FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Trevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next two years (2022 and 2023), Trevor

expects to report salary of $108,000, contribute $8,350 to charity, and pay $3,500 in state income taxes.

Required:

a. Estimate Trevor's taxable income for 2022 and 2023 using the 2022 amounts for the standard deduction for both years.

b. Now assume that Trevor combines his anticipated charitable contributions for the next two years and makes the combined

contribution in December of 2022. Estimate Trevor's taxable income for each of the next two years using the 2022 amounts for the

standard deduction.

c. Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost

$3,400 and $31,000, respectively, each year. Estimate Trevor's taxable income for each of the next two years (2022 and 2023)

using the 2022 amounts for the standard deduction and also assuming Trevor makes the charitable contribution of $8,350 and

state tax payments of $3,500 in each year.

d. Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost

$3,400 and $31,000, respectively, each year. Assume that Trevor makes the charitable contribution for 2023 in December of 2022.

Estimate Trevor's taxable income for 2022 and 2023 using the 2022 amounts for the standard deduction. Reconcile the total

taxable income to your solution to part (c).

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

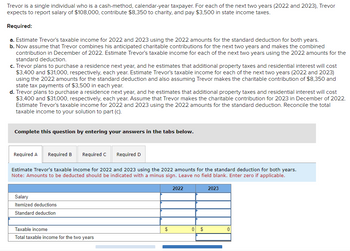

Estimate Trevor's taxable income for 2022 and 2023 using the 2022 amounts for the standard deduction for both years.

Note: Amounts to be deducted should be indicated with a minus sign. Leave no field blank. Enter zero if applicable.

Salary

Itemized deductions

Standard deduction

Required D

Taxable income

Total taxable income for the two years

$

2022

0 $

2023

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Meaning of taxable income

VIEW Step 2: Computation of taxable income

VIEW Step 3: Calculation of taxable income for when combined charity contribution is paid in first year

VIEW Step 4: Calculation of taxable income when resident property is purchased in second year

VIEW Step 5: Calculation of taxable income for requirement D

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Saved Brooklyn files as a head of household for 2023. They claimed the standard deduction of $20,800 for regular tax purposes. Their regular taxable income was $99,000. What is Brooklyn's AMTI? AMTI Description Amountarrow_forwardharrow_forwardMarc, a single taxpayer, earns $60,400 in taxable income and $5,040 in interest from an investment in city of Birmingham bonds. Using the U.S. tax rate schedule for year 2022, what is his effective tax rate? (Use tax rate schedule.)arrow_forward

- Mike (a single taxpayer ) paid $12,000 of medical expenses in 2022. His AGI in 2022 was $70,000 . His other itemized deductions (charitable contributions) were $12,900. Mike is reimbursed $8,000 for these medical expenses in 2023. What amount of the $8,000 refund is taxable in 2023?arrow_forwardCompute the taxable income for 2023 in each of the following independent situations. Click here to access the Exhibits 3.4 and 3.5 to use if required. a. Aaron and Michele, ages 40 and 41, respectively, are married and file a joint return. In addition to four dependent children, they have AGI of $125,000 and itemized deductions of $29,000. AGI Less: Itemized deductions Taxable income b. Sybil, age 40, is single and supports her dependent parents who live with her, as well as her grandfather who is in a nursing home. She has AGI of $80,000 and itemized deductions of $8,000. AGI Less: Standard deduction Taxable income AGI Less: Standard deduction c. Scott, age 49, is a surviving spouse. His household includes two unmarried stepsons who qualify as his dependents. He has AGI of $76,800 and itemized deductions of $10,100. Taxable income $125,000 AGI Less: Standard deduction $80,000 d. Amelia, age 33, is an abandoned spouse who maintains a household for her three dependent children. She has…arrow_forwardTrevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next two years (2023 and 2024), Trevor expects to report salary of $98,000, contribute $8,600 to charity, and pay $3,250 in state income taxes. Required: a. Estimate Trevor's taxable income for 2023 and 2024 using the 2023 amounts for the standard deduction for both years.arrow_forward

- A has AGI of $400,000 in 2022 and has medical expenses of $65,000 in 2022. In 2023, A’s insurance company reimburses him for $40,000 of those expenses. How much of the $40,000 does A have to include in computing its taxable income for 2023?arrow_forwardChuck, a single taxpayer, earns $78,400 in taxable income and $13,800 in interest from an investment in City of Heflin bonds. A. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? B. What is his marginal rate if, instead, he had $40,000 of additional deductions?arrow_forwardBernice is filing a joint return and qualifies to deduct student loan interest on her 2022 tax return. The modified adjusted gross income is $146,000, and her 1098-E shows $3,900 in box 1. For 2022, the maximum student loan interest deduction she can deduct is _____.arrow_forward

- Lara, a single individual, has $140,000 taxable income. Assume the taxable year is 2023. Use Individual Tax Rate Schedules. Required: Compute income tax assuming that: a. Taxable income includes no capital gain. b. Taxable income includes $26,600 capital gain eligible for the 15 percent preferential rate. Note: For all requirements, round your intermediate calculations and final answers to the nearest whole dollar amount. Case a. Includes no capital gain b. Includes capital gain Income Taxarrow_forwardcorrect answers pleasearrow_forwardKirsy , a single taxpayer, has taxable income of $40,000 and is in the 12% tax bracket. During 2021, she had the following capital asset transactions: Long-term gain from the sale of a coin collection $11,000 Long-term gain from the sale of a land investment 10,000 Short-term gain from the sale of a stock investment 2,000 Kirsy's tax consequences from these gains are as follows: a.(12% × $13,000) + (28% × $11,000). b.(5% × $10,000) + (12% × $13,000). c.(0% × $10,000) + (12% × $13,000). d.(12% × $23,000).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education