FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

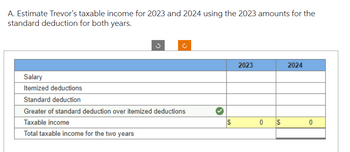

Transcribed Image Text:A. Estimate Trevor's taxable income for 2023 and 2024 using the 2023 amounts for the

standard deduction for both years.

Salary

Itemized deductions

Standard deduction

Greater of standard deduction over itemized deductions

Taxable income

Total taxable income for the two years

$

EA

2023

0 $

2024

0

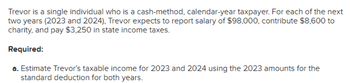

Transcribed Image Text:Trevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next

two years (2023 and 2024), Trevor expects to report salary of $98,000, contribute $8,600 to

charity, and pay $3,250 in state income taxes.

Required:

a. Estimate Trevor's taxable income for 2023 and 2024 using the 2023 amounts for the

standard deduction for both years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Saved Brooklyn files as a head of household for 2023. They claimed the standard deduction of $20,800 for regular tax purposes. Their regular taxable income was $99,000. What is Brooklyn's AMTI? AMTI Description Amountarrow_forwardharrow_forwardIn 2022, Esther paid $20,000 in state income tax, and $20,000 in real estate taxes. Esther’s filing status is Single, and she claimed the above expenses as itemized deductions. In 2022, Esther’s deduction for state and local taxes is limited to which of the following amounts on her Federal Income Tax Return? Group of answer choices $10,000 $20,000 $40,000 $0arrow_forward

- Marc, a single taxpayer, earns $60,400 in taxable income and $5,040 in interest from an investment in city of Birmingham bonds. Using the U.S. tax rate schedule for year 2022, what is his effective tax rate? (Use tax rate schedule.)arrow_forward< Daniel's standard deduction for 2023 is $13,850. a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible". Payment of alimony (divorce finalized in March 2021) Mortgage interest on residence Property tax on residence Contribution to traditional IRA (assume the amount is fully deductible) Contribution to United Church Loss on the sale of real estate (held for investment) Medical expenses State income tax Federal income tax What is Daniel's gross income and his AGI? Gross income: $ AGI: $ b. Should Daniel itemize his deductions from AGI or take the standard deduction? Because Daniel's total itemized deductions (after any limitations) are $ he would benefit from 10:34arrow_forwardMike (a single taxpayer ) paid $12,000 of medical expenses in 2022. His AGI in 2022 was $70,000 . His other itemized deductions (charitable contributions) were $12,900. Mike is reimbursed $8,000 for these medical expenses in 2023. What amount of the $8,000 refund is taxable in 2023?arrow_forward

- Beginning inventory, purchases, and sales for Product XCX are as follows: Sept. 1 Beginning Inventory 26 units @ $13 5 Sale 12 units 17 Purchase 23 units @ $16 30 Sale 15 units Assuming a perpetual inventory system and the last-in, first-out method, determine (a) the cost of the merchandise sold for the September 30 sale and (b) the inventory on September 30. a) Cost of merchandise sold $ b) Inventory, September 30 $arrow_forwardCompute the taxable income for 2023 in each of the following independent situations. Click here to access the Exhibits 3.4 and 3.5 to use if required. a. Aaron and Michele, ages 40 and 41, respectively, are married and file a joint return. In addition to four dependent children, they have AGI of $125,000 and itemized deductions of $29,000. AGI Less: Itemized deductions Taxable income b. Sybil, age 40, is single and supports her dependent parents who live with her, as well as her grandfather who is in a nursing home. She has AGI of $80,000 and itemized deductions of $8,000. AGI Less: Standard deduction Taxable income AGI Less: Standard deduction c. Scott, age 49, is a surviving spouse. His household includes two unmarried stepsons who qualify as his dependents. He has AGI of $76,800 and itemized deductions of $10,100. Taxable income $125,000 AGI Less: Standard deduction $80,000 d. Amelia, age 33, is an abandoned spouse who maintains a household for her three dependent children. She has…arrow_forwardMarried taxpayers, Jason and Catherine Ward, will file a joint Form 1040 for year 2023, on which they will report modified adjusted gross income of $240,000 and net investment income of $20,000. What will be their net investment income tax for the year? A. $760 B. $1,520 C. $9,120 D. $380 E. None of the abovearrow_forward

- Jered and Samantha are married. Their 2021 taxable income is $95,000before considering a $10,000 deduction for adjusted gross income (AGI).What is the tax savings attributable to their deduction? $0 $1,200 $2,200 $2,400$10,000arrow_forwardIn 2022, Nadia is single and has $104,000 of regular taxable income. She itemizes her deductions as follows: real property taxes of $1,700, state income taxes of $2,200, and mortgage interest expense of $11,000 (acquisition indebtedness of $200,000). In addition, she receives tax-exempt interest of $1,400 from a municipal bond (issued in 2006) that was used to fund a new business building for a (formerly) out-of-state employer. Finally, she received a state tax refund of $400 from the prior year. Note: Amounts to be deducted should be indicated by a minus sign.arrow_forwardDuring 2022, a divorced taxpayer with no dependents received or paid the following in 2022: 1. Wages (teacher) 2. Municipal bond interest 3. Qualified dividends 4. Inheritance from mother 5. Student loan interest paid 6. Gambling winnings 7. Gambling losses 8. Unemployment compensation 9. HCC tuition scholarship 10. Alimony paid to ex-spouse (divorced 2021) 11. Qualifying medical expenses 12. State income tax withholding 13. Personal property taxes on car 14. Charitable contributions 15. Rental property expenses Required: Using the letter code only, identify the tax treatment for each of the above numbered items as (a) inclusion, (b) exclusion, (c) for AGI deduction, (d) itemized deduction, (e) not deductible, (f) preferred tax treatment. More than one letter code may apply to a given numbered item. If a limitation applies to any of the numbered items, state the primary relevant dollar or percentage limitation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education