has a debt...financial questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning