Further info is in the attached images

For the Excel part of the question give the solutions in the form of the Excel equations. Please and thank you! :)

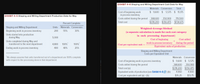

Download the Applying Excel form and enter formulas in all cells that contain question marks.

For example, in cell B34 enter the formula "= B9".

After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text.

Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50.

Thank you!

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Typing clearly urjentarrow_forwardAttached are two pictures. The first picture has the instructions (3 pages) and the second picture is a screenshot of an excel spreadsheet that need the "formulas".arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- please help with parts a,b, and carrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardDuring the research process, if you are unsure whether or not you've found all the relevant literature, what should you do? A. Google it to see if there is anything else you've missed. B. Call your manager to verify that you've found it all. C. Use the search engine included in the Codification. D. Complain that it's too much work and call it a day.arrow_forward

- Dinesh bhaiarrow_forwardPlease watch the following video, then answer the prompt below: https://youtu.be/nfkqCv3Rd_g: copy and paste it to view After watching, answer the question below: Describe the Time Value of Money.arrow_forwardAssignment: In the space at the right, type the best formula (or function) needed to perform the following computations. The first one has been done for youarrow_forward

- Hello i have attached two pictures. They are both used together to answer the question. The first picture is the information to use too answer the question. The second attachment is the for the answer. I hope it is understandable and whoever answer this can please explain how they got the answers. I need the help. I have marked a yellow x on what i have done already. I DO NOT NEED HELP WITH WHAT IS CROSSED IN YELLOW (PARTS 1-3) I NEED PARTS 4-6. THIS IS IS IS THE ANSWER TO PARTS 1-3 Analysis and Calculation: 1) Gold Medal Athletic Co., Sales Budget: For the month ended March: Product Sales Volume Sale Price per unit Sales, $ Batting helmet 1,200 units $40 $ 48,000 Football helmet 6,500 units $160 $1,040,000 Total revenue from sales $ 1,088,000 2) Production Budget: Batting Football Helmet Helmet Expected units to be sold 1,200 6,500 Add: desired Ending inventory 50 220 Total 1,250 6,720 Less: Beginning estimated inventory 40 240 Total…arrow_forwardFreeTaxUSA is an integrated software package used to complete tax returns for individuals and businesses. This week, you will use FreeTaxUSA to complete your critical thinking assignment. Thus, this is a great time to learn more about the software. Visit the site - www.freetaxusa.comLinks to an external site. and create a free account using your CSU Global email address. Review the site and share one item that you found interesting and may assist you in completing a tax return.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education