FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

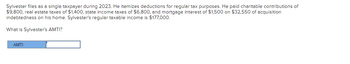

Transcribed Image Text:Sylvester files as a single taxpayer during 2023. He itemizes deductions for regular tax purposes. He paid charitable contributions of

$9,800, real estate taxes of $1,400, state income taxes of $6,800, and mortgage interest of $1,500 on $32,550 of acquisition

indebtedness on his home. Sylvester's regular taxable income is $177,000.

What is Sylvester's AMTI?

AMTI

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2022, Nadia is single and has $104,000 of regular taxable income. She itemizes her deductions as follows: real property taxes of $1,700, state income taxes of $2,200, and mortgage interest expense of $11,000 (acquisition indebtedness of $200,000). In addition, she receives tax-exempt interest of $1,400 from a municipal bond (issued in 2006) that was used to fund a new business building for a (formerly) out-of-state employer. Finally, she received a state tax refund of $400 from the prior year. Note: Amounts to be deducted should be indicated by a minus sign.arrow_forwardIn 2023, Janet and Ray are married filing jointly. They have five dependent children under 18 years of age. Janet and Ray's taxable income (all ordinary) is $2,400,000, and they itemize their deductions as follows: state income taxes of $10,000 and mortgage interest expense of $25,000 (acquisition debt of $300,000). Use Exhibit 8-5 and Tax Rate Schedule for reference. a. What is Janet and Ray's AMT?arrow_forwardI’m trying to figure out Wilma’s tax liability.arrow_forward

- Trevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next two years (2022 and 2023), Trevor expects to report salary of $108,000, contribute $8,350 to charity, and pay $3,500 in state income taxes. Required: a. Estimate Trevor's taxable income for 2022 and 2023 using the 2022 amounts for the standard deduction for both years. b. Now assume that Trevor combines his anticipated charitable contributions for the next two years and makes the combined contribution in December of 2022. Estimate Trevor's taxable income for each of the next two years using the 2022 amounts for the standard deduction. c. Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost $3,400 and $31,000, respectively, each year. Estimate Trevor's taxable income for each of the next two years (2022 and 2023) using the 2022 amounts for the standard deduction and also assuming Trevor makes the charitable…arrow_forwardPaige had $100,000 of income from wages and $3,650 of taxable interest. Paige also made contributions of $2,300 to a tax-deferred retirement account. Paige has 4 dependents and files as head of household.What is Paige's total income?What is Paige's adjusted gross income?For Paige's filing status, the standard deduction is $18,000. What is Paige's taxable income?arrow_forwardLouis files as a single taxpayer. In April of this year he received a $1,090 refund of state income taxes that he paid last year. How much of the refund, if any, must Louis include in gross income under the following independent scenarios? Assume the standard deduction last year was $12,550.arrow_forward

- Brandon, an unmarried individual, has $196,300 taxable income. Assume the taxable year is 2022. Use Individual Tax Rate Schedules. Required: a. Identify Brandon's statutory marginal rate and compute average tax rate assuming Brandon is a single taxpayer. b. Identify Brandon's statutory marginal rate and compute average tax rate assuming Brandon is a head of household. c. Identify Brandon's statutory marginal rate and compute average tax rate assuming Brandon is a surviving spouse. Complete this question by entering your answers in the tabs below. X Answer is complete but not entirely correct. Required A Required B Required C Identify Brandon's statutory marginal rate and compute average tax rate assuming Brandon is a single taxpayer. Note: Do not round intermediate calculation. Round your "Average rate" answer to 2 decimal places (for example XX.XX%). Marginal rate Average rate 32 % 32.00%arrow_forwardKirsy , a single taxpayer, has taxable income of $40,000 and is in the 12% tax bracket. During 2021, she had the following capital asset transactions: Long-term gain from the sale of a coin collection $11,000 Long-term gain from the sale of a land investment 10,000 Short-term gain from the sale of a stock investment 2,000 Kirsy's tax consequences from these gains are as follows: a.(12% × $13,000) + (28% × $11,000). b.(5% × $10,000) + (12% × $13,000). c.(0% × $10,000) + (12% × $13,000). d.(12% × $23,000).arrow_forwardJamie is single. In 2022, she reported $106,000 of taxable income, including a long-term capital gain of $5,600. What is her gross tax liability? (Use the tax rate schedules, long-term capital gains tax brackets.) Note: Round your answer to the nearest whole dollar amount.arrow_forward

- Trevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next two years (2023 and 2024), Trevor expects to report salary of $98,000, contribute $8,600 to charity, and pay $3,250 in state income taxes. Estimate Trevor's taxable income for 2023 and 2024 using the 2023 amounts for the standard deduction for both years.arrow_forwardSs.236.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education