FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Can you please answer A and fill in the table; please show me how you got those numbers and any formulas or rules used. I want to be able to understand.

note: use ABC method

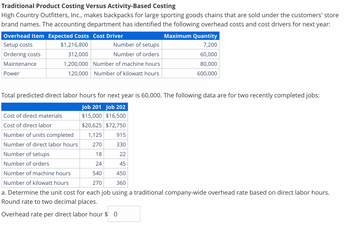

Transcribed Image Text:Traditional Product Costing Versus Activity-Based Costing

High Country Outfitters, Inc., makes backpacks for large sporting goods chains that are sold under the customers' store

brand names. The accounting department has identified the following overhead costs and cost drivers for next year:

Overhead Item Expected Costs Cost Driver

Setup costs

$1,216,800

Number of setups

Ordering costs

312,000

Number of orders

Maintenance

1,200,000

Number of machine hours

120,000 Number of kilowatt hours

Power

Maximum Quantity

7,200

60,000

80,000

600,000

Total predicted direct labor hours for next year is 60,000. The following data are for two recently completed jobs:

Job 201 Job 202

$15,000 $16,500

Cost of direct materials

Cost of direct labor

$20,625 $72,750

Number of units completed

1,125

915

Number of direct labor hours

270

330

Number of setups

18

22

Number of orders

24

45

Number of machine hours

540

450

Number of kilowatt hours

270

360

a. Determine the unit cost for each job using a traditional company-wide overhead rate based on direct labor hours.

Round rate to two decimal places.

Overhead rate per direct labor hour $0

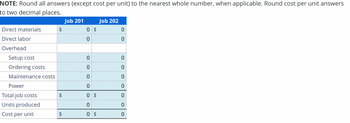

Transcribed Image Text:NOTE: Round all answers (except cost per unit) to the nearest whole number, when applicable. Round cost per unit answers

to two decimal places.

Direct materials

Direct labor

Overhead

Setup cost

Ordering costs

Maintenance costs

Power

Total job costs

Units produced

Cost per unit

$

$

$

Job 201

0

0

$

0

0

0

0

0 $

0

0 $

Job 202

0

0

0

O

0

0

0

0

0

Expert Solution

arrow_forward

Step 1: Introduction

- Traditional Method of Overhead allocation allocates the overheads based on either Direct Material, Direct Labor Hours or Machine Hours etc.

- But under Activity Based Costing (ABC), overheads are allocated to the jobs based on activities consumed by such jobs.

- ABC helps in better and fair allocation of overheads to the jobs and this will result in fair calculation of unit cost and its price.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Will you please provide the formulas (explanation) to understand the results or numbers that were added in the solution?arrow_forwardHi, Could you please show me how to solve this with formulas? not excel, I should have clarified. Thanksarrow_forwardExplain the Golsen Rule and, in your own words, provide an example of the application of the Golsen Rule. 4 MacBook Air Foarrow_forward

- is there a way to do this question with formulas and a calculator instead of excel? if so please upload the solution this wayarrow_forwardFurther info is in the attached images For the Excel part of the question give the solutions in the form of the Excel equations. Please and thank you! :) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B34 enter the formula "= B9". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. Thank you!arrow_forwardAssignment: In the space at the right, type the best formula (or function) needed to perform the following computations. The first one has been done for youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education